Next week's blockbuster financial events will hit:

The New York Stock Exchange is closed on President's Day on Monday.

The Federal Reserve FOMC will also announce JanuaryMinutes of the monetary policy meeting!

The quoted interest rate of China's one-year loan market in February will be announced

Walmart Inc, Ping An Insurance, Lenovo Group Limited financial report attack!

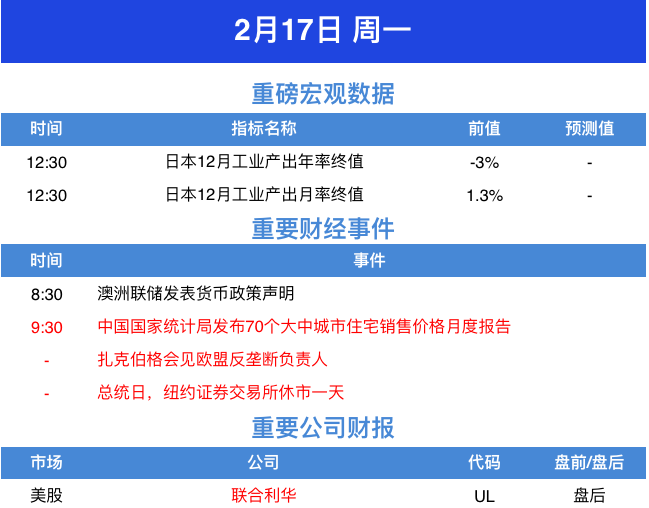

Monday February seventeenth

Key words: us stock president's day off arrangement, Unilever financial report

Monday's data is relatively light, and investors, mainly in Asia, need to keep an eye on Japan's fourth-quarter GDP data, which is expected to be the worst since the second quarter of 2014, which could be a drag on the yen.

Monday's data is relatively light, and investors, mainly in Asia, need to keep an eye on Japan's fourth-quarter GDP data, which is expected to be the worst since the second quarter of 2014, which could be a drag on the yen.

Within a few days, Zuckerberg will meet with the EU antitrust chief.。Facebook Inc CEO Zuckerberg will meet with EU digital and industry leaders on Feb. 17 to discuss new Internet rules. According to an European Commission proposal, European Competition and Digital Commissioner Margaret Vestager and Internal Market Commissioner Thierry Vestager will announce proposals to create a single European data market on February 19. it aims to challenge the dominance of American technology giants such as Facebook Inc, Alphabet Inc-CL C and Amazon.Com Inc.

Besides, Monday happens to beThe New York Stock Exchange is closed on President's Day.。

Tuesday February eighteenth

Key words: minutes of RBA meeting, Walmart Inc / who to study with / HSBC Holdings PLC Financial report

Investors need to pay attention to the minutes of the RBA meeting during the Asian session on Tuesday, which may have some impact on the movements of the Australian dollar and the New Zealand dollar.

The RBA left interest rates unchanged on February 4th, but the RBA believes that the Australian economy, jobs and sales have all shown signs of improvement, which boosted market optimism and contributed to a rebound in the Australian dollar in the short term. However, relevant institutions believe that weak wages and poor inflation in Australia still need to be on guard against the risk of interest rate cuts in May, but RBA Chairman Lowe's recent speech is skewed towards hawks, which has significantly cooled the RBA's interest rate cut expectations for the first half of the year. Investors can look for more clues in the minutes of the meeting.

There are also reports that a meeting of EU finance ministers will be held on Tuesday. EU finance ministers will warn of the need to prepare for a more severe global economic slowdown than expected, according to an EU document seen by well-known foreign media.

In terms of financial statements, Hong Kong stocks$HSBC Holdings PLC (00005.HK) $、$Hang Seng Bank (00011.HK) $, U. S. stocks$Walmart Inc (WMT.US) $、From whom to learn (GSX.US) $Please pay attention to the financial report which will be released today.

Wednesday February nineteenth

Key words:CPI and PPI data of January in UK、January PPI data of the United States

Wednesday is a relatively busy day for the following week; the European session will usher in the UK's January CPI and PPI data, and hi is expected to influence sterling in the short term. Market expectations are mixed and investors need to keep an eye on changes in market expectations.

