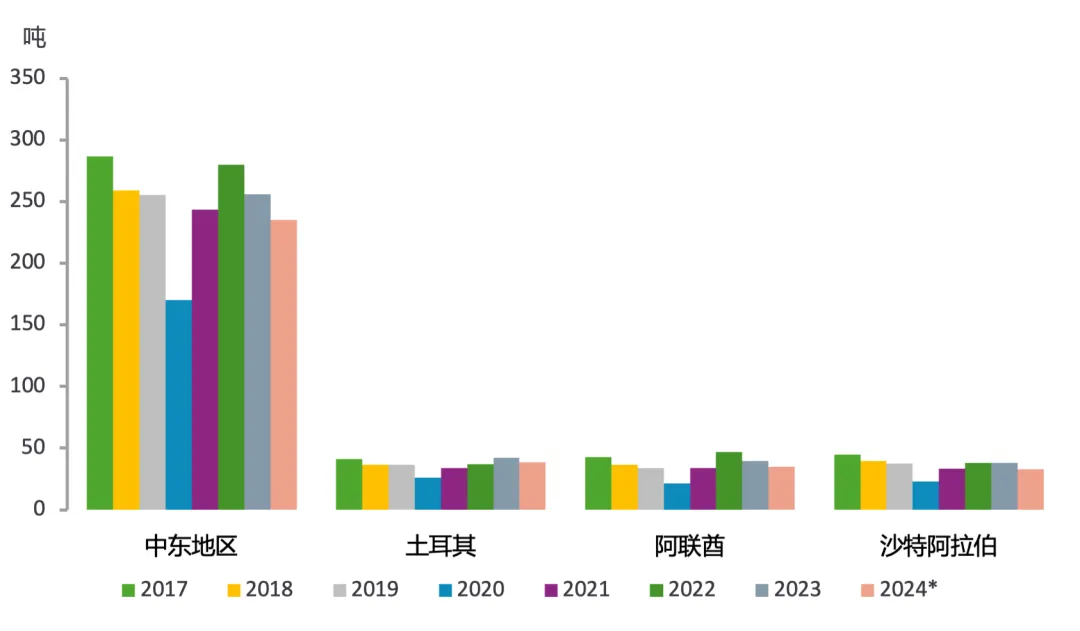

Recently, MetalsFocus stated that the average Gold price is expected to increase by 23% year-on-year this year, while the region's Gold jewelry consumption is anticipated to decrease by 8% year-on-year.

According to Zhito Finance APP, recently, MetalsFocus stated that the average Gold price is expected to increase by 23% year-on-year this year, while the consumption of Gold jewelry in the Middle East is expected to decrease by 8% year-on-year. Notably, despite the significant fluctuations and strong price increases, the drop in consumption volume is limited. However, concerns about 2025 still persist.

MetalsFocus mentioned that after a 10% rebound in Middle East Gold jewelry demand compared to pre-pandemic levels in 2019, last year saw a year-on-year decline of about 9%, which is roughly on par with 2019. Last year's dollar Gold price rose by 39% compared to 2019, while jewelry consumption was still 50% higher than the pandemic-affected levels of 2020, indicating that consumer demand remains resilient.

In addition to the impact of rising Gold prices, India's cut in import tariffs (from 15% to 6% in July this year) has also dampened demand from South Asian tourists. The timing and scale of this measure surprised the market. Although it boosted sentiment in India's Gold Industry, it also affected the jewelry supply chain in the Middle East, which has a large inflow of Indian expatriates and tourists. In contrast, Indian jewelry companies are currently predicting a revenue growth of 15-20% for the fiscal year 2025 (up to April 2025) and plan to expand their store networks by 5-10%, focusing on second-tier cities, while demand in the Middle East is expected to decline further in 2025.

In addition to the impact of rising Gold prices, India's cut in import tariffs (from 15% to 6% in July this year) has also dampened demand from South Asian tourists. The timing and scale of this measure surprised the market. Although it boosted sentiment in India's Gold Industry, it also affected the jewelry supply chain in the Middle East, which has a large inflow of Indian expatriates and tourists. In contrast, Indian jewelry companies are currently predicting a revenue growth of 15-20% for the fiscal year 2025 (up to April 2025) and plan to expand their store networks by 5-10%, focusing on second-tier cities, while demand in the Middle East is expected to decline further in 2025.

From a sales tax perspective in the Gulf Cooperation Council (GCC) countries, currently, Kuwait and Qatar implement a zero tax rate, Oman and the UAE have a tax rate of 5%, Bahrain's rate is 10%, and Saudi Arabia has implemented a 15% tax since July 1, 2020 (up from the initial 5% implemented in 2017) to mitigate the impact of the COVID-19 pandemic. Although a significant portion of the value-added tax is refundable to tourists (except in Saudi Arabia, where a VAT refund mechanism has yet to be implemented), this has not benefited foreign nationals living in these countries, thus affecting local demand. In fact, the performance in the region for the third quarter of 2024 showed that retail consumption and jewelry manufacturing both experienced double-digit declines. Besides the impact of India's tax cut, the substantial rise in Gold prices has also limited jewelry sales.

Therefore, given that Gold prices may remain high or volatile, coupled with ongoing concerns about uncertainty in the regional environment, participants in the Gold market in the Middle East remain cautiously pessimistic about the coming weeks and 2025.

