There is no more chivalrous man than Boss Xu Jiayin. In the haze of the epidemic, Evergrande sent warmth to the vast number of people without houses.

According to Evergrande's latest policy, there will be a 25% discount for residential properties in hand across the country from February 18 to February 29, 2020, and a 22% discount from March 1 to March 31.

In addition, in the 25% discount, Evergrande is also in the down payment, mortgage and other links, giving varying degrees of additional discount. According to media reports, some Evergrande insiders said that this is the lowest preferential measure given in the history of Evergrande's national joint promotion.

In the past, it helped to destroy the family of Chinese football and relieve the national disaster, but now it gives warmth to the vast number of homeless people. Boss Xu is addicted to doing good deeds?

Looking at Evergrande's financial report, we can find that Xu Jiayin is not addicted to doing good deeds. Price reduction promotion, to some extent, is due to Evergrande's highly leveraged and highly indebted situation. In other words, when Evergrande decided to expand aggressively a few years ago, it was doomed to come.

Not surprisingly, in the environment of strengthening regulation and control policies, the era of excessive leverage in real estate has passed, and the era of cash king is coming. To some extent, Evergrande's price cut fired the first shot in this cash flow war.

With the arrival of fierce competition, the improvement of industry concentration has become inevitable. Coinciding with real estate stocks in the capital market is not as expected, sound real estate leading stocks may usher in a good investment opportunity.

610 billion will be repaid in the next two years

Taking the lead in the real estate industry, cultural tourism, health and health have been laid out, and the field of new energy vehicles is not lagging behind. how much does it cost to achieve such an achievement?

1.75 trillion, which is the total debt shown in China Evergrande Group's semi-annual report in 2019. I have to say, Evergrande is a real borrowing machine.

But it's understandable. Real estate itself is a highly leveraged project, land acquisition and construction, both require a lot of money.

For real estate enterprises, debt is not terrible, as long as cash flow can be maintained in a virtuous circle. Unfortunately, due to the existence of the real estate cycle, it is not easy for crazy enterprises to maintain a virtuous circle.

For real estate enterprises, cash inflows mainly come from sales income and loans, while cash outflows are mainly from land acquisition, contracting projects, debt repayment and so on.

When the prosperity of the industry rises, real estate companies usually take land crazily. This will lead to a sharp increase in borrowing by real estate companies at a certain stage. For example, from 2015 to 2017, the total of operating cash flow and investment cash flow of Evergrande was 36.3 billion yuan, 178.1 billion yuan and 198.4 billion yuan respectively, and the net inflow of loans was 109.4 billion yuan, 273 billion yuan and 152.9 billion yuan, respectively.

A sharp rise in borrowing in a particular year will also lead to an explosion of repayments at a later time. Like Evergrande. According to its 2019 semi-annual report, Evergrande needs to repay 375.8 billion yuan in the next year, and 610 billion yuan in the next two years.

At this time, once the total cash contributed by sales revenue and new loans is not enough to repay a large number of maturing liabilities, then the enterprise is not far from cool.

The price of cosmic real estate enterprises

In the first half of 2019, Evergrande's attitude remains to expand.

In the first half of 2019, Evergrande had a net operating cash flow of 45.622 billion yuan and an investment cash flow of 11.688 billion yuan. Accordingly, the cash obtained through borrowing is 133.717 billion yuan.

Radical strategy, let Evergrande become a cosmic real estate enterprise, but also become the most stressed one.

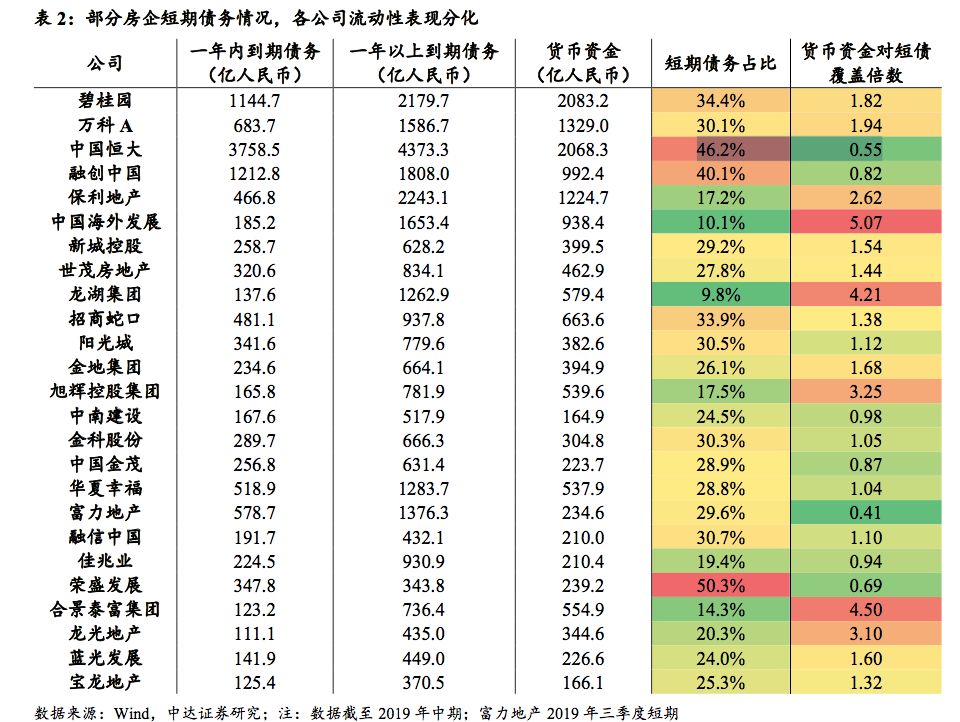

Compared with the solvency of a large number of housing enterprises, a variety of indicators always appear to be extremely prominent. As of June 30, 2019, Evergrande's net debt ratio was 152.1 per cent; similarly radical Country Garden Holdings was only 58.5 per cent; Vanke A was only 35 per cent.

