It is expected that the domestic 'wide mmf + wide fiscal policy' will promote signs of marginal improvement from macro, meso, to micro levels;

According to Zhitung Finance APP, sinolink issued a research report stating that in the December sector allocation, there is an expectation for a 'spring rally', focusing on opportunities in the technology theme. Behind the rebound is the repair of credit expectations and the expansion of valuations; industry and individual stock selections can emphasize: 'denominator elasticity', being bullish on middle cap + oversold + undervalued + buyback + merger and acquisition expectations, while facing weak numerator constraints (roe recovery or cash flow improvement) of 'growth > consumer', (1) primarily choosing growth: 1. TMT, especially electronics and computers; 2. national defense military industry; 3. siasun robot&automation, industrial mother machine and other high-end manufacturing. (2) secondarily choosing consumer: 1. social services; 2. medical beauty; 3. baijiu(chinese liquor). Structurally, it focuses on 'technology bull', including technology-related equipment which needs to be especially emphasized, ① one of the fiscal policy investment directions; ② many theme catalysts; ③ benefiting varieties of the Juglar cycle.

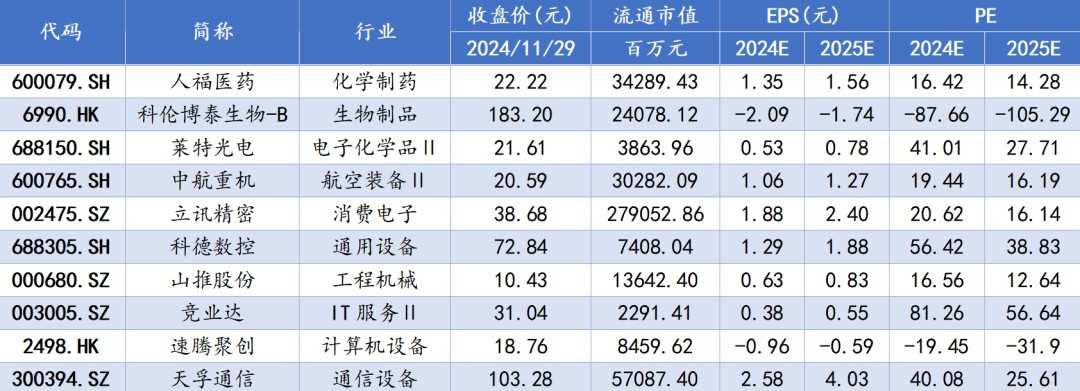

December gold stock combination:

Sinolink Securities' main points are as follows:

Sinolink Securities' main points are as follows:

Looking back at the performance of the A-share market in November, after a phase of early-month rise, the market generally fell until the 26th when there were signs of temporary stabilization.

