Source: Caixin.

Author: Xiaoxiang. In 23, the company's overall sales volume was 18,000 kiloliters, with a YoY increase of 28.10%, showing significant growth. In terms of product structure, the operating income of products worth 10-30 billion yuan was 401/1288/60 million yuan, respectively.

① The scale of yen arbitrage trading has gradually returned to its "peak time"; ② The "guillotine" of the Bank of Japan's interest rate hike may also fall later this month!

This summer, the unwinding of the yen arbitrage trades wiped out approximately $6.4 trillion in market cap from global stock markets within a mere three weeks.$Nikkei 225 (.N225.JP)$Indices also faced their largest single-day decline since 1987. The global market storm at that time still lingers in the memories of many market traders to this day...

This summer, the unwinding of the yen arbitrage trades wiped out approximately $6.4 trillion in market cap from global stock markets within a mere three weeks.$Nikkei 225 (.N225.JP)$Indices also faced their largest single-day decline since 1987. The global market storm at that time still lingers in the memories of many market traders to this day...

Now, as the end of the year approaches, an unsettling phenomenon is that the large environment that triggered a series of summer market earthquakes seems to be replaying itself in a "replicated version":

The scale of yen arbitrage trading has gradually returned to its "peak time", and the "guillotine" of the Bank of Japan's interest rate hike may also fall later this month!

This inevitably makes many market participants wonder: Once the secret hand that triggered the August USA-Japan stock disaster reappears, where will the global market head this time?

Financing arbitrage trading refers to investors borrowing currencies from low interest rate countries like japan, and then using these funds to invest in higher interest rate countries like the usa and mexico. In recent years, due to the extremely low interest rates in japan, the yen has been the most popular financing currency. However, once arbitrage trading is forced to unwind, investors may sell off a series of previously purchased risky assets while buying back yen.

Yen arbitrage trading is "popular"

There are signs that yen arbitrage trading is recently regaining popularity.

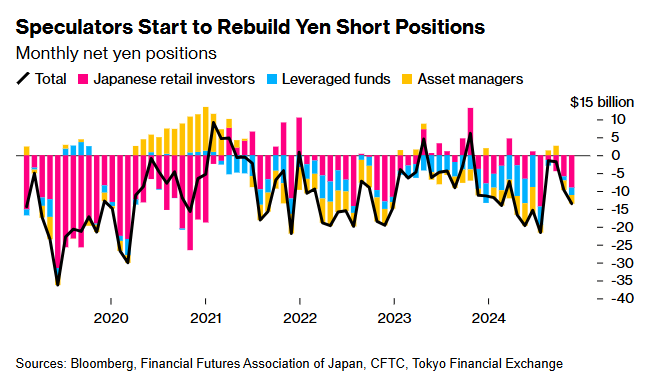

According to the analysis of data from the Japan Financial Futures Association, the Tokyo Financial Exchange, and the U.S. Commodity Futures Trading Commission (CFTC), the net short position in yen held by Japanese retail investors and foreign leveraged funds and asset management companies increased from 9.74 billion dollars in October to 13.5 billion dollars in November.

Many analysts point out that driven by factors such as widening interest rate differentials, increased U.S. government borrowing, and lower volatility in the money market, yen arbitrage trading remains favored by the market. These conditions make borrowing in Japan (borrowing yen) and investing in global high-yield markets quite attractive.

Strategists from Mizuho Securities and Saxo Bank state that arbitrage trading may return to the levels seen earlier this year.

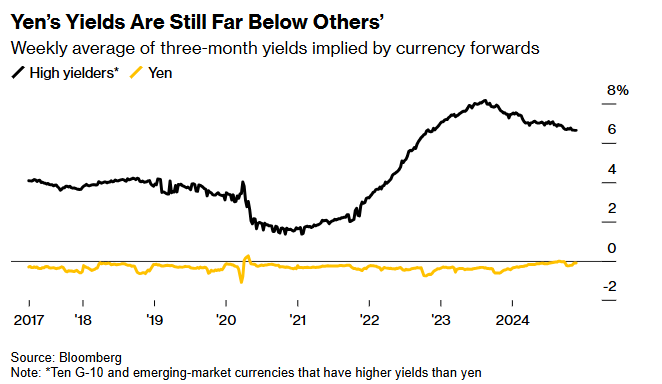

For a long time, the interest rate differential has been the main driving force behind yen arbitrage trading. The average interest rates for G10 currencies and ten types of emerging market high-yield currencies exceed 6%. In contrast, the Bank of Japan's benchmark interest rate remains only 0.25%, while local bank loan rates hover around 1.7%, indicating that the cost of borrowing yen remains relatively low.

