Funds and insurance are leading the way + betting on further easing of monetary policy.

Recently, the market has increased its bets on policy support.

Today, the china 10-year treasury notes yield fell below the critical psychological level of 2%, the last time it reached this point was on September 24, marking the lowest level since April 2002.

The china 10-year treasury notes yield has now fallen for the fifth consecutive week, at one point dropping 2 basis points to 1.9995% today.

The china 10-year treasury notes yield has now fallen for the fifth consecutive week, at one point dropping 2 basis points to 1.9995% today.

The 30-year treasury notes yield decreased by 3.1 basis points to 2.17%. Last month, this yield fell below the japan treasury notes yield for the first time in 20 years.

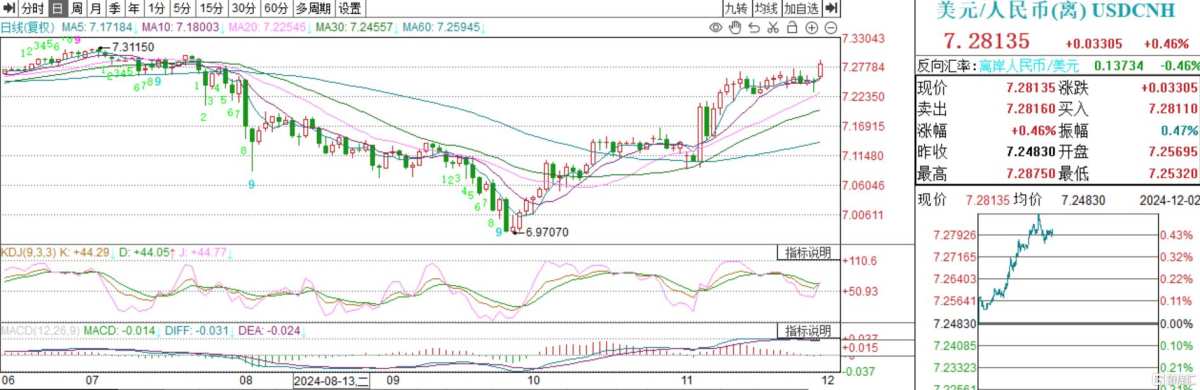

As treasury notes yields decline, the exchange rates of the renminbi are also affected.

As of now, the offshore renminbi has fallen more than 0.46% against the usa dollar, currently quoted at 7.2813.

The onshore renminbi fell 0.28% against the dollar, quoted at 7.2686.

Reasons for the rise in the bond market.

Analysts believe that the reasons for the rise in the bond market are, on the one hand, increased market betting that monetary policy will further loosen, and on the other hand, institutions such as funds and insurance are exhibiting panic buying behavior.

In recent months, the people's bank of china has been steadily guiding interest rates downward to stimulate the economy.

In September, the people's bank of china lowered the statutory reserve requirement ratio for financial institutions by 0.5 percentage points, resulting in a weighted average reserve requirement ratio of about 6.6%; and reduced the benchmark seven-day reverse repurchase rate by 20 basis points to 1.5%.

In October, the central bank lowered the one-year loan market quote rate by 25 basis points to 3.1%.At the subsequent financial street holdings forum, China’s central bank governor Pan Gongsheng revealed signals of a reserve requirement ratio and interest rate reduction.

He indicated that further reserve requirement ratio cuts of 0.25 to 0.5 percentage points are expected to be made at an opportune moment before the end of the year, depending on market liquidity. He also hinted that the seven-day reverse repurchase rate might be lowered by another 20 basis points before the year-end.

