Despite an already strong run, Workiva Inc. (NYSE:WK) shares have been powering on, with a gain of 25% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 3.2% isn't as impressive.

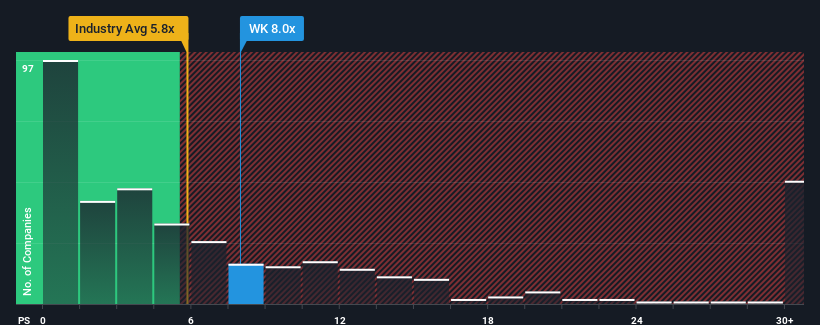

After such a large jump in price, Workiva may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8x, since almost half of all companies in the Software in the United States have P/S ratios under 5.8x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Has Workiva Performed Recently?

There hasn't been much to differentiate Workiva's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Workiva will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Workiva's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Workiva's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the ten analysts following the company. With the industry predicted to deliver 21% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Workiva is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Workiva's P/S Mean For Investors?

Workiva shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Workiva, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Workiva (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of Workiva's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.