Despite the gradual increase in interest rates by the Bank of Japan, the yield gap with major economies such as the USA remains significant. Therefore, the profits of yen arbitrage trading strategies are still very lucrative. Since the end of 2021, the yen arbitrage trading has achieved a return rate of 45% targeting 10 major currencies and emerging market currencies, in contrast, the return rate is only 32% when including dividend reinvestment.$S&P 500 Index (.SPX.US)$The return rate is only 32%.

This substantial profit has attracted an increasing number of investors, and by the end of July—just before significant unwinding of yen arbitrage trades—the net short position in yen had once reached 21.6 billion dollars. Alvin Tan, head of Asia forex strategy at the Royal Bank of Canada in Singapore, stated that the absolute interest rate differential of other currencies relative to yen is quite large, meaning it will always be regarded as a funding currency.

Regarding the yen's exchange rate, ongoing structural issues such as massive capital outflows continue to put pressure on the yen, making it perform the worst among G10 currencies this year. Although just a few months ago, against the backdrop of unwinding interest rate trades, the yen to dollar exchange rate rose to the 140 level, it currently remains relatively weak around 150.

The Bank of Japan reaches for the 'interest rate knife.'

It is evident that while the yen arbitrage trading has "come back to life," a hidden danger remains: will a wave of closing yen arbitrage trades similar to this summer's reoccur if the Bank of Japan raises interest rates at the end of the year?

Last week, the sudden surge in the yen highlighted the ongoing risks faced by investors engaging in renewed arbitrage trades.

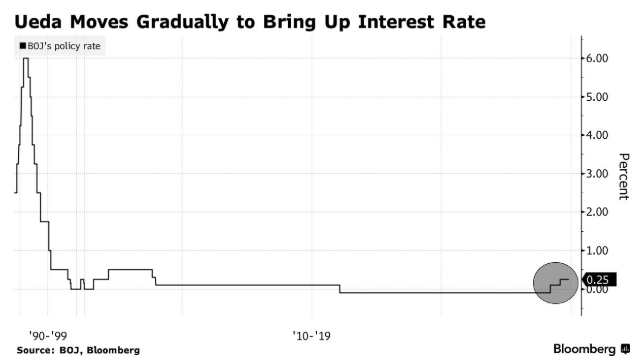

Some industry insiders are currently concerned that the narrowing of interest rate differentials will bring yen arbitrage trading back to a downturn next year, especially after Bank of Japan Governor Ueda opened the door for a rate hike in December. Many Japanese officials have also recently expressed concerns about the trend of yen depreciation, with the Japanese Finance Minister stating last month that the yen has experienced sharp one-way fluctuations since late September.

The Bank of Japan will announce its rate decision on December 19 at noon—just hours after the Federal Reserve announces its December rate decision. Many industry insiders currently expect the Bank of Japan to raise rates by 25 basis points to 0.5% at this meeting, and if this expectation is realized, it will mark the first time Japan has tightened policy three times in a year since the asset bubble peaked in 1989.

Last Friday, in an interview excerpt published in Japan, Bank of Japan Governor Ueda stated in response to the question "Can it be understood that the next rate hike is approaching?" that "they are getting closer," as economic data is moving in the right direction.

Jane Foley, Head of Foreign Exchange Strategy at Rabobank London, wrote in a research report, "The market has been encouraged to believe that the Bank of Japan may raise interest rates in December, which the latter may not want to disappoint."

Considering that the large unwinding of yen arbitrage trades in August occurred immediately after the Bank of Japan implemented a "rate hike + QT" tightening policy, it is clearly worth investors' vigilance whether this time the Bank of Japan's rate hike will bring similar destructive power.

Foley stated that the Japanese Ministry of Finance has re-engaged with speculators through verbal interventions, and the Bank of Japan Governor's remarks continue to raise market concerns about an interest rate hike in December. Therefore, although arbitrage trading has recently gained further support, it may lack confidence and momentum to operate further before next spring.

Of course, given that the ultimate hawkish or dovish stance of the central banks of the usa and japan is still unclear, whether arbitrage trades will really close is not yet a definite conclusion. After the meetings of the bank of japan and the federal reserve in December, investors may gain further insight into arbitrage trading. If the bank of japan increases interest rates in a dovish manner or if the federal reserve decreases rates in a hawkish manner, then yen arbitrage traders may still remain above the market.

Shoki Omori, the chief strategist of Mizuho Securities in Japan, pointed out, "The speed of interest rate hikes by the bank of japan is expected to be very slow, and if Powell does not plan to cut rates quickly, then the interest rate differential will still be very attractive for arbitrage trading."

Editor/Rocky

今年夏季,日元套利交易的平仓在短短三周内就从全球股市中抹去了约6.4万亿美元的市值,

今年夏季,日元套利交易的平仓在短短三周内就从全球股市中抹去了约6.4万亿美元的市值,