Editor's note:

Since February, ZTE Corporation's A shares and H shares have risen at the same time, and the current market capitalization of A shares is close to 200 billion yuan. Yesterday, Guojin Securities released a research report, optimistic about the company's market value to 300 billion yuan, from the current market value still has 50% room to rise.

The article is edited by the Guojin Securities Research newspaper "ZTE" at 5G Dawn: why we are optimistic about ZTE Corporation to 300 billion market capitalization.

一、The epidemic affects the company's revenue rhythm and does not affect the total amount, and the annual 5G investment is likely to exceed expectations.

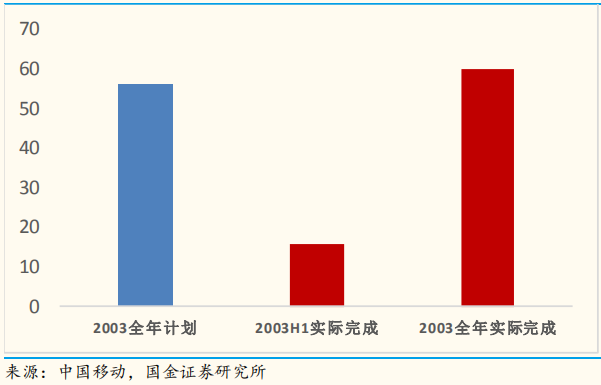

The company's annual performance will show an obvious trend of low before and then high, but it is expected that the total amount of the year will not be affected.Based on the progress of the epidemic, we infer that the 5G collection of the three major operators will be about 2-4 weeks later than expected, which will affect the first quarter results. However, with reference to China Mobile Limited's capital expenditure during SARS in 2003, he still overfulfilled the plan for the whole year, so the company's performance is expected to be low before and high after, and the total amount will not be affected.

China Mobile Limited's Capital Expenditure during the SARS epidemic in 2003 (in US $100 million)

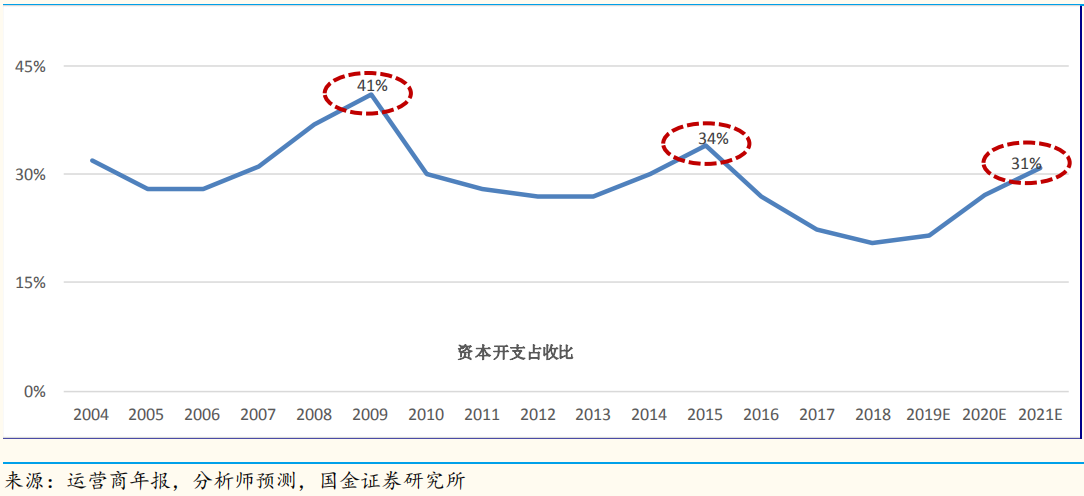

As the core direction of scientific and technological infrastructure, 5G is expected to continue to introduce measures to promote 5G-enabled economic development and improve people's livelihood and welfare after the epidemic.The annual 5G investment is likely to exceed expectations, and it is expected that the capital expenditure intensity of the three major operators in 20 years will be about 5pp higher than that in 19 years.

Forecast of the trend of investment intensity (capital expenditure as a percentage of income) of the three major operators

Second, it is expected to be the biggest beneficiary of global equipment manufacturers' market share rebalancing.

