Source: the finishing touch of Zhongjin

Authors: Zhang Yu, Wang Pu

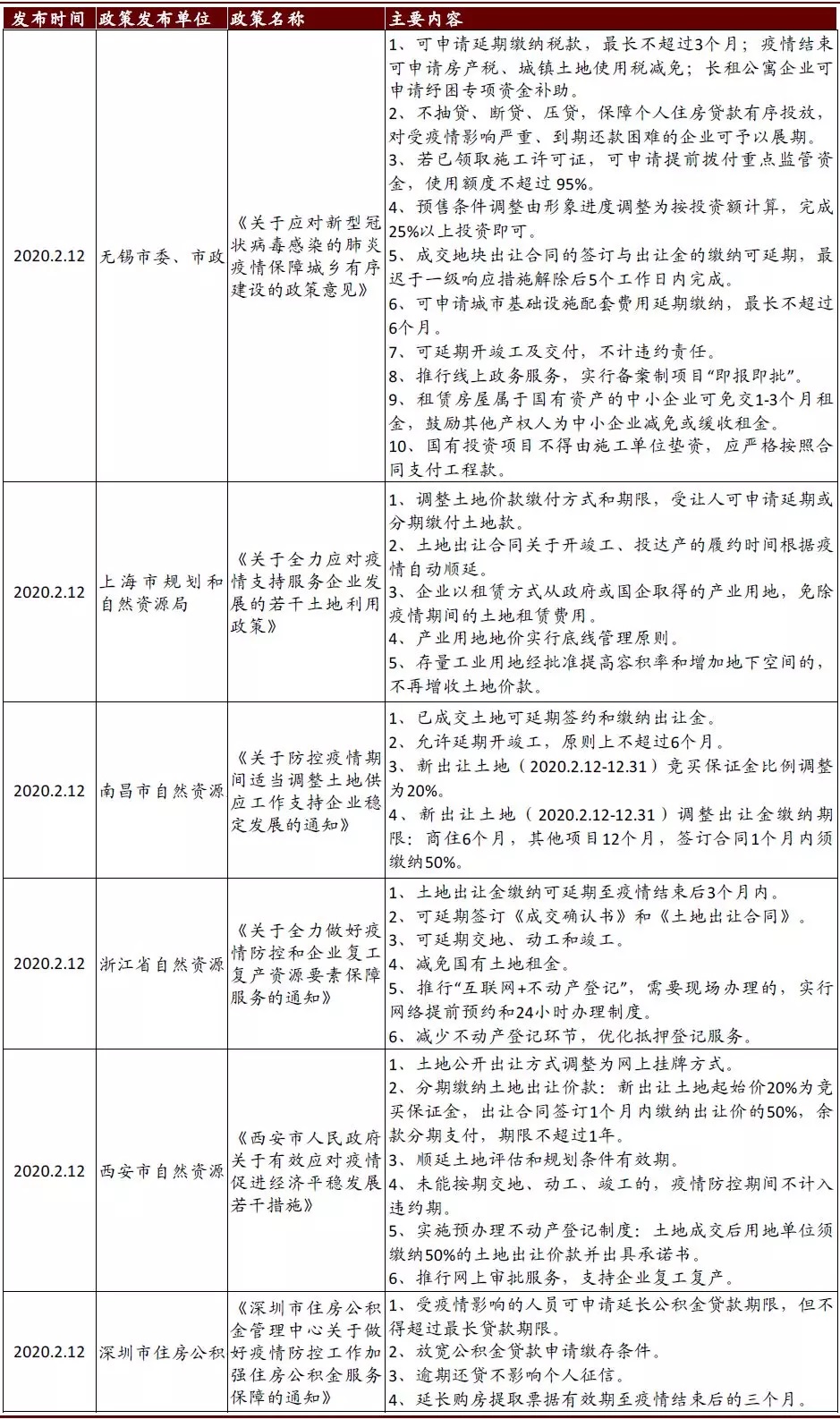

Recently, Wuxi, Xi'an, Shenzhen, Zhejiang and other provinces and cities have issued a series of property market support policies in response to the "COVID-19" epidemic. The policies include allowing delays in the payment of land prices, deferred payment of taxes and fees, appropriate relaxation of pre-sale conditions, promotion of online examination and approval services, credit support, and so on, to fully support real estate development enterprises in dealing with the difficulties faced by production and business activities under the epidemic.

Local policies mainly focus on dealing with the financial pressure of the industry under the impact of the epidemic, which is helpful to slow down the risk of developers' cash flow and guide the gradual restoration of industry order.

We believe that the property market support policies issued by various localities are a strong implementation of the spirit of "co-ordinating epidemic prevention and control and the restoration of economic and social order" put forward by the standing Committee of the political Bureau of the CPC Central Committee on February 12. It is a targeted response to the financial impact faced by the real estate industry under the impact of the epidemic. At present, sales offices in most parts of the country are closed, project construction is suspended, sales rebates of real estate enterprises are greatly reduced, the superposition industry is facing a peak of debt maturity, and the cash flow risk of real estate enterprises is gradually accumulating.

At this time, the policy side in the tax and fees and land payment delay, credit support and other aspects of tilt, can effectively alleviate the developers' short-term cash payment pressure, improve their cash flow security, slow down the downside risks of the industry. The implementation of the government's online examination and approval services and the appropriate relaxation of examination and approval conditions will help to guide housing enterprises to gradually resume production and operation activities and promote the return of the order of the property market.

In the follow-up, more cities are expected to follow, and the policy is gradually opening up the space for adjustment.

