FX168 Financial News (Asia-Pacific) reported that the governor of the Bank of Japan, Kazuo Ueda, has ample data to support an increase in the benchmark interest rate in December. This move would mark the first time Japan has raised rates three times in a year since the peak of the asset bubble in 1989. In a recent interview, Ueda hinted that the timing for the next rate hike is approaching, suggesting that a 'black swan' event could unfold at any moment.

Ueda seems determined to weigh his options up until the last minute before making a decision on December 19. He will closely study the upcoming data, including the Bank of Japan's short-term economic outlook survey on December 13, and pay attention to the Federal Reserve's rate decision made hours before the Bank of Japan's policy meeting.

However, expectations for a rate hike have been rising recently.

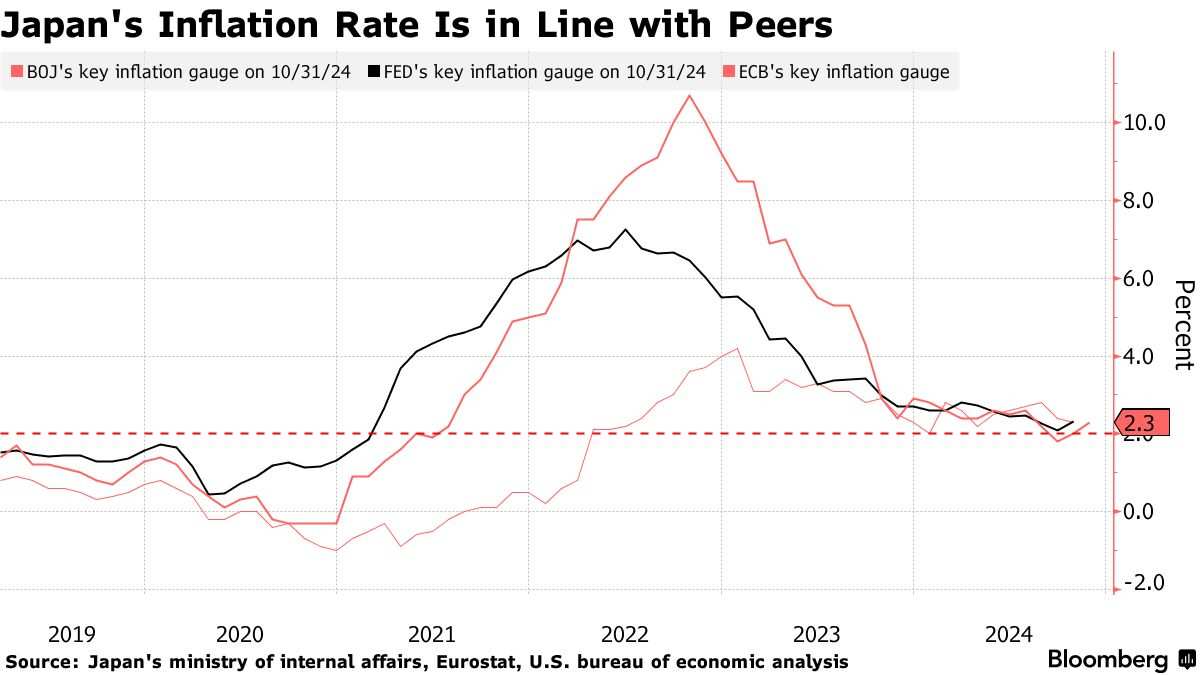

In an interview last Saturday (November 30), Ueda reiterated that if the economy performs as expected, the Bank of Japan will raise rates. He further stated that the timing for a rate hike is 'approaching', as predictions have proven to be prescient. Inflation momentum continues, businesses are planning to invest, and wages are rising. #Bank of Japan dynamics#

In an interview last Saturday (November 30), Ueda reiterated that if the economy performs as expected, the Bank of Japan will raise rates. He further stated that the timing for a rate hike is 'approaching', as predictions have proven to be prescient. Inflation momentum continues, businesses are planning to invest, and wages are rising. #Bank of Japan dynamics#

The annual wage negotiations are also quite optimistic, indicating that the economy is slowly moving toward a virtuous wage-price cycle. The policy meeting in December is expected to be a key event. Most economists surveyed last month anticipated a rate hike in January 2025, and Ueda's weekend interview may have spurred some of these views as the yield on 2-year government bonds rose to its highest level since 2008 on Monday.

"The next rate hike is likely in December," said Ko Nakayama, chief economist at Okasan Securities and a former Bank of Japan official. "The Bank of Japan has stated that it would raise rates if the economy meets official forecasts. More and more evidence supports this."

The last time the Bank of Japan raised rates three times in a year was in 1989, and the third hike that year occurred in December, just four days before the nikkei 225 index peaked at 38,957.44 points. #Japanese market#

The cumulative scope of these measures raised the official bank rate from 2.5% at the beginning of the year to 4.25%, and along with the Bank of Japan's warnings about the bubble, it placed a heavy burden on the economy and helped to undermine the overly tense confidence of investors. It was not until 35 years later that the stock market returned to these highs again in February this year.

In 2024, Kazuo Ueda faces a completely different economic situation. Japan no longer has any competitors that could become the world's largest economy. On the contrary, Japan is an aging economy trying to rebuild the cycle of inflation, economic vitality, and growth. After years of policy experimentation, the governor hopes to return the central bank to a more orthodox approach to policy control through interest rates.

