Received bullish rating from Goldman Sachs.

Demand related to AI is strong. On Tuesday, several US companies reported strong performance, and their stock prices soared in post-market trading.

Among them, the cybersecurity company okta reported results for the last fiscal quarter, with revenue and guidance exceeding market expectations.

In post-market trading, okta's stock price increased by over 15%. This year, the company's stock price initially rose significantly, reaching a high of $114.5 per share, but then fluctuated and declined, accumulating a drop of 9.74% within the year.

In post-market trading, okta's stock price increased by over 15%. This year, the company's stock price initially rose significantly, reaching a high of $114.5 per share, but then fluctuated and declined, accumulating a drop of 9.74% within the year.

On Tuesday, okta's closing price was $81.71 per share, down over 28% from the peak, with the latest total market value at $13.879 billion.

Both the performance and guidance exceeded expectations.

According to information, okta was established after the financial crisis in 2009 and is a cloud-based software service platform that helps enterprises manage the identities of employees and customers.

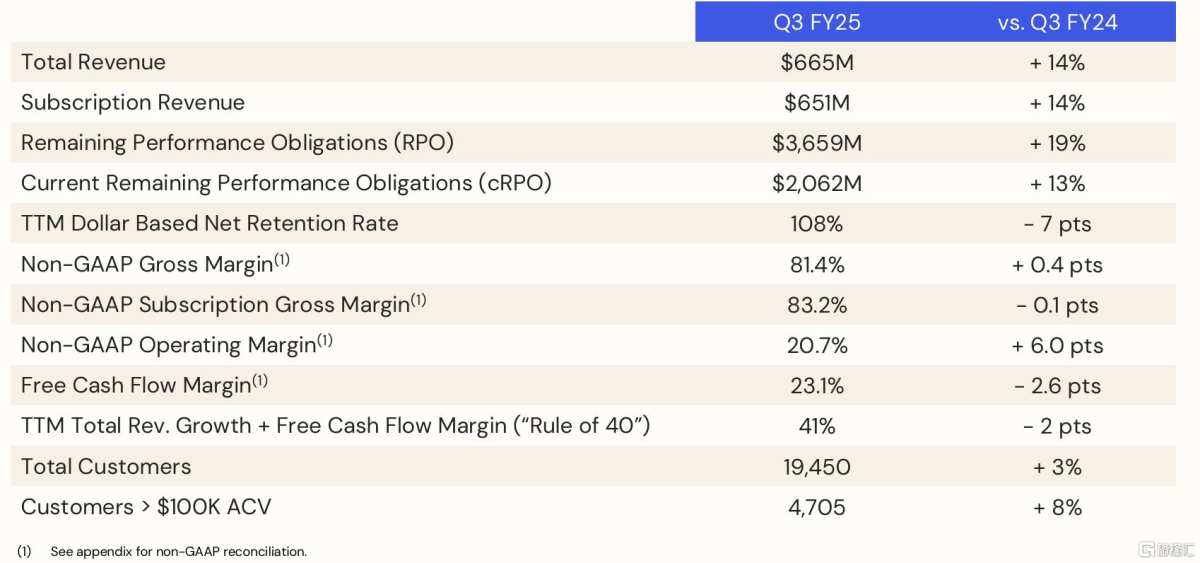

Specifically, Okta achieved revenue of 0.665 billion dollars in the last fiscal quarter, a year-on-year increase of 14%, exceeding the analyst expectation of 0.6496 billion dollars.

Net income turned profitable, recording 16 million dollars; the adjusted eps was 0.67 dollars, higher than the analyst expectation of 0.58 dollars.

As of the end of the last fiscal quarter, Okta's total remaining performance obligations (RPO) amounted to 3.659 billion dollars, a year-on-year increase of 13%. Among them, the RPO from existing customers was 2.062 billion dollars, also a year-on-year increase of 13%.

Looking ahead, Okta expects that the revenue for the next fiscal quarter will be between 0.667 billion and -0.669 billion dollars, with eps expected to be between 73 and 74 cents, both exceeding analyst expectations.

In addition, Okta has also raised its full-year performance guidance, expecting revenue to be between 2.595 billion and -2.597 billion dollars, up from the previous revenue expectation of 2.57 billion dollars; the adjusted eps is expected to be between 2.75 and 2.76 dollars, up from the prior expectation of 2.58 to 2.63 dollars.

Received bullish rating from Goldman Sachs.

On December 2, morgan stanley raised okta's rating from hold to shareholding and increased the target price from $92 to $97.

morgan stanley stated that it is bullish on the long-term favorable factors in the security field.

morgan stanley believes that the demand environment is stabilizing, competitive disadvantages seem to be easing, and a new product cycle consistent with the increasingly important role of GenAI in cybersecurity is also beginning to gain traction, thus raising okta's rating.

美股盘后,Okta股价涨超15%。今年以来,该公司股价先是大幅上涨,最高触及114.5美元/股,后震荡走低,年内已经累计跌9.74%。

美股盘后,Okta股价涨超15%。今年以来,该公司股价先是大幅上涨,最高触及114.5美元/股,后震荡走低,年内已经累计跌9.74%。