Financial giants have made a conspicuous bullish move on Iris Energy. Our analysis of options history for Iris Energy (NASDAQ:IREN) revealed 35 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $3,484,594, and 27 were calls, valued at $2,110,681.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.5 to $25.0 for Iris Energy over the last 3 months.

Insights into Volume & Open Interest

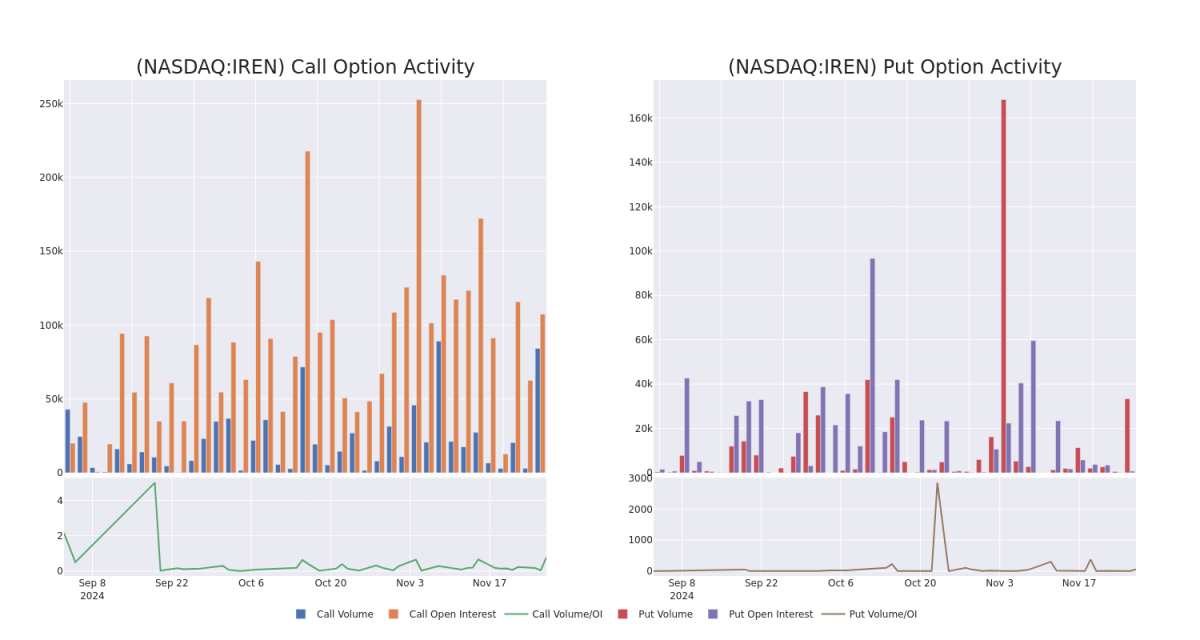

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Iris Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Iris Energy's significant trades, within a strike price range of $7.5 to $25.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Iris Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Iris Energy's significant trades, within a strike price range of $7.5 to $25.0, over the past month.

Iris Energy Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | PUT | SWEEP | BULLISH | 03/21/25 | $5.2 | $5.1 | $5.2 | $15.00 | $1.7M | 610 | 9.3K |

| IREN | PUT | SWEEP | BULLISH | 03/21/25 | $6.1 | $5.1 | $5.1 | $15.00 | $1.1M | 610 | 3.0K |

| IREN | CALL | SWEEP | BULLISH | 03/21/25 | $2.3 | $2.25 | $2.3 | $15.00 | $286.8K | 16.0K | 1.1K |

| IREN | CALL | SWEEP | BEARISH | 03/21/25 | $2.5 | $2.3 | $2.3 | $15.00 | $282.1K | 16.0K | 3.0K |

| IREN | CALL | SWEEP | BULLISH | 03/21/25 | $2.5 | $2.15 | $2.15 | $15.00 | $247.2K | 16.0K | 6.1K |

About Iris Energy

Iris Energy Ltd is a Bitcoin mining company. It builds, owns, and operates data centers and electrical infrastructure for the mining of Bitcoin powered by renewable energy. The company's mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of its specialized computers called Application-specific Integrated Circuits and exchanging these Bitcoin for currencies such as USD or CAD on a daily basis.

Having examined the options trading patterns of Iris Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Iris Energy

- Currently trading with a volume of 8,043,716, the IREN's price is up by 24.84%, now at $11.94.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 78 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Iris Energy options trades with real-time alerts from Benzinga Pro.