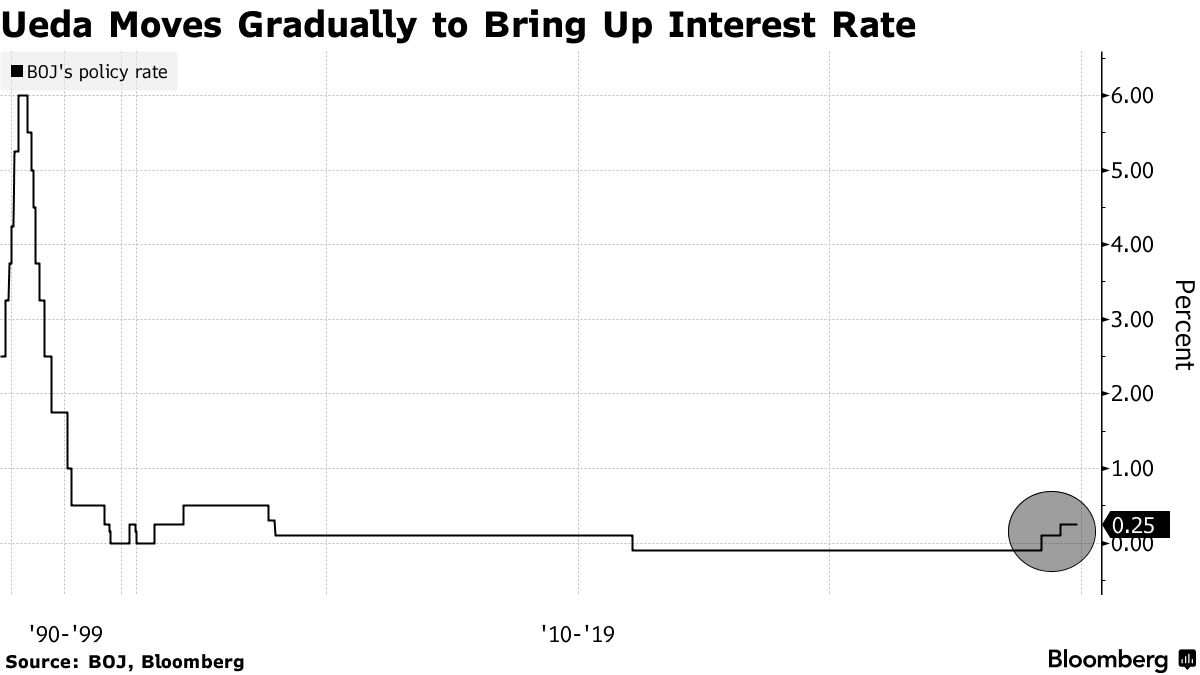

Kazuo Ueda ended the central bank's extensive monetary easing program in March of this year and implemented the first interest rate hike in 17 years, making 2024 a milestone year.

(Source: Bloomberg)

The next interest rate hike will raise the Bank of Japan's policy rate from 25 basis points to 50 basis points, the highest level since 2008. Although this level remains quite low compared to borrowing costs of major global central banks, this action still represents a significant change compared to the last time negative interest rates were implemented globally and maintained at -0.1% for several years.

(Source: Bloomberg)

Despite Kazuo Ueda's surprisingly swift return to normalcy, progress has been smoother than expected but not without some obstacles. The second interest rate hike by the Bank of Japan in July triggered a market crash in early August, including the nikkei 225 index recording its largest single-day drop in history. However, the market eventually stabilized.

Ueda Kazuo vowed to communicate cautiously before the Bank of Japan takes the next step, and he did not adopt the type of communication favored by Federal Reserve Chairman Powell, who indicated that "the time has come" to signal impending rate actions by the central bank.

Ueda Kazuo chose to use the term "upcoming," suggesting that he would take action without being limited to a specific month.

In a media interview broadcast on Saturday, he pointed out that he is closely watching wage negotiations and any risks that may arise in the USA economy, as authorities are trying to achieve a soft landing during a political transition period. The strong wage growth achieved this spring was a driving force behind the bank's decision to begin withdrawing stimulus plans in March.

As the decision day in December approaches, the interest rate gap between the USA and Japan may narrow, prompting actions from both sides. As of Monday, traders estimated the probability of a Fed rate cut at about 67%, while the likelihood of a Bank of Japan rate increase was approximately 61%, doubling from a month ago.

"If the Fed takes action while the Bank of Japan does not, it could expose the Bank of Japan's cautious stance and weaken the yen," Nakayama said. "This could also create confusion, undermining the stability of the financial markets."

Some economists indicated that political factors might delay the Bank of Japan's rate hike decision until January 2025. One reason for pausing rate increases is that Prime Minister Ishiba Shigeru's position has become precarious after the ruling coalition lost its majority and faced the worst election result since 2009 in October.

The Prime Minister of Japan must seek cooperation from the opposition parties to help pass an additional budget of 14 trillion yen, approximately 93 billion USD, to fund the stimulus plan. The government also needs their support to draft regular budgets and make legal amendments.

Economists Ryutaro Kono and Hiroshi Shiraishi from BNP Paribas wrote in a report on Monday: "Ishiba Shigeru is walking a tightrope, as his ruling coalition does not have a majority in parliament. If his government cannot communicate effectively, the Bank of Japan may decide to wait while also considering other tasks."

However, Naomi Muguruma, who has long been focused on the bank of japan, indicated that if Ueda Kazuo believes that the likelihood of a rate hike in December is low, he may not accept interview requests. This governor only accepts media interviews twice a year, so the timing of last weekend's reports may be significant.

Mitsubishi UFJ morgan stanley securities chief fixed income strategist Muguruma wrote in a report: "If the bank of japan is considering a rate hike in January next year, then there is no need to accept interviews now and hint at a rate increase. The bank of japan is laying the groundwork for further rate hikes at the December meeting."