Real yields on inflation-protected Treasuries also fell below zero between 2012 and 2013, but the US economy was in a state of weakness. Will this time be different? This problem is worth pondering, because the increasingly spreading COVID-19 epidemic is exerting tremendous pressure on China and has an increasingly far-reaching impact on the economies of countries around the world. For example, the European Union said on February 13th that the COVID-19 epidemic was "a major downside risk" to the euro zone economy.

The US Treasury market seems to have reflected this risk in its quotations. It is worth noting that real yields on US inflation-protected Treasuries for several key periods have recently fallen into a negative range. In the long run, the real yield of bonds is usually positive and in an upward trend during a period of optimistic economic prospects and accelerated economic growth. On the other hand, if the real yield on the bond is negative, then the opposite is true.

However, when it comes to the real yield of US inflation-protected Treasuries, the situation is more complicated, because the demand for US Treasuries comes from countries around the world, so it is not clear whether the current level of US Treasury yields can effectively predict the outlook for the US economy. There is also some debate about how the real yield level of US inflation-protected Treasuries can play a role in macroeconomic prediction. because the market liquidity of inflation-protected Treasuries, which has only a place in the US bond market, is quite illiquid.

It is clear that the real yield on US inflation-protected Treasuries has fallen for more than a year, and the real yield on inflation-protected Treasuries with several major maturities has recently fallen below 0 per cent. As of Feb. 12, the real yields on 5-year and 10-year inflation-protected Treasuries were-0.19% and-0.04%, respectively, according to the Treasury's home page, Treasury.gov. The real yield on five-year inflation-protected Treasuries has been negative since 2020, while the real yield on 10-year inflation-protected Treasuries has only recently fallen below zero, but has been in a negative range since early February.

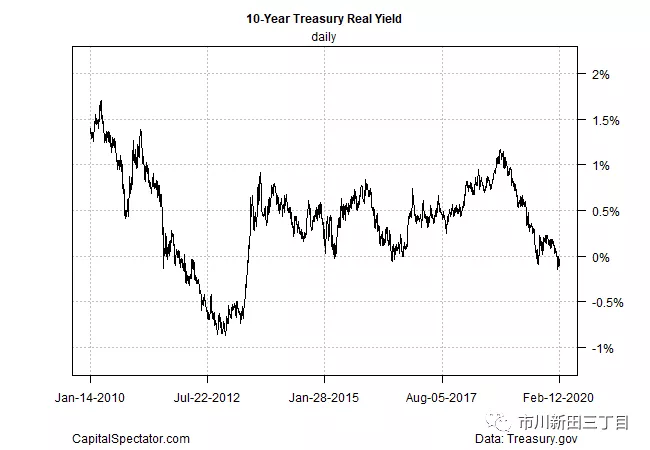

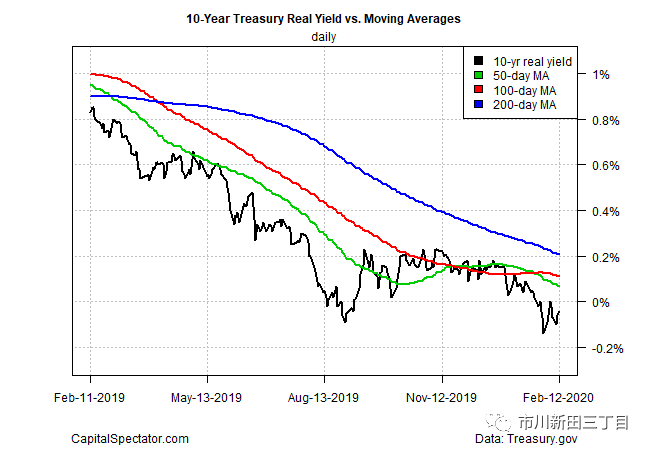

It is not surprising that the real yield on 10-year inflation-protected Treasuries has fallen below zero. As the chart below shows, the real yield on 10-year inflation-protected Treasuries has been down for more than a year. If the status quo is a corollary of the evolution of trends, then the current market performance was doomed months ago.

Some people will think that this will have a bad impact on the economy. Indeed, in September last year, when real yields on 10-year inflation-protected Treasuries were still falling but barely within a positive range, some analysts took a negative view.

"the real yield on US Treasuries is falling, and the decline is disturbing," Subadra Rajappa, head of US interest rate trading strategy at Societe Generale, told Bloomberg five months ago in September 2019. "expectations for US inflation are also falling, indicating that the market quotation level predicts a recession in the US economy, which will cause the Fed to maintain interest rate cuts for much longer than the Fed had previously predicted. The Fed has claimed that the recent rate cuts are only temporary adjustments in the big rate-raising cycle. "

At present, the real yield of US inflation protected treasury bonds continues to be in a negative range, and from the perspective of real yield, it can be considered that the outlook of the US economy has deteriorated.

The good news is that the US economy is still resilient, at least better than some pessimistic expectations. Recently released data show that US GDP grew steadily at a moderate rate of 2.1 per cent in the fourth quarter of 2019, the same as in the third quarter.

Some forecasts show that the US economy will maintain a relatively strong growth momentum in the first quarter of 2020. For example, the Atlanta Fed's GDPNow model predicts that the US economy will grow by 2.7% in the first quarter of 2020. Of course, some forecasts are worse: the latest forecast from the New York Fed is quite bad. It is expected that US economic growth will slow to 1.7% in the first quarter of 2020, which also ends on Feb. 7.

Perhaps the key factor worth paying close attention to should be how the risks associated with the COVID-19 epidemic will ferment in the coming weeks. The current news reports are full of negative news. China has reported a continuous rise in the number of deaths from disease and a sharp increase in the number of people infected, indicating that the challenges are far higher than originally estimated.

As for the real yield on 10-year US inflation-protected Treasuries, the level of real yield will remain negative in the short term, and there seems to be the possibility of falling into a deeper negative range, which is based on multiple moving averages.

The extent of the impact on the global economy is unclear and needs to be observed, but for now, the impact on the US economy is relatively small. However, there will still be side effects, but the impact on different countries will be different. China's strict quarantine measures to combat the spread of the epidemic are dragging down the country's economic growth, which will have a profound impact on the global supply chain.

"the quarantine and other coercive measures taken to stop the epidemic have seriously hurt China's economy, and the chain reaction has affected the whole of Asia," said Kawamoto Kawamoto, a former under-Secretary of the Ministry of economy, Trade and Industry and now a professor at Keio University. The closure of Chinese companies will have an impact on the operation of global enterprises in the Asian supply chain system. "

It is not clear to what extent this negative impact will spread outside Asia, but it is almost certainly wrong to assume that the impact is zero. Until things become clear, the real yield on US inflation-protected Treasuries looks set to fall further.

Edit / Sylvie