According to Zhito Finance APP, as investors hope to end another glorious year for the US stock market, US stocks are entering the final month of 2024 with a performance close to historical highs.

During last week's shortened holiday trading, the Dow Jones Industrial Average rose by more than 2%. At the same time,$Nasdaq Composite Index (.IXIC.US)$Both the S&P 500 index and$S&P 500 Index (.SPX.US)$And.$Dow Jones Industrial Average (.DJI.US)$achieved historic highs at the close of November.

In the coming week, a series of key labor market data will greet investors, with the USA Bureau of Labor Statistics set to release the employment report for November on Friday, which will be the most significant data of the week. The latest data on job vacancies and private sector wage growth, as well as data on service and manufacturing activities, will also be released throughout this week.

Investors will focus on this week's economic data to understand the next interest rate moves that the Federal Reserve will announce on December 18.

Investors will focus on this week's economic data to understand the next interest rate moves that the Federal Reserve will announce on December 18.

Regarding corporate news,$Salesforce (CRM.US)$、$Okta (OKTA.US)$And.$Lululemon Athletica (LULU.US)$The financial report will be the highlight of next week's financial reports.

Employment Data

In recent months, market expectations for future interest rate cuts by the Federal Reserve have changed.

According to the CME's FedWatch tool, as of last Friday, the market expects a 66% chance of the Federal Reserve cutting rates at its annual final meeting on December 18. However, looking ahead, the market anticipates two more rate cuts next year, raising concerns about the Fed's progress in reducing inflation.

The labor market continues to slow down, but not significantly, which may keep the Federal Reserve focused on inflation, making the case for major rate cuts in 2025 less compelling. The November employment report will be released on Friday Eastern Time, which will update this assertion.

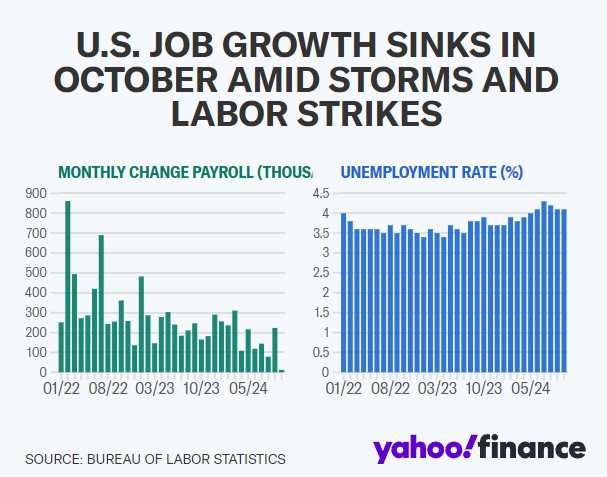

Economists expect the report to reverse the dismal employment numbers from October. Many believe the October employment report was heavily affected by hurricanes and worker strikes.

The November report is expected to show that the USA labor market added 0.2 million jobs that month, up from 0.012 million in October. Meanwhile, the unemployment rate is expected to slightly rise from 4.1% to 4.2%.

In a report to clients, the economics team at wells fargo & co, led by Jay Bryson, wrote: “ThroughNon-farm employmentmonthly volatility, we expect the November employment report to reaffirm that, although the labor market remains solid in absolute terms, the trend of weakening employment conditions has not stopped. This message may be reflected more clearly in the unemployment rate, which we expect to rise to 4.2%.”

The profit expectations for the 'seven giants' are strong.

Wall Street strategists are generally optimistic when releasing their 2025 forecasts, with many believing that the year-end target for the S&P 500 index will be between 6400 and 7000. A common prediction among these outlooks is that the stock market's upward trend will continue to expand, moving away from the "Big Seven" tech stocks.$Apple (AAPL.US)$、$Alphabet-A (GOOGL.US)$、$Microsoft (MSFT.US)$、$Amazon (AMZN.US)$、$Meta Platforms (META.US)$、$Tesla (TSLA.US)$And.$NVIDIA (NVDA.US)$and switch to the other 493 stocks in the index.

Lori Calvasina, head of us equity strategy at royal bank of canada capital markets, wrote: 'We believe the market rally will continue to broaden or shift towards value stocks, but it will be a tough opportunity to navigate.' She emphasized that strong economic growth again may help support the s&p 493 index.

However, not everyone agrees. Venu Krishna, head of us equity strategy at barclays, pointed out that the quarterly earnings of large tech companies continue to exceed expectations. As long as this trend continues, Krishna believes that 'large tech companies may have a significant impact on the s&p 500 index's eps growth momentum, just as they did this year.'

