In fact, based on historical experience, the "warming" of the performance and valuation of the Aviation/airlines Industry this time is not unfounded.

The consecutive rise over several days has clearly made the Aviation/airlines Sector an eye-catching segment in the Hong Kong stock market.

On December 5, 6, and 9, the Aviation/airlines Sector in the Hong Kong stock market continued to rise, recording increases of 1.82%, 4.07%, and 5.35%, respectively, with a cumulative rise of over 10% in the sector over these three trading days. During this period, China Eastern Airlines (00670) recorded a nearly 18% rise on the 3rd, China Southern Airlines (01055) recorded over 15% rise on the 3rd, and Air China Limited (00753) recorded over 14% rise on the 3rd. The rise of these individual stocks and the sector clearly indicates that the Aviation/airlines Industry has emerged from the previous sluggish market and is currently in a warming phase.

(Market source: Futu)

(Market source: Futu)

As the saying goes, "The spring river water warms the ducks first," so what signals are behind the multiple days of rise in the Aviation/airlines Sector?

Multiple Bullish factors are enhancing the ongoing recovery of the Aviation Industry.

The recent rally in the Aviation Sector is clearly driven by multiple bullish stimuli from the news.

On November 12, the General Office of the State Council released a notice regarding the arrangement of holidays for 2025: starting from January 1, 2025, all citizens will have an additional 2 days off, with the Spring Festival and Labor Day each gaining 1 extra day. This means that the Spring Festival and National Day in 2025 will have an 8-day holiday, and Labor Day will have a 5-day holiday. The notice emphasized that 'except for certain special circumstances,' the continuous working days surrounding statutory holidays will generally not exceed 6 days, which means the public's concern about 'holiday adjustments' will be alleviated.

In addition to the benefits from the extended holidays led by consumption, tourism, and aviation sectors, China's expansion of visa-free entry policies will undoubtedly further drive a strong recovery in the Aviation Industry.

On November 22, the Ministry of Foreign Affairs announced that from November 30, 2024, to December 31, 2025, visa-free policies will be trialed for ordinary passport holders from Bulgaria, Romania, Malta, Croatia, Black Hills Corp, North Macedonia, Estonia, Latvia, and Japan. In addition, the Ministry also decided to further optimize the visa-free policies by including exchange visits as a reason for visa-free entry and extending the visa-free stay period from the current 15 days to 30 days. Starting from November 30, 2024, ordinary passport holders from 38 visa-free countries can enter China for business, tourism, visiting relatives, exchange visits, and transit for up to 30 days without a visa.

Moreover, the cooling down and decline in oil prices have evidently provided some advantages to the cost side of the Aviation Industry. Previously, GTJA estimated that due to the approximately two-month lag in the adjustment of domestic aviation fuel ex-factory prices, the average fuel price for airlines is expected to decline slightly year-on-year, though it remains nearly 30% higher than in the third quarter of 2019. It is anticipated that the pressure from oil prices will significantly improve starting in the fourth quarter of 2024.

From the above, it is clear that the introduction of visa-free series policies will further boost inbound passenger traffic, benefiting international aviation demand and the recovery of international passenger flights, which is expected to accelerate the improvement of supply and demand in the aviation sector. Additionally, coupled with the accelerated improvement of pressures such as RBOB Gasoline, the recovery trend in the Aviation Industry is expected to continue, thereby significantly uplifting industry performance and sector valuations.

