For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ExlService Holdings (NASDAQ:EXLS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is ExlService Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that ExlService Holdings has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

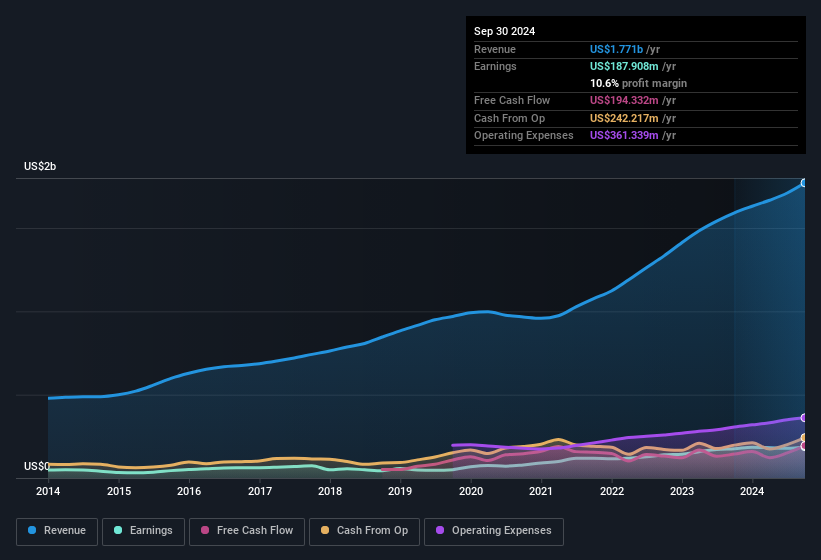

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for ExlService Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to US$1.8b. That's progress.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for ExlService Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to US$1.8b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for ExlService Holdings?

Are ExlService Holdings Insiders Aligned With All Shareholders?

Since ExlService Holdings has a market capitalisation of US$7.5b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth US$192m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is ExlService Holdings Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into ExlService Holdings' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in ExlService Holdings' continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. However, before you get too excited we've discovered 1 warning sign for ExlService Holdings that you should be aware of.

Although ExlService Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.