Financial giants have made a conspicuous bearish move on Newmont. Our analysis of options history for Newmont (NYSE:NEM) revealed 22 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $793,136, and 10 were calls, valued at $1,178,399.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $45.0 for Newmont during the past quarter.

Volume & Open Interest Trends

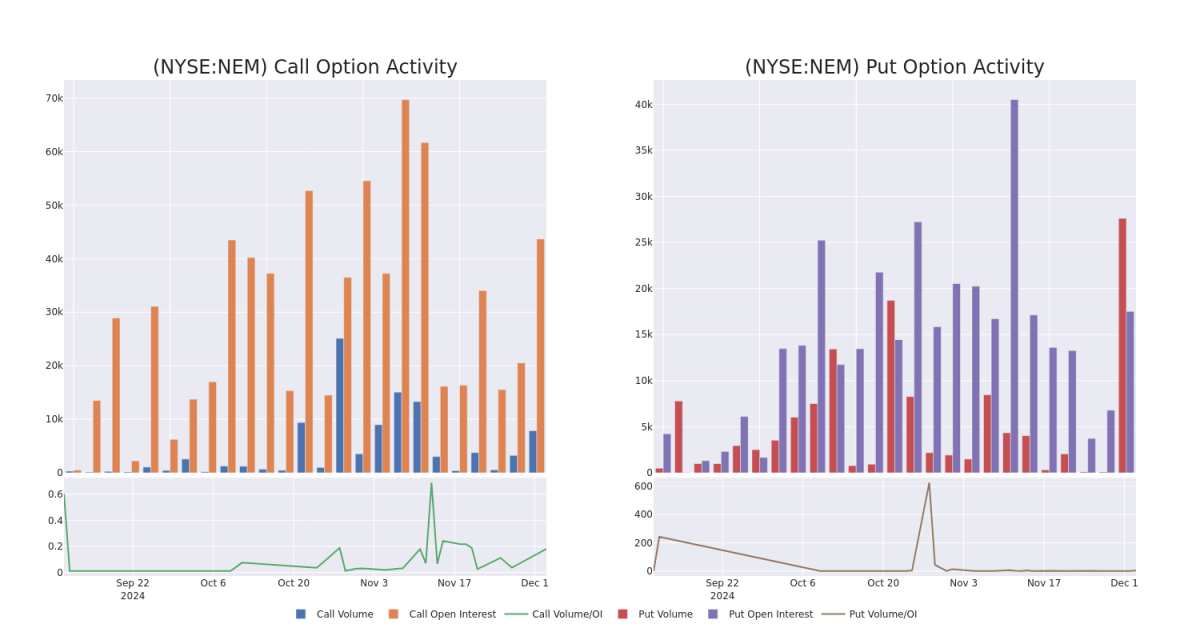

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Newmont's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Newmont's whale activity within a strike price range from $35.0 to $45.0 in the last 30 days.

Newmont Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | SWEEP | BEARISH | 02/21/25 | $2.32 | $2.29 | $2.29 | $42.50 | $263.9K | 792 | 1.1K |

| NEM | CALL | SWEEP | BULLISH | 01/17/25 | $2.85 | $2.7 | $2.8 | $40.00 | $248.3K | 13.0K | 919 |

| NEM | PUT | SWEEP | BEARISH | 03/21/25 | $1.14 | $1.11 | $1.13 | $37.50 | $197.4K | 6.6K | 4.7K |

| NEM | CALL | TRADE | BEARISH | 06/20/25 | $6.9 | $6.75 | $6.8 | $37.50 | $189.0K | 956 | 302 |

| NEM | CALL | TRADE | BEARISH | 02/21/25 | $2.33 | $2.29 | $2.29 | $42.50 | $168.5K | 792 | 1.9K |

About Newmont

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 5.5 million ounces of gold in 2024 from its core mines and 6.8 million in total. It is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

In light of the recent options history for Newmont, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Newmont Standing Right Now?

- Currently trading with a volume of 3,365,651, the NEM's price is up by 3.08%, now at $42.17.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 79 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.