The coverage ratio of monetary funds to short-term debt, Evergrande is 0.55, cash is less than half of short-term debt, while Country Garden Holdings is 1.82, Vanke is 1.94.

Photo source, Zhongda Securities Research report

Unfortunately, the black swan arrived quietly.

In May, document No. 23 issued by the Bancassurance Regulatory Commission regulated real estate trust funds; in July, it was clear that overseas bonds of real estate enterprises could only be used to "borrow the new to repay the old"; and in August, it began to control the amount of bank-side development loans and mortgage loans. So far, the main sources of funds of housing enterprises have been controlled, and the access to incremental financing has basically been blocked.

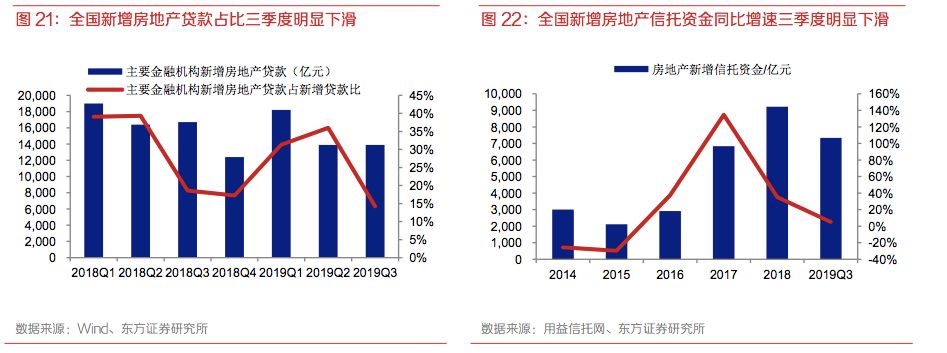

Regulators control the total amount of trusts and banks, and the effect is immediate. In the third quarter of 2019, the proportion of new real estate loans by financial institutions fell 22 percentage points to 14.2 per cent compared with the second quarter of 2019, while the growth rate of new real estate trust funds fell 30 percentage points to 5.2 per cent compared with 2018.

Photo Source: Oriental Securities Research News

At Sunac's interim results meeting in August last year, Chairman Sun Hongbin even described the current financing environment as "unprecedented".

From the typical financing data of 40 real estate enterprises, the total amount of financing for the whole year of 2019 shows a gradual downward trend.

The tightening of the financing environment is undoubtedly full of challenges for Evergrande. After all, the second half of 2019 to 2021, but Evergrande debt repayment period.

It's easy for you to understand why Evergrande was willing to raise $6 billion at a minimum interest rate of 11.5% and a maximum interest rate of 12% last month. It is also easy to understand why Henghui launched the promotion of "bone" discount at this time.

Cash flow war "first shot"

To some extent, Evergrande's price cut launched the first shot in the cash flow war in the real estate industry.

As a typical capital-intensive industry, the rise and fall of the real estate industry is closely related to the abundance of funds. In the pattern of continued credit crunch, the growth of credit funds is not sustainable, while foreign investment is limited, which can only rely on developers to raise funds and increase revenue inflows.

In terms of policy, the current real estate industry is at an extremely delicate point in time. Coupled with more consumers in the wait-and-see mood, the limited number of buyers into the bag, will undoubtedly squeeze the living space of other real estate developers.

In fact, after Evergrande, Country Garden Holdings, R & F and other real estate enterprises have kept up with the pace of online housing sales. For the real estate industry, it is undoubtedly the beginning of another round of reshuffle. Fundamentally, this is a war for cash flow.

In this cash for the king of the environment, a large number of early land purchases, and no money for the development of housing enterprises will face difficulties, and the capital chain worry-free leader, will undoubtedly usher in a good opportunity for development.

At present, this is likely to bring investment opportunities for sound real estate leading stocks. There are three reasons:

First, although it has a large class of asset attributes, but from a lengthening period, the house is still a consumer product after all. In other words, the demand for housing may fluctuate under the influence of external factors in the short term, but this demand will never disappear and will tend to stabilize.

Second, in the real estate industry with high cash flow requirements, the epidemic brings a cash flow gap, which is likely to crush a large number of small and medium-sized real estate enterprises, thus increasing the concentration of the real estate industry.

Third, the market pessimism about the real estate industry has been fully reflected in the stock price, bringing good buying opportunities. At present, the valuation of real estate companies is at an all-time low: the average price-to-earnings ratio of A-share real estate companies is 10.71 times, while that of sound leading enterprises such as Vanke is only 9 times earnings, while in the Hong Kong stock market, the average price-to-earnings ratio of real estate companies is only 5.2 times.

Overall, when the industry exists forever, buying leading companies that benefit from increased industry concentration at a relatively low price may yield a relatively ideal return.

Edit / Ray