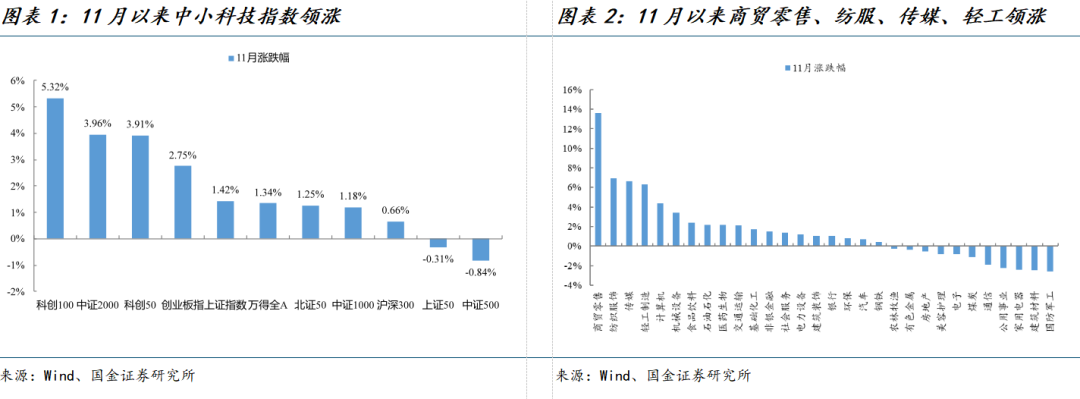

Data shows that as of November 28, among the major wide base indices of A-shares, the mid-small technology indices represented by Science and Technology Innovation 100, CSI midcap 200 index, and SSE Science and Technology Innovation Board 50 index saw significant increases, recording month-on-month growth rates of +5.32%/+3.96%/+3.91%; whereas the CSI 500 index, SSE 50, and CSI 300 index were relatively weak, recording month-on-month changes of -0.84%/-0.31%/+0.66%. Structurally, the leading performing industries among the first-level industries include trade and retail, textiles and apparel, media, light industry manufacturing, and computer, recording month-on-month changes of 13.59%, 6.90%, 6.65%, 6.33%, and 4.39%, respectively; while the national defense military industry, building materials, household appliances, and communications recorded month-on-month changes of -2.58%, -46%, -2.41%, -2.23%, and -1.91%, respectively. From a structural perspective, November's 'Trump taking office' heightened market concerns about trade risks, putting pressure on relevant sectors, while expectations for policies stimulating domestic demand became a key focus in market trading. In addition, the introduction of policies related to 'broken net stocks' also made it a trading hot spot in the market.

In 2025, overseas risks need to focus on the accelerated decline in global prosperity, while the USA's increased tariffs on China may be more of a show than actual impact.

Determining the impact of the overseas economic environment may be the market focus, where the downturn in overseas prosperity and the risk of a "hard landing" in the USA economy will be "far greater" than the impact of increased tariffs on China. On one hand, the impact of Trump's policies on Chinese exports is expected to be medium to long-term, combined with the ongoing trend of global economic downturn, making the true negative impact of increased tariffs on Chinese exports appear marginally weaker; on the other hand, under the Federal Reserve's framework, the interest rate cut cycle has not changed: implying that potential risks still exist, and during this period, the increased tariffs on China may have negative repercussions on the USA itself, especially concerning rising inflation and debt costs, and accelerating the deterioration of the USA's own balance sheet. In fact, although a series of data including employment, retail, and PMI since the September interest rate meeting has shown signs of stabilization, corresponding to a temporary cooling of overseas risks; we continue to maintain the judgment of the "non-linear deterioration" of the USA economy, as there still exist risks behind seemingly resilient data, such as significantly lower than expected job vacancies, an increase in layoffs, and data indicating that new employment following disturbances like hurricane strikes may still be weak, all pointing towards a clearer slowdown trend in the USA economy. The warning remains: keep an eye on the median unemployment rate forecast of 4.4% given by the Federal Reserve in the September SEP, and if it is breached, it means overseas risks will resurge.

It is anticipated that the domestic "loose monetary + loose fiscal" policies will lead to signs of marginal improvement from macro, meso to micro levels.

From recent economic data, signs of improvement have become increasingly apparent: 1) In October, M1 year-on-year was -6.1%, showing a turning point from -7.4% in September, while M2 year-on-year was 7.5%, improving for four consecutive months since June; considering that M1 leads PPI by about 6-9 months, it's expected that Q3 2025 will see a turning point in PPI, indicating a market bottom in profits. 2) In October, the growth rate of retail sales reached 4.8%, increasing by 1.6 percentage points from September, exceeding market expectations; benefiting from the support of special government bonds for the replacement of consumer goods, retail sales growth is expected to continue improving, while the Finance Minister indicated that in 2025 the policies are expected to increase support for "two new" initiatives, making sustained improvement likely. 3) In October, industrial added value grew by 5.3% year-on-year, remaining stable; combined with a significant narrowing of PPI decline in October, the situation of worsening corporate profits is expected to slow down; the service production index grew by 6.3% year-on-year, rebounding for two consecutive months since August, reaching a new high for the year, further supporting the achievement of the annual GDP growth target. 4) In the investment sector, manufacturing investment cumulative growth reached 9.3% in October, rebounding for two consecutive months since August, while infrastructure investment cumulative growth reached 4.3%, marking the first turning point; the increase in infrastructure investment growth may be benefiting from the gradual influx of special bonds and other fiscal funds, which accelerates the progress of infrastructure investment. (5) In November, PMI rose to 50.3, marking three consecutive months of rebound, and continues to stand above the 50 threshold. Among them, both the production and order sub-indices continued to recover, reflecting improved corporate demand and production willingness.

"Spring frenzy" is expected to start early, with the upward slope likely to exceed market expectations.