In New York, investors need to focus on the US PPI data in January, and the market is expected to be more optimistic and is expected to continue to support the dollar.

In addition, investors also need to pay attention to the total number of annualized housing starts in the United States in January and the total number of permits for construction in January. If the January US housing market data continues the performance of December 2019, it is also expected to continue to support the dollar.

In terms of financial statements, China-listed stocks$OneSmart International Education Group Ltd (ONE.US) $、$Autohome Inc (ATHM.US) $Financial reports will be released before trading.

Thursday February twentieth

Key words:China in FebruaryLPR 、Federal ReserveMinutes of monetary policy meeting, Ping An Insurance / Lenovo / Domino pizza

On Thursday, the quoted interest rate of China's February one-year loan market will be announced, and there is a high probability that LPR will go down.。Pan Gongsheng, deputy governor of the people's Bank of China, said on February 7 that the recent price increase and decline in the liquidity supply of the people's Bank of China has effectively stabilized market sentiment and pushed market interest rates down as a whole. The market expects the winning interest rate of the next medium-term lending convenience operation and the loan market quotation rate (LPR) announced on February 20 to have a higher probability of going down.

In addition, it should be noted that the Federal Reserve FOMC will also release the minutes of its January monetary policy meeting. TD Securities expects the minutes of the January monetary policy meeting to be released at 03:00 on February 20, which is not expected to include any significant changes in the near-term outlook (compared with the testimony of Federal Reserve Chairman Powell this week); however, the minutes are likely to reveal the latest discussions about the Fed's ongoing policy review.

In terms of financial statements, Hong Kong stocks$Ping An Insurance (02318.HK) $、$Lenovo Group Limited (00992.HK) $、Gao Xin Retail (06808.HK) $The results will be released one after another, and the stars of American stocks$Domino pizza (DPZ.US) $、$American Power (AEP.US) $The results will also be announced before the trading of US stocks.

Friday February twenty _ first

Keywords: the initial value of Markit manufacturing PMI in February,The British Labour Party elects a new party leader

There will also be a lot of economic data to be released on Friday, and investors need to pay attention to the initial PMI figures for Markit manufacturing in the United States in February. Data released on February 4th showed that ISM manufacturing PMI rebounded in January, rising to 50.9 from 47.8 in December, reflecting the end of a five-month contraction in US manufacturing, boosting sentiment on Wall Street and marking an improvement in an industry that had been a drag on the US economy.

If the initial PMI of the US Markit manufacturing sector is optimistic in February, it will strengthen the judgment of improvement in the US manufacturing sector and is expected to provide an opportunity for the dollar to rise further. Of course, there will be speeches from at least four Fed voting committee members on Friday, which will also affect the weakness of the dollar, which investors need to focus on.

It is observed that the Fed voting committee that will speak on Friday are Dallas Fed Chairman Kaplan, Fed Governor Brainard Fed Vice Chairman Clarida and Cleveland Fed Chairman Mestre; judging from the current trend, recent remarks by Fed officials tend to send optimistic signals and tend to support the dollar in the midline.

From this day onThe British Labour Party will elect a new party leader。Britain's largest opposition party, the Labour Party, is scheduled to vote in the party's leadership election from February 21 to April 2; a special meeting will be held on April 4 to announce the winner. This is the fourth re-election of the leader of the Labour Party since it became an opposition party in 2010. A fierce battle is widely expected within the Labour Party. After the Labour Party suffered a crushing defeat to Prime Minister Johnson's Conservative Party in the parliamentary elections in December last year, Party leader Corbyn announced his resignation and will remain in office until the new party leader is elected.

In terms of financial statements, Hong Kong stocks$Sands China Ltd. (01928.HK) $, US stock plus$Royal Bank of Canada (RY.US) $The results will be announced today.

In the new week, I wish all investors all the best and enjoy their work. Thank you for your support to Futu Information!

In the new week, I wish all investors all the best and enjoy their work. Thank you for your support to Futu Information!

Edit / emily