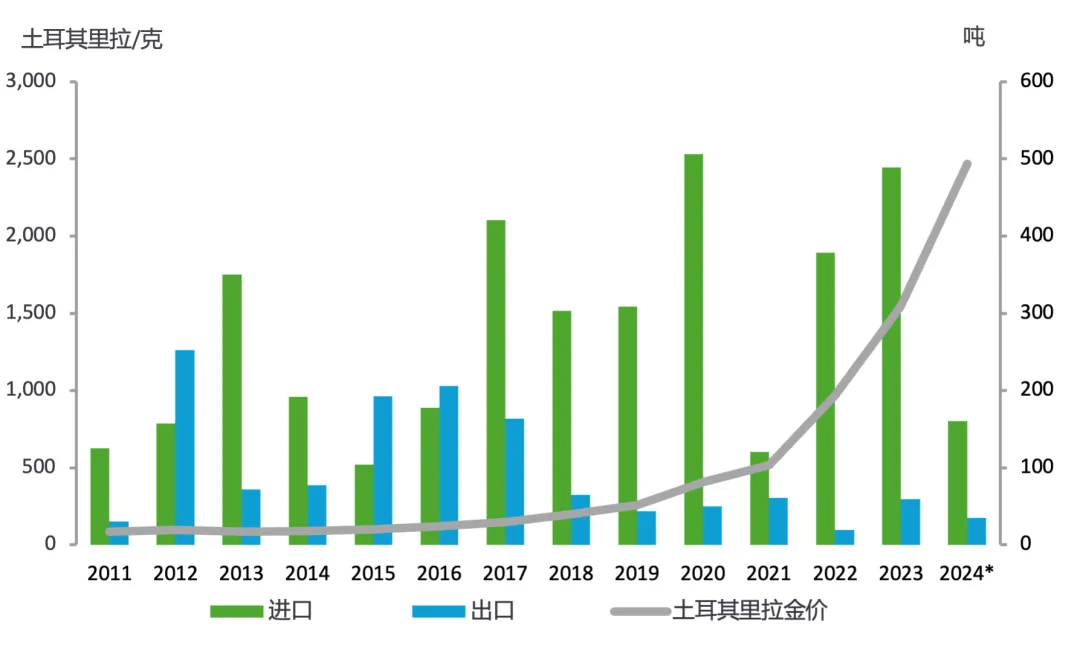

To a large extent, these concerns have already manifested in Turkey, with additional changes in various local regions. After achieving year-on-year growth for eight consecutive quarters, Turkey's jewelry consumption saw a significant decline in the second and third quarters. To better understand this, it is worth briefly reviewing the reasons that led to this outcome. The implementation of economic policies at the end of 2021 (high-interest rates leading to high inflation), followed by the rapid depreciation of the lira and rising inflation, caused Gold imports to surge to 379 tons (the third highest on record at the time). In comparison to Turkey's import scale, the estimated jewelry processing volume in 2022 was 163 tons, and 156 tons in 2023, making it the third-largest Gold jewelry processing manufacturer in the world.

Turkey's Gold Import and Export

As of the end of September 2024, data source: TCMB, S&P Global

Subsequently, Turkish authorities took a series of measures to reduce gold demand ahead of the parliamentary and presidential elections in May 2023, aiming to help lower the premiums. Previously, premiums had soared to $150/ounce (then stabilized around $100 at the end of April and in May). By the end of May, local inflation reached 64%, while the central bank's policy interest rate stood at 8.5%. After the elections, the government introduced a new economic policy to help lower the inflation rate. However, due to the policy's perceived ineffectiveness, gold demand rebounded months later, leading to the implementation of a gold bar import quota system of 12 tons/month on August 8, 2023, to help reduce Turkey's trade deficit.

In December 2023, the Turkish government announced that regulatory policy changes led to a sharp rise in gold premiums, soaring from $40/ounce in December to $200/ounce in March 2024. Just before the elections in March, the policy interest rate was also significantly increased to 50%. With expectations of a sharp depreciation of the lira (similar to after the elections in May 2023) gradually fading, investors shifted from gold to fixed-income assets, causing local market premiums to begin to decline.

This has affected retail investment demand and led to a decline in gold jewelry consumption, primarily due to the investment-like nature of the consumption of 22k bracelets and necklaces. At the same time, non-essential spending has also decreased due to high borrowing costs.

Considering this, the lira gold price has increased by over 50% so far this year (as of the time of writing this article), while local premiums remain around $60. Therefore, the intensifying negative sentiment and declining purchasing power may lead to a downturn in Turkey's gold jewelry consumption, potentially returning to 2022 levels, while total gold demand in the Middle East may fall below pre-pandemic levels.

Middle East Gold Jewelry Consumption Volume

除了金价上涨的影响外,印度削减进口关税(今年7月从15% 降至6%)也打击了来自南亚游客的需求。该举措无论是在时机还是规模上都出乎市场预料。虽然提振了印度黄金行业的情绪,但它也影响了拥有大量印度侨民和游客流入的中东市场的首饰供应链。相比之下,印度首饰公司目前预测2025财年(至2025年4月)的收入将增长15-20%,并计划将其门店网络扩大5-10%,重点关注二线城市,而中东的需求预计将在2025年进一步下降。

除了金价上涨的影响外,印度削减进口关税(今年7月从15% 降至6%)也打击了来自南亚游客的需求。该举措无论是在时机还是规模上都出乎市场预料。虽然提振了印度黄金行业的情绪,但它也影响了拥有大量印度侨民和游客流入的中东市场的首饰供应链。相比之下,印度首饰公司目前预测2025财年(至2025年4月)的收入将增长15-20%,并计划将其门店网络扩大5-10%,重点关注二线城市,而中东的需求预计将在2025年进一步下降。