Whales with a lot of money to spend have taken a noticeably bullish stance on Meta Platforms.

Looking at options history for Meta Platforms (NASDAQ:META) we detected 85 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $547,806 and 75, calls, for a total amount of $11,053,985.

From the overall spotted trades, 10 are puts, for a total amount of $547,806 and 75, calls, for a total amount of $11,053,985.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $1030.0 for Meta Platforms, spanning the last three months.

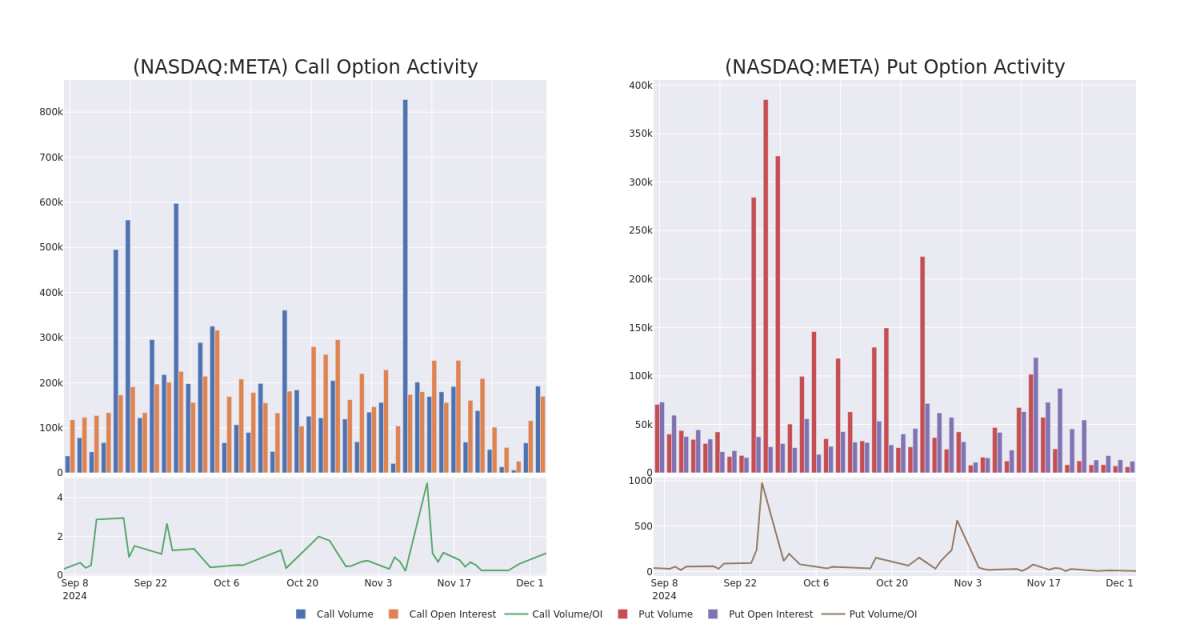

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $50.0 to $1030.0 over the preceding 30 days.

Meta Platforms Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.65 | $89.9 | $700.00 | $952.9K | 596 | 430 |

| META | CALL | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.45 | $90.0 | $700.00 | $666.4K | 596 | 138 |

| META | CALL | SWEEP | BEARISH | 01/17/25 | $565.5 | $562.85 | $564.7 | $50.00 | $451.7K | 1.3K | 10 |

| META | CALL | SWEEP | BEARISH | 01/17/25 | $565.35 | $563.15 | $564.44 | $50.00 | $451.4K | 1.3K | 42 |

| META | CALL | SWEEP | NEUTRAL | 01/17/25 | $564.25 | $562.7 | $563.99 | $50.00 | $451.1K | 1.3K | 246 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Having examined the options trading patterns of Meta Platforms, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Meta Platforms

- With a volume of 2,281,294, the price of META is down -0.04% at $613.43.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

Professional Analyst Ratings for Meta Platforms

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $675.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Raymond James downgraded its action to Strong Buy with a price target of $675.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.