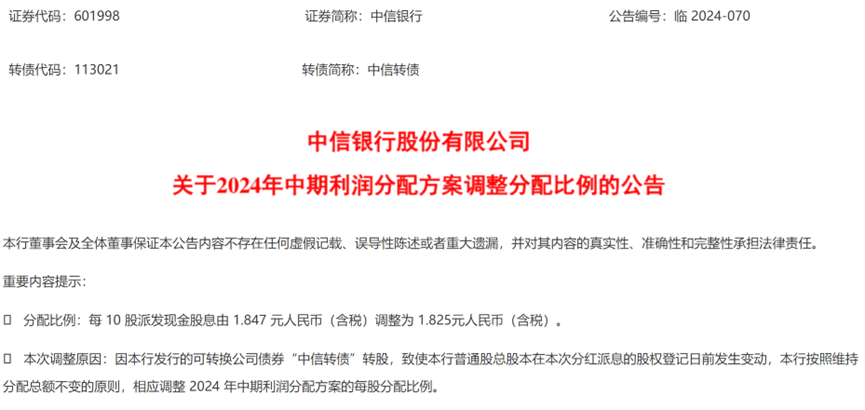

Blue Whale News, December 3rd (Reporter Jin Lei Xiao Yang Intern) On the evening of December 2nd, China Citic Bank (601998.SH) issued an announcement regarding the adjustment of the profit distribution ratio for the mid-year of 2024. The announcement shows that the dividend ratio this time has been adjusted from distributing cash dividends of 1.847 yuan (including tax) per 10 shares to 1.825 yuan (including tax).

The announcement points out that the reason for this adjustment is due to the conversion of convertible corporate bonds issued by China Citic Bank, known as "Citic Convertible Bonds", which resulted in changes in the total share capital of common stock before the ex-dividend date. In accordance with the principle of maintaining the total distribution amount unchanged, the corresponding per share distribution ratio was adjusted.

In fact, China Citic Bank had previously announced the adjustment of the mid-term dividend ratio.

At the end of the previous interim reporting season, on August 28, China Citic Bank announced the mid-year profit distribution plan for 2024, deciding to distribute cash dividends of 1.847 yuan (including tax) per 10 shares to A-share shareholders and H-share shareholders registered on the ex-dividend date. Calculated based on the total capital stock of A-shares and H-shares of the bank as of the end of June 2024 (approximately 53.457 billion shares), the total amount of cash dividends for ordinary shares in 2024 mid-year is 9.873 billion yuan (including tax), accounting for 29.20% of the net income attributable to ordinary shareholders of the bank after the mid-year of 2024 combined.

At the end of the previous interim reporting season, on August 28, China Citic Bank announced the mid-year profit distribution plan for 2024, deciding to distribute cash dividends of 1.847 yuan (including tax) per 10 shares to A-share shareholders and H-share shareholders registered on the ex-dividend date. Calculated based on the total capital stock of A-shares and H-shares of the bank as of the end of June 2024 (approximately 53.457 billion shares), the total amount of cash dividends for ordinary shares in 2024 mid-year is 9.873 billion yuan (including tax), accounting for 29.20% of the net income attributable to ordinary shareholders of the bank after the mid-year of 2024 combined.

At the same time, as indicated in the semi-annual report, due to the company's issuance of convertible corporate bonds in the conversion period, if there were changes in the total share capital before the ex-dividend date of this distribution, the distribution total is intended to be maintained unchanged with corresponding adjustments in the per share distribution ratio.

Until December 2nd, China Citic Bank disclosed that there had been changes in the total share capital of common stock on the eve of the dividend distribution.

Specifically, due to the conversion of convertible corporate bonds issued by China Citic Bank, known as “Citic Convertible Bonds”, from July 1st to December 2nd, 2024, the total share capital of common stock of the bank increased to approximately 54.098 billion shares. Therefore, in accordance with the principle of maintaining the total distribution amount unchanged, the per share distribution ratio was adjusted based on the total share capital of 54.098 billion shares, with a revised distribution of 1.825 yuan (including tax) per 10 shares, and the total amount of cash dividends for ordinary shares distributed is approximately 98.73 yuan (including tax).

However, looking at the specific dividend amount data, the adjusted dividend amount decreased by approximately 0.5365 million yuan compared to the original planned amount. China Citic Bank explained that the difference in the total profit distribution amount was due to rounding the cash dividend per share.

However, adjusting the profit distribution proportion scheme on the eve of dividends is not uncommon.

On November 7, Bank of Suzhou announced that during the period from June 30, 2024, to the implementation, the total share capital of the company increased from 3.667 billion shares to 3.765 billion shares due to the conversion of convertible corporate bonds to shares. According to the principle of unchanged distribution ratio, the total distribution amount was adjusted, and after the adjustment, cash dividends of 2.00 yuan (tax included) were distributed to ordinary shareholders for every 10 shares, with an estimated cash dividend of approximately 0.753 billion yuan (tax included).

So far, nearly half of the 42 listed banks that have disclosed midterm profit distribution plans have announced that they plan to distribute over 250 billion yuan in cash dividends. Among them, 6 state-owned banks are introducing midterm dividend plans for the first time, with a total planned cash dividend of 204.823 billion yuan.

According to incomplete statistics, Ping An Bank, Bank of Suzhou, Minsheng Bank, and 6 other listed banks have already implemented midterm dividend distributions.

In addition to midterm dividends, Bank of Chongqing has also introduced a third-quarter dividend plan, intending to distribute cash dividends of 1.66 yuan for every 10 shares, totaling an estimated cash dividend of 0.577 billion yuan, accounting for 13.03% of the net income attributable to common shareholders of the bank.

在此前中报季收官之际,即8月28日,中信银行公布了2024 年中期利润分配方案,决定向股权登记日登记在册的A股股东和H股股东每10股派发现金股息1.847元(含税)。按照截至2024年6月末该行A股和H股总股本数来计算(约534.57亿股),分派2024年中期普通股现金股息总额为98.73亿元(含税),占 2024 年中期合并后归属于该行普通股股东净利润的29.20%。

在此前中报季收官之际,即8月28日,中信银行公布了2024 年中期利润分配方案,决定向股权登记日登记在册的A股股东和H股股东每10股派发现金股息1.847元(含税)。按照截至2024年6月末该行A股和H股总股本数来计算(约534.57亿股),分派2024年中期普通股现金股息总额为98.73亿元(含税),占 2024 年中期合并后归属于该行普通股股东净利润的29.20%。