According to Zhitong Finance APP, due to recent excellent performance and historical trends boosting market sentiment, there may be even greater upside potential this record year.

After President Trump was elected earlier this month, the stock market reached an all-time high. Despite looming tariff risks, Wall Street remains optimistic about the economic agenda of the incoming administration.

Mark Haefele from ubs group global wealth management stated last Wednesday: "The threat of tariffs may trigger recent market volatility, but the fundamental backdrop remains favorable."

This year, the s&p 500 index has set over 50 all-time closing highs, with the dow jones industrial average and nasdaq 100 index following closely behind.

This year, the s&p 500 index has set over 50 all-time closing highs, with the dow jones industrial average and nasdaq 100 index following closely behind.

Looking ahead, strategists believe that the market's bull market may end on a positive note.

Michele Schneider, chief strategist at MargetGuage.com, stated: "At this point, it cannot be denied that everything looks positive." She added that investors should "stay with the momentum, stay with the trend."

Historically, this trend is very likely to be upward. According to Sam Stovall from CFRA, December is the most stable month for the s&p 500 index, with the highest frequency of gains. Its volatility is also the lowest, nearly 40% lower than the average of other months since World War II.

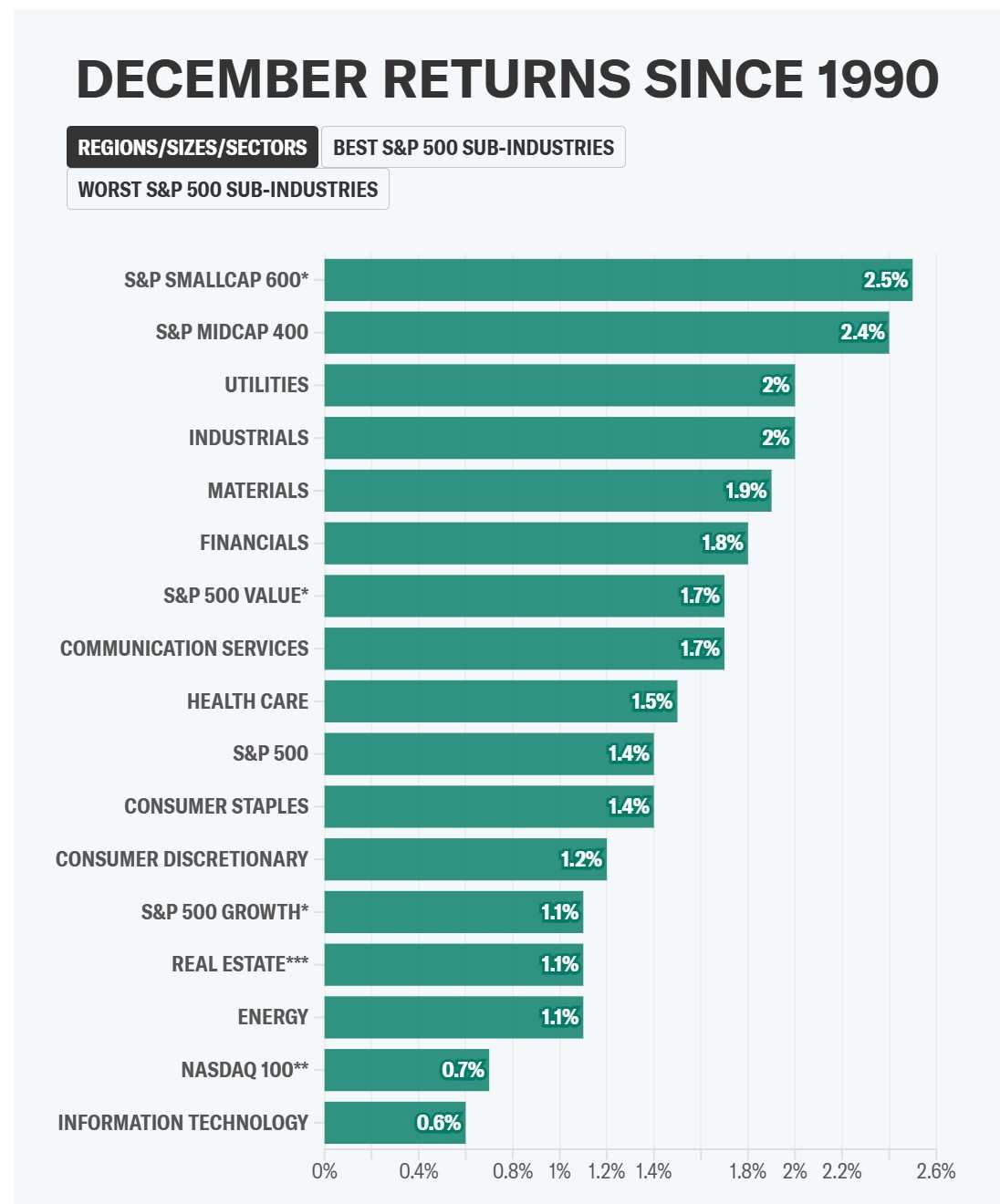

This month, the s&p midcap 400 index and the small-cap 600 index outperformed other sectors in the market, followed closely by utilities, industrials, materials, and financial sectors.

What sets this year apart is that the election has increased bullish sentiment. Analysis by Ryan Detrick of Carson Group shows that December has historically been the second-best month for the s&p 500 index in election years, with an average roi of 1.3% since 1950.