The short-term market adjustment is primarily driven by sentiment, considering that concerns over increased USA tariffs on China have been gradually digested; in fact, the increased tariffs from the USA on China are more likely to have medium to long-term impacts, and the actual level of tariff increases may be far below market expectations, hence the negative sentiment is likely to be coming to an end. Returning to the market's "rebound" logic, it is largely about improving cash flows of local government, enterprises, and households, and related balance sheet repairs, providing fundamental support for the rise in the A-share market. Looking back at Q3 2013 and Q1 2019, whenever stimulus policies affect households and enterprises on the "debt side", it often leads to a cycle of about four months for economic fundamental recovery, thus it is expected that this round of "rebound" is likely not yet over and may continue until at least February next year. In addition, considering the recovery of the PMI production index, it is expected that M1 will continue to rise in November; at the same time, share buybacks by major shareholders and financial institutions exchanging the convenient 300 billion and 500 billion quotas will likely accelerate with market warming, and it is anticipated that the slope of this "spring frenzy" trend may become more pronounced and steep.

Looking ahead to 2025, both the macro "internal circulation" and the A-share "reversal" highly depend on the emergence of a "profit bottom"; two paths for realization are available for reference:

(1) Domestically focus on finance, it is expected that the Politburo work meeting in April next year will likely ramp up, with a structure more inclined to "asset side" efforts, which may drive increases in corporate profits and enhance household consumption capabilities; (2) patiently await alleviation of overseas risks and a rebound in prosperity. Before the emergence of the "profit bottom", it is anticipated that there will be difficulty in the "technology-consumer-cycle" sector rotation, overall showing a trend of "finance as a platform, growth as the main event", and "large cap as a platform, mid-small cap as the main event"; therefore, attention should be paid to the "elasticity at the denominator" + "constraints on the numerator being weak", with a bullish outlook on mid-small cap + significant corrections + undervaluation + buyback + merger expectations in the "growth > consumer" direction, structurally focusing on the "technology bull".

In 2025, there is a high probability of a "spring rally" in the market, which is expected to begin in December.

Compared to previous years with strong "spring rallies" such as 2006, 2009, 2016, and 2019, it is also highly probable that a "spring rally" will occur in 2025. The specific reasons are as follows: 1) The domestic economy is improving. Macro economic data such as PMI, domestic consumption, exports, as well as mid-cycle production and sales data and the rebound in capacity utilization rate all confirm that the economy is showing signs of marginal recovery. 2) Effective market liquidity is tending to improve. The year-on-year increase in M1 in October, along with a decline in short-term financing growth, indicates that the remaining market liquidity represented by "M1-short-term financing" is rising, driven by "expansive monetary policy + expansive fiscal policy" which enhances cash flow for enterprises and households and raises the willingness to spend, providing a basis for expansion on the denominator side of the A-share market. 3) Inflation has not shown a significant rise, and the discount rate remains low. Based on the leading relationship between year-on-year M1 and PPI (historical experience shows that M1 leads PPI by about 6-9 months), the "PPI bottom" corresponds to the "profit bottom" for A-share companies, and the rebound in year-on-year M1 growth in October suggests that the corporate "profit bottom" may correspond to Q3 2025. The PPI turning point is expected in July next year, with a positive turnaround possibly in September at the earliest. 4) Valuations are reasonable, even slightly low. Currently, the valuation of the A-share market is at a moderately low level compared to major global equity markets. 5) The current ERP is at a temporary high and has considerable room for downward convergence. As of November 20, 2024, whether looking at EPR or the "equity-debt yield differential," it indicates that the risk appetite for A-shares has much room for improvement.

In Q1 2025, expansive monetary policy combined with the recovery of credit at the bottom, along with a restoration of market risk appetite, makes the "spring rally" suitable for growth themes: the AI industry and national security.

From the thematic areas related to the AI industry and national security, select concept indices that meet the criteria: 1) Oversold; the average decline of individual stocks since the 2020 peak is >75%, focusing on indices that primarily belong to this category; 2) Cheap valuations; the average valuation of component indices is <65th percentile; 3) Based on the above, first choice is significant improvement in profits: ① EPS growth is in the top 30% of the sample; ② EPS trend has improved or turned upward—>60%; 4) Second choice is significant improvement in cash flow: the proportion of component indices with recovering operating cash flow is >65%; 4) Additionally, attention can also be paid to: the average valuation of component indices <30th percentile. Major focus areas: electronics, computers, military industry, and machinery.

Risk warning:

The usa economy's "hard landing" is accelerating confirmation, exceeding market expectations; domestic exports are slowing more than expected.