As the price of bitcoin (BTC) approaches the $0.1 million threshold, it is set to reach a historic milestone. This significant price increase has sparked optimism among investors, confirming bitcoin's dominant position in the cryptos market.

However, despite the optimistic outlook, bitcoin is not completely immune to potential downward pressure. The factor that maintains the stability of bitcoin prices, Long-Term Holders (LTH), is showing signs of volatility, raising concerns about the possibility of short-term price declines.

Long-Term Holders' confidence is shaken.

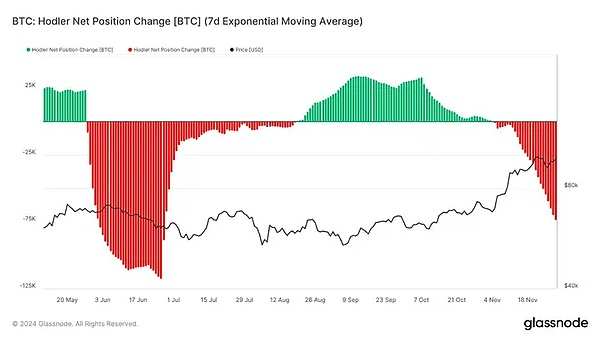

Recently, long-term bitcoin investors have shown signs of pessimism. The Net Position Change indicator tracking LTH behavior has turned negative.

This change indicates that a significant number of long-term investors are taking profits. A negative value of this indicator usually indicates a decrease in confidence, which could bring downward pressure to bitcoin.

This change indicates that a significant number of long-term investors are taking profits. A negative value of this indicator usually indicates a decrease in confidence, which could bring downward pressure to bitcoin.

Since LTH is considered a pillar of bitcoin prices, their selling could disrupt market momentum. These investors often hold assets during market fluctuations, helping to maintain price stability.

When they start selling, this could lead to increased price volatility. If this trend continues, it could result in price adjustments, especially when BTC prices approach the $100,000 threshold.

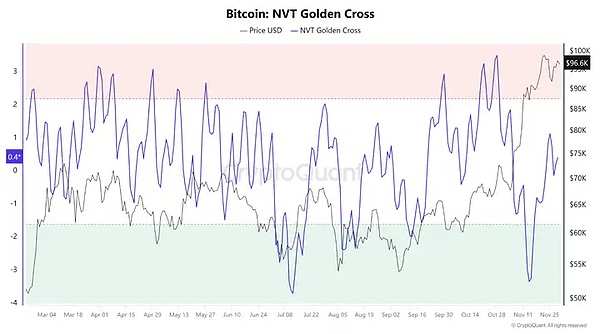

Although long-term holders are currently pessimistic, the macro momentum of bitcoin remains strong. One important indicator to pay attention to is the Network Value to Transactions (NVT) ratio of bitcoin, which is currently in a neutral zone.

Although not yet in the call area (below -1.6), the NVT ratio is still an important signal for the future price trend of bitcoin. Historically, when the NVT ratio crosses the pessimistic zone (above 2.2), the market usually sees this as a sell signal.

Currently, bitcoin has not reached this pessimistic area, indicating that there is still room for growth. The NVT ratio continues to provide bullish signals, confirming that bitcoin has enough momentum to continue rising before facing any significant downward pressure.

As long as the NVT ratio remains firmly in the neutral zone, bitcoin still has the opportunity to break the $0.1 million milestone without immediate downward pressure.

Bitcoin price creating history.

Bitcoin price is currently fluctuating around $96,572, approaching the historic $100,000 threshold. Due to institutional interest and growing adoption, the token has demonstrated strong momentum in recent weeks. If the current trend continues, bitcoin may surpass this psychological barrier and reach a new high of $99,595.

If it surpasses the $100,000 threshold, the next target could be $120,000. Successfully breaking the $0.1 million milestone may trigger a stronger demand from both retail and institutional investors. However, the risk of profit-taking by long-term holders remains a concern, as any major sell-off could lead to a temporary correction.

Despite short-term concerns, the overall trend of bitcoin remains optimistic. The recent NVT Golden Cross indicator shows that the target of $100,000 is still possible. As long as bitcoin stays above the key resistance, its long-term outlook remains positive.ResistanceAlthough the selling activity of long-term holders (LTH) may cause some fluctuations, unless there is a major market disturbance, bitcoin may continue its growth trend in the coming months.

During the weekends, block orders from institutions in the USA are off duty, and on-exchange funds start to go crazy. Both Ethereum (ETH) and Ripple (XRP) have trading volumes surpassing bitcoin, indicating a certain level of FOMO sentiment in the market. At the same time, a noticeable seesaw effect is occurring, where bitcoin is weak and others are strong, typifying the money-making effect of a bull market. As long as bitcoin holds steady, the chaotic dance will continue.

A major current issue is if December continues to push above 100,000, then the probability of a short-term peak will increase. Judging by the sentiment outside the market, a large number of potential investors are becoming curious about bitcoin. It seems everyone is discussing bitcoin, and historically, this often indicates a relatively high position in the market cycle. It is not ruled out that after external funds come in, there may be another crazy surge before reaching its peak. Another possible trend is to start a retracement from this point, entering a dip adjustment in December, waiting for a new bull market to start after Trump takes office in January. If it goes in this direction, the height of the rise will be even higher. As for how the market chooses, we still need to observe and confirm further.

However, without a doubt, regardless of the direction it takes, the cost-effectiveness of buying bitcoin at this point is already low. The longevity of altcoins depends on the performance of the top few big players, as long as the funds can handle it, small coins can continue to fluctuate, especially since the market cap of most is not high, a rise is not unreasonable. Another detail to note is that the leading MEME coins in this bull market are starting to cool off recently. The adjustment of the leading sectors often precedes other sectors, while the back ranks' rise tends to be towards the end of an upward trend. There may be further upward movements ahead, but everyone should be wary of the risk that could arise at any time. Don't forget that the crypto market is not immune to declines; each drop is a plunge. Surviving once means you can earn much more money than others. Don't fret over the last couple of coppers; moving forward more steadily is the key.

This cycle, regardless of the direction it takes, getting on board with bitcoin at this point already has a low risk-reward ratio. How long altcoins can remain active depends on the performance of the top few major players. As long as the funds are sustainable, small coins can continue to thrive, as their overall market cap is not high, a rise is acceptable. Another aspect to note is that the top MEME coins in this bull market are starting to lose steam recently. Corrections in the leading sectors often come before those in other sectors, and the rise of the lower-ranked coins typically signals the end of a bullish trend. There might be more increase ahead, but one must be cautious about potential risks at all times. Remember, the crypto market does not just rise; every fall is a sharp drop. Surviving one such drop means earning much more than others. Don't dwell on the last couple of pennies; moving forward steadily is the right approach.

这一变化表明大量长期投资者正在获利了结。该指标的负值通常表明信心下降,这可能会给比特币带来下行压力。

这一变化表明大量长期投资者正在获利了结。该指标的负值通常表明信心下降,这可能会给比特币带来下行压力。