We believe that in the follow-up, more cities will issue varying degrees of property market support policies under the framework of "policies due to the city". At this stage, the main purpose of local policies is to "tide over the difficulties." policy means will focus on reducing the burden on developers and alleviating short-term financial pressure. In the follow-up, we judge that the policy will gradually point to "trust demand", especially to protect the reasonable and orderly recovery of land market demand, which may be reflected in the appropriate adjustment of developers' financing policies. on the basis of ensuring that housing enterprises borrow new and repay the old quota is reasonable and adequate, do not rule out the opportunity of some high-quality housing enterprises in the new debt financing quota.

Chart: summary of supporting policies for the real estate industry in six regions

Sources: Wuxi Municipal Party Committee, Municipal Government, Shanghai Municipal Planning and Natural Resources Bureau, Nanchang Natural Resources Bureau, Zhejiang Provincial Natural Resources Department, Xi'an Natural Resources and Planning Bureau, Shenzhen Housing Provident Fund Management Center, China International Capital Corporation Research Department

The fundamentals of the industry are under short-term pressure and are expected to show a "V" trend throughout the year.

We judge that real estate sales, construction, land transactions, investment and other core indicators in February and March will be significantly affected by the epidemic. If the epidemic is effectively controlled before April, all indicators are expected to enter the repair channel from the second quarter. Throughout the year, the fundamentals of the industry will show a "V-shaped" trend of low before and high behind (the bottom is likely to appear in March). If the epidemic lasts longer, the bottom of the "V" may be deeper and longer, and the follow-up feedback on the policy side may be stronger.

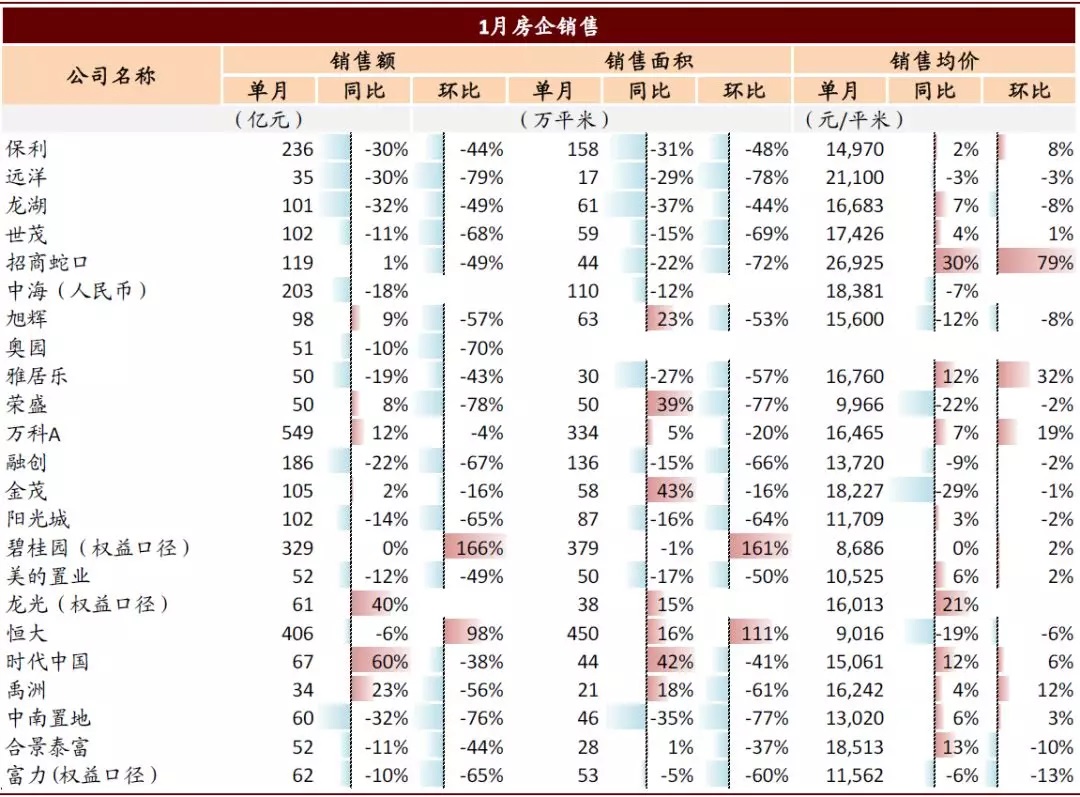

Chart: sales data of key housing enterprises in January 2020

Source: company announcement, China International Capital Corporation Research Department

We continue to remind real estate stocks of investment opportunities.

Although the short-term fundamentals of the industry are affected by the epidemic and face a certain negative impact, we are not pessimistic about the overall views of the industry's high-quality leading companies, mainly taking into account:

1) the negative impact of the epidemic is temporary for residential developers, and the demand is only delayed, which reflects the strong defense of the leading companies in terms of sales and profits.

2) the current macroeconomic and real estate fundamentals are under pressure, and there may be more room for positive adjustment on the policy side.

3) Plate valuations and positions are already at the bottom. At present, investors are advised to pay attention to the low suction opportunities of head developers.

Chart: historical NAV discount level and dynamic P / E ratio of A-share real estate companies

Source: company announcement, China International Capital Corporation Research Department

Chart: historical NAV discount level and dynamic P / E ratio of Hong Kong real estate companies

Source: company announcement, China International Capital Corporation Research Department

Risk

The duration of the epidemic is longer than expected; the positive adjustment of industry policy is less than expected; the mortgage quota is lower than expected; and the macro-environmental uncertainty is increased.

Edit / Jeffy