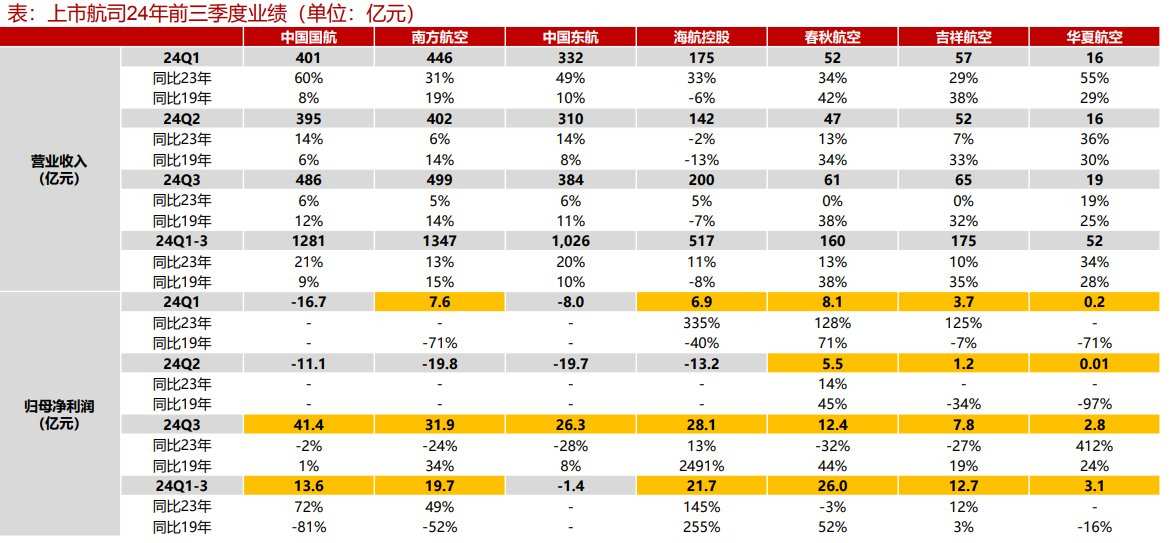

This can also be observed in the Q3 performance of the aviation concept stocks.

According to the Zhito Finance APP, Q3 is the peak season for summer travel in the aviation industry. While increased volume and decreased prices have eroded profits, the RMB appreciated by 1.7% in the third quarter, contributing to foreign exchange gains. Coupled with investment income contributions, Air China Limited (00753, 601111.SH), China Southern Airlines (01055, 600029.SH), and HNA's Q3 performance exceeded expectations, while Spring Airlines and Juneyao Airlines met expectations. Additionally, with a low base last year, the performance of China Express Airlines is expected to recover significantly in Q3 2024 as utilization rates improve and new branch airline policies take effect.

(Image source: Zheshang)

Breaking it down, on the revenue side: during the peak summer travel season, despite an increase in volume, prices decreased, and unit RPK revenue fell back from a high base in 2023, with airlines' operating revenue slightly increasing year-on-year. On the cost side: a slight drop in oil prices combined with a continuous recovery in utilization diluted unit costs. On the profit side: an increase in volume with a decrease in price eroded some profits, and the airlines' Q3 performance declined from the high base of 2023, but still exceeded the same period in 2019.

Based on this, it is evident that benefiting from bullish policies and recovering demand, the performance and valuation of the aviation/airlines industry have received a significant boost.

A turning point in supply and demand is emerging, and the industry will enter the 'sweet spot'.

In fact, based on historical experience, the 'recovery' of performance and valuation in the Aviation/airlines Industry this time is not unfounded.

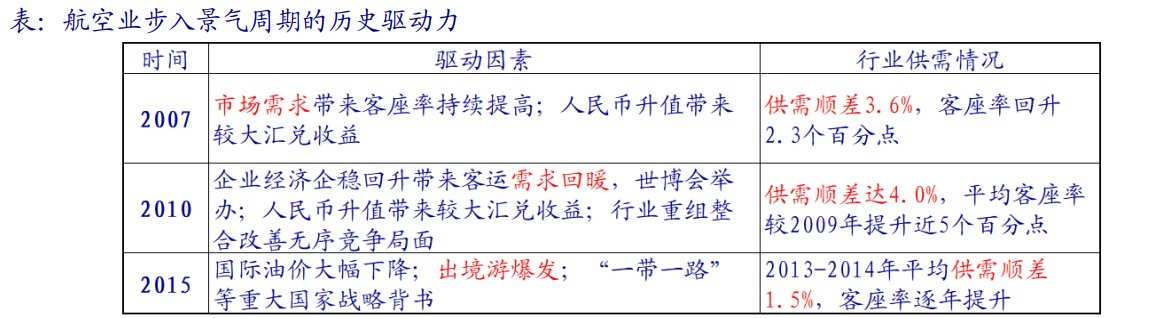

As a typical cyclical industry, the core logic of investing in the aviation/airlines industry lies in the supply and demand structure. Additionally, the performance of airlines is directly impacted by oil prices and exchange rates, which are not absolute external variables. Historically, the determinants of the gains in airline stocks during several major cycles have been: the supply-demand gap, which is the expectation that demand exceeds supply.

For instance, the historical driving force for airline stocks entering a prosperous cycle in 2007 was related to the supply-demand gap. That year, market demand led to a continuous increase in load factor, while the appreciation of the renminbi also brought significant exchange gains. Against this backdrop, the aviation industry's supply-demand surplus reached 3.6%, and the load factor rebounded by 2.3 percentage points.

(Image source: HAITONG SEC)

Looking ahead to the current cycle of the Aviation/airlines Industry, there is a clear upward foundation—domestic demand has already exceeded that of the same period in 2019, and there is also a very clear turning point in industry supply.

