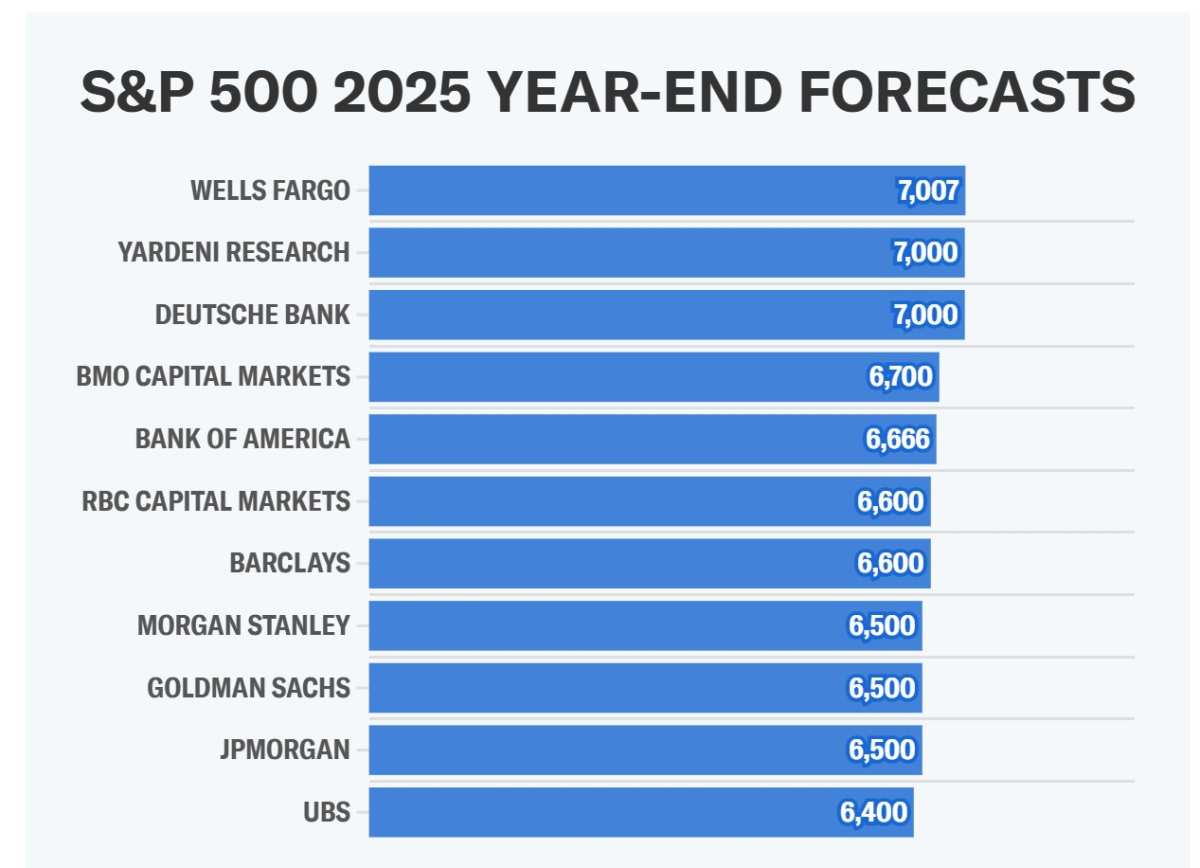

Wells Fargo stock strategist Harvey expects the S&P 500 to rise to 7007 points by the end of 2025, which is the highest target for Wall Street strategists

The Zhitong Finance App noticed that Wall Street's forecast for the 2025 stock market reached a new high. On Tuesday, Wells Fargo stock strategist Christopher Harvey and his team predicted that the S&P 500 would rise to 7007 points by the end of 2025, the highest target for Wall Street strategists, and predicted that the S&P 500 could rise by more than 26% next year.

This target is only 7 points higher than the predictions of Deutsche Bank and Yardeni Research, which predict that the S&P 500 will close at 7,000 points in 2025.

“Overall, we expect the Trump administration to usher in an increasingly favorable macro environment for the stock market, while the Federal Reserve will slowly cut interest rates,” Harvey wrote in his 2025 stock market outlook. “In short, this is a backdrop for the stock market to continue to rise.”

“Overall, we expect the Trump administration to usher in an increasingly favorable macro environment for the stock market, while the Federal Reserve will slowly cut interest rates,” Harvey wrote in his 2025 stock market outlook. “In short, this is a backdrop for the stock market to continue to rise.”

Harvey added that corporate profit margins continue to expand, the US economy is growing faster than the current 2.1% forecast, and”mergers and acquisitionsThe stock market will rise in an environment where “activity will pick up slightly at the end of 2025.”

Harvey saw a similar script to Bank of America's 2025 outlook, which lays out the rationale that US economic growth will drive cyclical industries upward.

Harvey believes that “an upward revision of GDP and the regulatory environment will catalyze cyclical opportunities.”

This includes predicting that weighted indices such as the S&P 500 will perform well in 2025, and that the index is not unduly affected by the trend of large stocks such as the benchmark market capitalization weighted index.

In other words, Harvey is the newest voice on Wall Street, and he expects the market rebound to continue to expand from the tech “Big Seven” to 493 other components of the S&P 500.

Harvey wrote in the report that given concerns about bullish market sentiment, high stock valuations, and already solid economic growth, he initially wanted to “lean towards reverse investment.”

However, Harvey wrote, “The data does not support” the S&P 500 index's weak performance or negative growth this year. “2025 is likely to be a solid to strong year.”

“总的来说,我们预计特朗普政府将迎来一个对股市越来越有利的宏观环境,而美联储将缓慢降息,”哈维在他的2025年股市展望中写道。“简而言之,这是一个股市继续上涨的背景。”

“总的来说,我们预计特朗普政府将迎来一个对股市越来越有利的宏观环境,而美联储将缓慢降息,”哈维在他的2025年股市展望中写道。“简而言之,这是一个股市继续上涨的背景。”