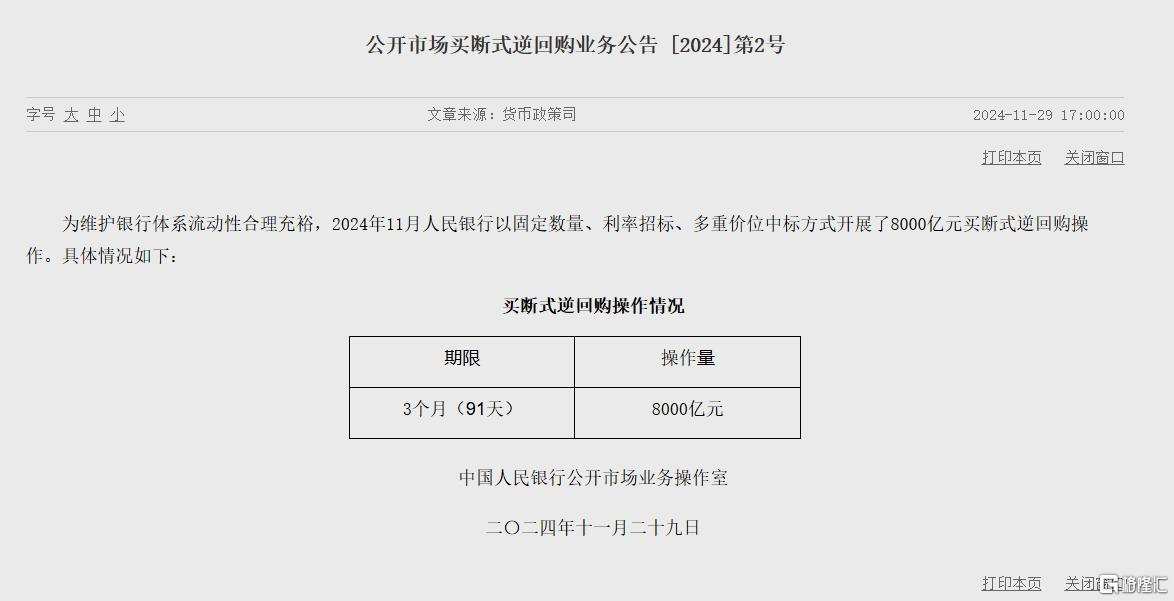

Meanwhile, the central bank announced last Friday that in order to maintain reasonable liquidity in the banking system, it conducted a 800 billion yuan buyout reverse repurchase operation in November through fixed amount, interest rate tendering, and multiple price levels, with a maturity of 3 months. The amount in October was 500 billion yuan.

In addition, China’s central bank also net purchased 200 billion yuan of treasury bonds in the open market operations in November.

Currently, the market widely expects that the weak economy will prompt China’s central bank to increase monetary easing, including further lowering the reserve requirement ratio and injecting more liquidity into the market.

In this regard, OCBC Bank’s Asia macro research director Tommy Xie pointed out on Monday that the rise in Chinese treasury bonds is mainly driven by three factors: expectations of reserve requirement ratio cuts, liquidity support, and economic fundamentals.

He added that the central bank increased liquidity support last month.MergerBuying sovereign bonds also helps to offset the increase in debt supply.

In addition to domestic factors, there is also the impact of Trump's high tariff plan overseas, and the policy interest rate is expected to continue to decline.

Morgan Stanley expects that by the end of the first quarter of next year, the People’s Bank of China will cut the policy interest rate by 40 basis points.

Moreover, the movements of funds and insurance have also driven the recent activity in the bond market.

A trader from a certain asset management institution in Shanghai stated that the bond market trading since the end of November has shown no significant relationship with the stock market, and more institutions are rushing to buy goods at the end of the year, choosing suitable short-term varieties to prepare for performance at the start of next year.

Another fixed income analyst from a large brokerage in Shenzhen also believes that the current liquidity is loose and market expectations are stable. Observing from the data, the recent activity in the bond market is primarily due to the purchases by funds and insurance capital.

Subsequent policy signals are still awaited.

In addition to the reduction of the required reserve ratio and interest rates, the macro level will welcome two significant meetings: the Politburo meeting and the Central Economic Work Conference.

At that time, the economic plan and growth targets for 2025 will be released, and both meetings are expected to be held around mid-December.

Looking ahead, citic sec analyst Mingming believes that in the short term, the long-term bond yield may test around the 2% key level under the inertia of being bullish, but further sustained decline may require stronger bullish catalysts, which will partly depend on the direction set by this round of important meetings for subsequent fiscal and monetary policies.

If there are unexpected policies to stabilize growth, long-term rates may face a pullback in the short term, but the magnitude is expected to be difficult to exceed the highs before September.

If the policies do not exceed expectations, long-term bond yields may maintain a volatile and slightly strong trend, and after future wide monetary space is reconfirmed, the center may decline to below 2%.

Tommy Xie believes that due to the increase in government bond issuance and the forthcoming important meetings, the resistance to further decline in bond yields may increase.

Macquarie Capital's China equity strategy head Eugene Hsiao pointed out that although China's yields are now close to 2%, the spread with the usa 10-year yields has actually narrowed, which is bullish for the liquidity of china stocks.

中国10年期国债收益率已经连续第五周下跌,今日一度下跌2个基点至1.9995%。

中国10年期国债收益率已经连续第五周下跌,今日一度下跌2个基点至1.9995%。