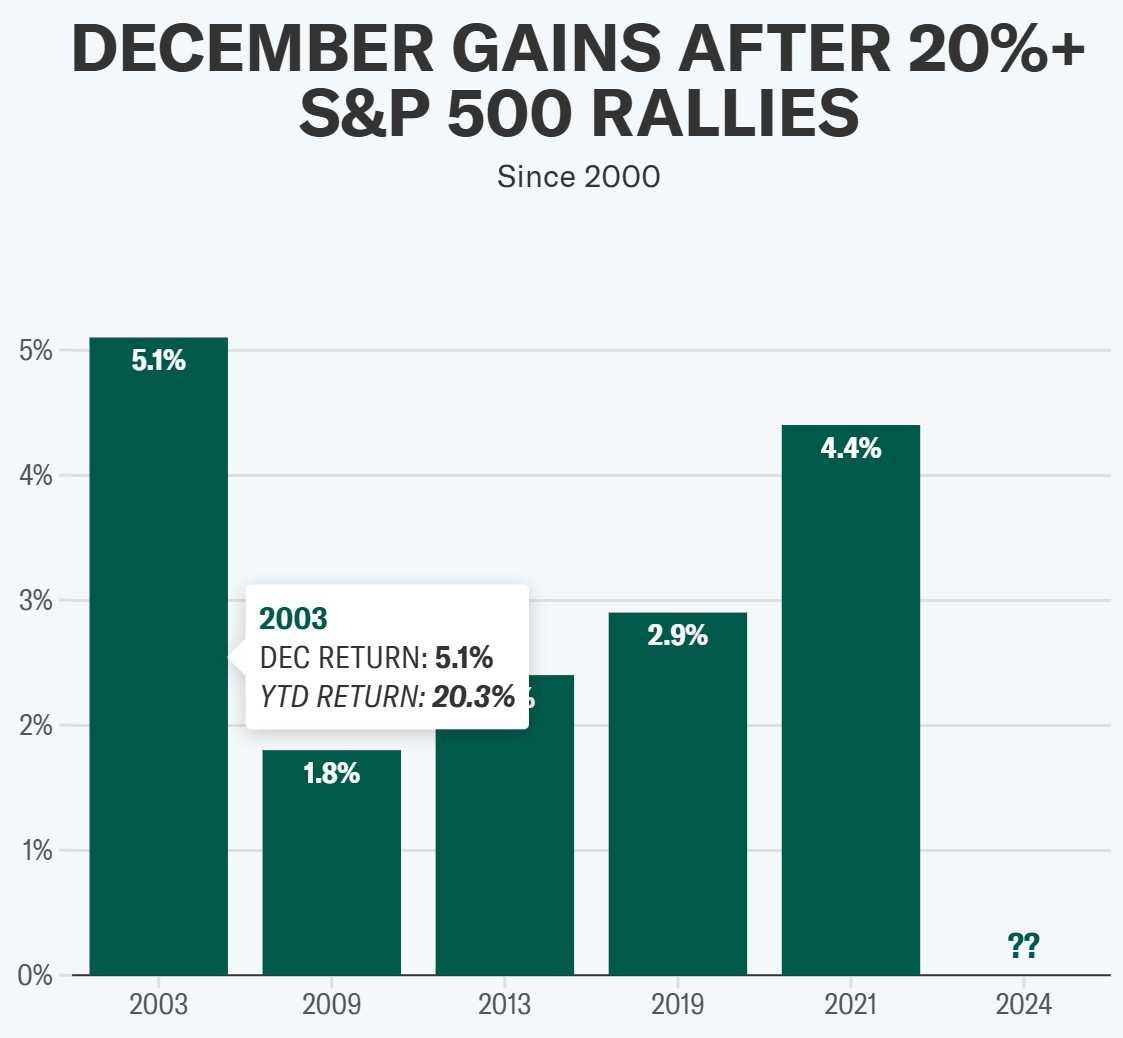

His analysis also found that strong performance year-to-date often increases the likelihood of investors chasing the market through the end of the year. In the past 10 occurrences, the s&p index had gained over 20% entering December, with an average gain of 2.4% for December.

Looking ahead, the possibility of a "Christmas rally" (which refers to the stock market rising in the last 5 trading days of the year and the first two trading days of the new year) may further boost roi.

Jeff Hirsch of the Stock Trader's Almanac explained that Thanksgiving marks the beginning of a series of seasonal bullish patterns in the market. He recently wrote that he has "combined these seasonal events into a trade: buy on the Tuesday before Thanksgiving and hold until the second trading day of the new year." Since 1950, from the Tuesday before Thanksgiving to the second trading day of each year, the s&p 500 index has risen 79.73% of the time, with an average increase of 2.58%.

The good days on Wall Street may not come to an end.

Although next year's gains may be weaker, many top strategists on Wall Street are becoming increasingly optimistic. Last week, Deutsche Bank's chief global strategist Binky Chadha set a target for the s&p 500 index at 7000 points by the end of 2025.

Meanwhile, Barclays and RBC Capital Markets have both announced their year-end targets for the s&p 500 index in 2025, which is 6600 points, while jpmorgan's equity team has a year-end target of 6500 points, up from 4200 points over the past two years.

Scott Sperling, co-CEO of THL Partners, stated that one of the key catalysts will be the market-friendly policies of the Trump administration.

He stated, "One of our expectations of the new administration is that the potential for overall economic growth will be significantly enhanced, and the cost of doing business will decrease... Given the issues we have seen over the past four years, the opportunities that the new administration could bring to all businesses may be greater."

Despite the uncertainty in the future, historical performance, recent momentum, and the optimism surrounding Trump’s economic policies suggest that this is a favorable opportunity for investors to continue to buy into the market.

Editor/ping

今年,标准普尔500指数创下了50多个历史收盘高点,道琼斯工业平均指数和纳斯达克100指数也紧随其后。

今年,标准普尔500指数创下了50多个历史收盘高点,道琼斯工业平均指数和纳斯达克100指数也紧随其后。