In Krishna's view, despite the expectation that next year's market rally will continue to expand, the earnings revisions of many large tech companies remain more positive compared to the other constituents of the s&p 500 index.

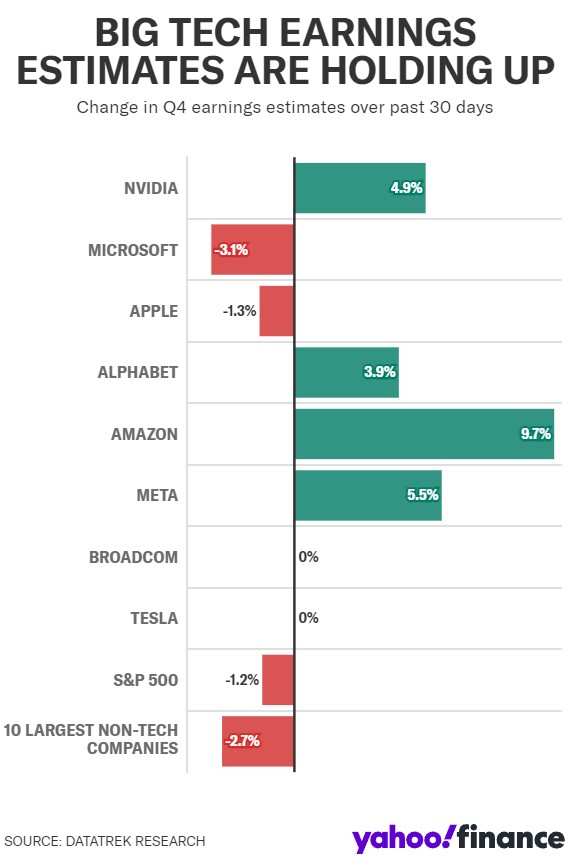

Jessica Rabe, co-founder of DataTrek, noted in a research report released on November 27 that, over the past 30 days, the earnings of six large tech companies for this quarter have been revised either flat or higher. During this period, only microsoft and apple saw downward revisions in earnings expectations that exceeded the s&p 500 index's expected decline of 1.2%.

At the same time, the earnings expectations of the 10 largest non-tech companies in the s&p 500 index have been revised down by an average of 2.7%.

Rabe wrote: "The earnings expectations momentum of large technology companies in the USA is strong, and their performance is far better than the overall s&p 500 index and its top ten non-technology stocks. Fortunately, large tech stocks account for one-third of the s&p index, so their fundamentals have a significant impact on the index."

December historical trends.

Another common view among strategists is that the strong bull market will continue until the end of the year, reaching more historical highs before trading ends in 2024.

History supports this view.

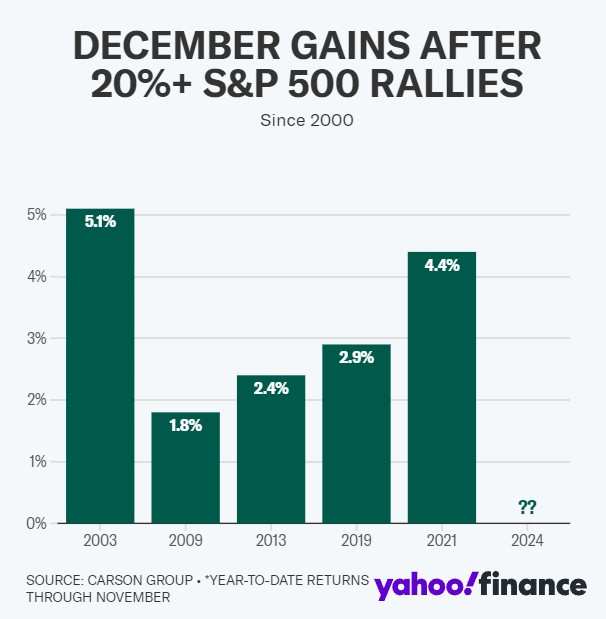

Ryan Detrick, chief market strategist at Carson Group, stated that in the market, strength often begets strength. Going back to 1985, the s&p 500 index had already risen more than 20% by the time it entered December, and in 9 out of 10 times, the benchmark index further increased. Since 2000, after such a significant rise in the first 11 months of the year, the index has risen every December.

Detrick wrote in a research report: "History shows that it is likely for the stock market to rise before the end of the year."

Editor/ping

投资者将关注本周的经济数据,以了解美联储将于12月18日宣布的下一步利率举措。

投资者将关注本周的经济数据,以了解美联储将于12月18日宣布的下一步利率举措。