In terms of demand, domestically, from January 2023 to September 2024, China’s passenger turnover has been continuously recovering. In September 2024, the passenger turnover of domestic routes reached 82.46 billion passenger-kilometers, surpassing the same period in 2019, with a growth of 18.53%. This supports an optimistic outlook for continued growth in 2024 and 2025 based on this foundation. Internationally, since 2024, with countries gradually relaxing visa policies, international routes are accelerating their recovery. It is expected that as travel agency group tourism businesses commence, the demand for international routes will further improve.

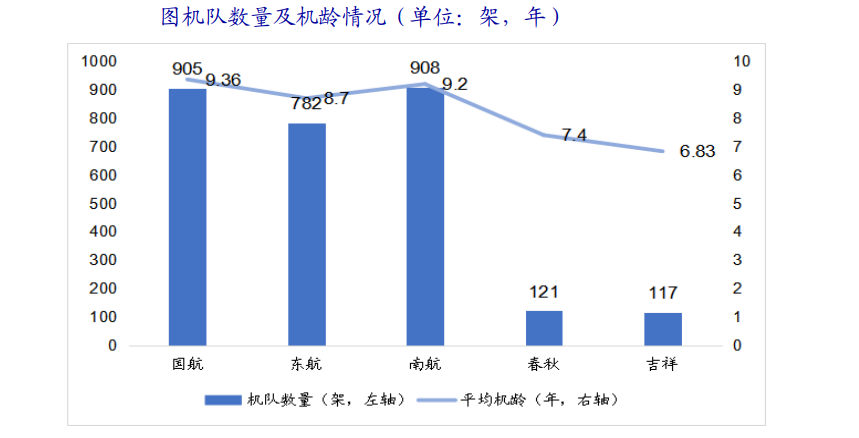

In terms of supply, in 2020, affected by the epidemic and the shutdown of some Boeing and Airbus factories, global fleet delivery data fell to a low point; deliveries in 2021 saw some recovery but were still affected by supply chain issues; from 2022 to 2023, the impact of the Russia-Ukraine conflict led to overall slow delivery progress, and the delivery of civilian aircraft will continue to be under pressure. Additionally, the three major airlines show a phenomenon of aging fleets, with an average aircraft age of 8.7 years; a large number of aircraft may need to retire in the future, marking a clear turning point in supply.

(Image source: HAITONG SEC)

In light of the aforementioned "supply-demand gap," Institutions have begun to assess the arrival of the aviation industry prosperity cycle.

Among them, Zheshang Securities pointed out that the logic of Aviation is beyond expectation, and attention should be paid to the opportunities for counter-cyclical layout during the off-season. In the long term, the consumer penetration rate of China's aviation remains low, with huge demand potential, ongoing airspace bottlenecks at critical moments, ticket prices essentially market-oriented, and a significant slowdown in fleet growth. Once supply and demand recover, it is expected that the profit center of airlines will rise beyond expectations.

CITIC Securities also stated that following the extreme state of "ticket price priority" in 2023 and "load factor priority" in 2024, the industry's pricing policy may face a turning point. The sharp decline in oil prices has driven the industry into an excess profit cycle since the end of 2014, focusing on how the alleviation of fuel cost pressure for airlines in 2025 will be transmitted to profitability. Aviation is expected to experience a surge. Continuous positive policy signals, such as the expansion of visa-free countries, indicate that the spring transportation peak in 2025 may serve as a litmus test for the aviation cycle.

According to Sinolink's calculations, airline performance is expected to grow significantly in 2025. It is assumed that in pessimistic, neutral, and optimistic scenarios, the airlines' yield per kilometer, after deducting fuel costs, will be -5%, +0%, +5% respectively compared to 2019; at the same time, fleet scale growth is taken into account. Using 2019 as the base year, the projected net income of Air China, Eastern Airlines, China Southern Airlines, Juneyao Airlines, Spring Airlines, and China Express Airlines in 2025 would be 7.6 billion yuan, 3.7 billion yuan, 3 billion yuan, 1.3 billion yuan, 2.7 billion yuan, and 0.7 billion yuan, respectively. Given that an inflection point in supply and demand is expected to arrive, the probability of a neutral scenario occurring in 2025 is large.

Thus, under the existing multiple growth logic such as "Aviation stocks Q3 performance margin improves" and "the supply and demand surplus pushing the Sector upward in the future," it is not surprising that the aviation sector has clearly entered the "strike zone". In this context, attention can be paid to large airlines that are highly sensitive to ticket prices and oil prices, such as the three major airlines listed in Hong Kong with relatively low valuations: Air China A+H, China Southern Airlines A+H, and private airlines with confirmed profit growth, such as Juneyao Airlines and Spring Airlines.

(行情来源:富途)

(行情来源:富途)