Deep-pocketed investors have adopted a bearish approach towards Intel (NASDAQ:INTC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in INTC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for Intel. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 70% bearish. Among these notable options, 5 are puts, totaling $307,733, and 12 are calls, amounting to $497,995.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $21.0 and $55.0 for Intel, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $21.0 and $55.0 for Intel, spanning the last three months.

Analyzing Volume & Open Interest

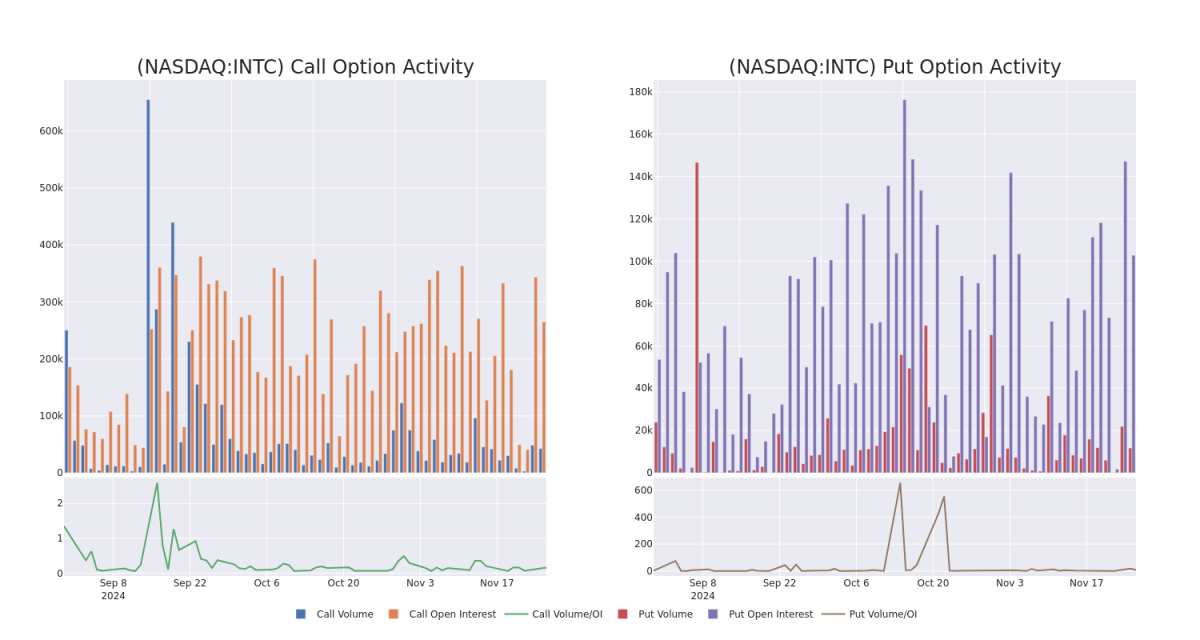

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intel's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intel's significant trades, within a strike price range of $21.0 to $55.0, over the past month.

Intel Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | SWEEP | BEARISH | 02/21/25 | $1.94 | $1.92 | $1.94 | $23.00 | $97.0K | 4.3K | 521 |

| INTC | PUT | SWEEP | BEARISH | 03/21/25 | $31.4 | $30.85 | $31.24 | $55.00 | $74.9K | 0 | 24 |

| INTC | CALL | SWEEP | NEUTRAL | 01/15/27 | $6.75 | $6.45 | $6.3 | $25.00 | $65.1K | 4.4K | 105 |

| INTC | CALL | TRADE | BEARISH | 06/20/25 | $1.66 | $1.44 | $1.45 | $30.00 | $63.8K | 32.3K | 569 |

| INTC | PUT | SWEEP | BEARISH | 04/17/25 | $2.75 | $2.74 | $2.75 | $24.00 | $52.5K | 4.7K | 191 |

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

Following our analysis of the options activities associated with Intel, we pivot to a closer look at the company's own performance.

Current Position of Intel

- With a volume of 16,234,689, the price of INTC is down -2.81% at $23.38.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.