1. Look at the industry:The attribute of 5G investment cycle is weakened.Because 5G is mainly oriented to a variety of vertical application scenarios, its overall investment cycle will be longer than 4G. We judge that after the first round of investment peak, operators' capital expenditure will not fall significantly, as 5G gradually matures in large-scale scenarios such as self-driving, smart grid, smart manufacturing and so on. It will push operators to maintain capital expenditure at a relatively high level.

Three waves of Investment under the theme of 5G

2、Look at the customer.:Looking at China in terms of global 5G, China's 5G global market share will rise from 25% in 19 years to about 60% in 20 years.China's wireless and transmission markets both ushered in large-scale networking in 2020, while the three major operators'5G networking changed from NSA to SA. It is predicted that the proportion of transmission network investment in total capital expenditure will rise to 35% in 2020. In terms of absolute investment, YoY has increased by more than 50% compared with the same period last year, which will help the company to gain more market share.

Estimation of capital expenditure of the three major operators from 2019 to 2021 (unit: 100 million yuan)

Historical Capital Expenditure structure trend and Forecast of the three operators

3、Look at the competition:The general trend of communication equipment manufacturers rising from the east to the west remains unchanged, and the competitiveness of the company in the 5G era has improved significantly.In the 5G era, ZTE has strengthened its investment in technological research and development and made breakthroughs in many fields. In contrast, Ericsson and Nokia gradually lag behind Huawei and ZTE in terms of 5G discourse rights. At present, ZTE's profit level is at the lowest level of the four major equipment manufacturers, and it is easier for ZTE to be favored by equipment manufacturers in terms of obtaining the market; at the same time, ZTE's market share is in a stuck position, making it easier to benefit from operator rebalancing, and its market share is expected to rise to second place in the 5G period. Whether the Huawei embargo is lifted or not, ZTE's upward trend in global market share will not change.

Wireless market share forecast of communication equipment vendors under the assumption of long-term Huawei embargo (%)

4. Look at yourself:The adverse effects of the embargo have been eliminated and the core competitive advantage has been consolidated.Recently, the company has won a large share of the bid in the collection of operators, and the domestic market share of wireless and transmission has increased steadily.

ZTE Corporation's main business composition change (by project)

ZTE Corporation's main business composition change (by region)

At the same time, with reference to Huawei's business evolution S curve, we believe that in addition to the operator business, ZTE Corporation is most likely to create the second S curve is that the company replicates the ICT technology, capabilities and solutions accumulated for a long time in the communications field in the industry digital market.

Business Evolution S Curve of Huawei

Enter a new growth cycle, ushering in performance and valuation Davis double-click

By reviewing the stock price performance of equipment manufacturers at home and abroad during the period from 2G to 4G, we come to the conclusion that the valuation of equipment manufacturers reflects the growth under the cycle, and the leader enjoys a valuation premium.

The leader of the communications equipment industry in US stocks has a significant valuation premium relative to the industry average.

The overall investment in communication equipment in China is later than that in Europe and the United States, the investment is larger, and the periodicity of the investment in communication equipment is more obvious. ZTE Corporation, as the leading listed company of the main equipment company, every time the peak of investment in communications equipment will usher in the improvement of PE, and the range exceeds that of Nokia and Ericsson. With reference to historical performance, as 5G enters a three-year network building period in 20-22, the company is expected to usher in valuation and performance Davis double-click.

IV. Investment advice and valuation

It is estimated that the overall revenue of the company in 1919-21 is 885 EPS1.25/1.54/2.39 1090 / 127.7 billion yuan respectively, and the net profit of returning to the mother is 53 Universe 71 / 11 billion yuan, corresponding to RMB100. It is optimistic that the company will become the biggest beneficiary of the rebalancing of the equipment market in the 5G era, giving it a valuation of 30 times PE in 21 years, corresponding to a target price of 72 yuan and a target market capitalization of 331.1 billion yuan, reiterating its "buy" rating.

ZTE Corporation's income split and profit forecast

Risk hint:There is uncertainty in the development of the epidemic, which may cause significant seasonal fluctuations to the company's 20-year operating performance; the company's domestic operators' bidding share falls short of expectations, and overseas market expansion falls short of expectations; 5G investment falls short of expectations and operators' capital expenditure falls short of expectations.

Edit / Jeffy