The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

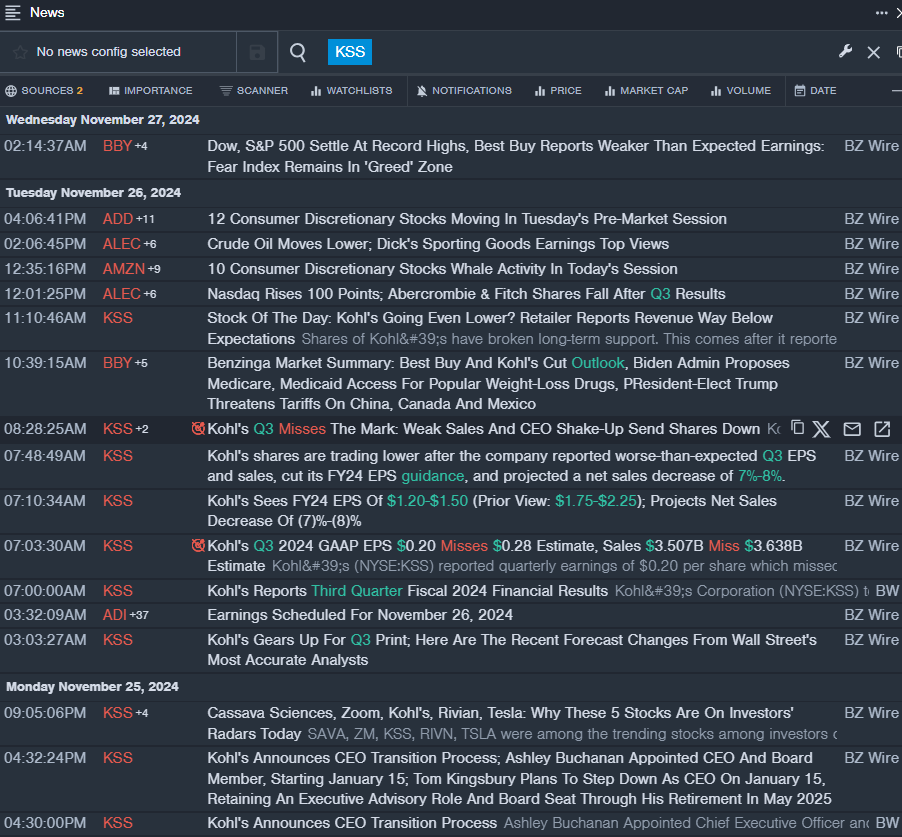

Kohls Corp (NYSE:KSS)

- On Nov. 26, Kohl's shares are trading lower after the company reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Tom Kingsbury, Kohl's chief executive officer, said, "Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies "R" Us shops in 200 of our stores, these were unable to offset the declines in our core business." The company's stock fell around 20% over the past month and has a 52-week low of $14.22.

- RSI Value: 26.35

- KSS Price Action: Shares of Kohls fell 17% to close at $15.22 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest KSS news.

Honda Motor Co Ltd (NYSE:HMC)

- On Nov. 6, Honda Motor reported a decline in the first-half profit and lowered its annual profit forecast. The company reported the first half of FY24 revenue growth of 12.4% year over year 10.798 trillion yen ($69.9 billion), while profits declined 19.7% to 494.6 billion Yen ($3.20 billion). The company's stock fell around 17% over the past month and has a 52-week low of $25.57.

- RSI Value: 25.03

- HMC Price Action: Shares of Honda fell 3% to close at $25.87 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in HMC stock.

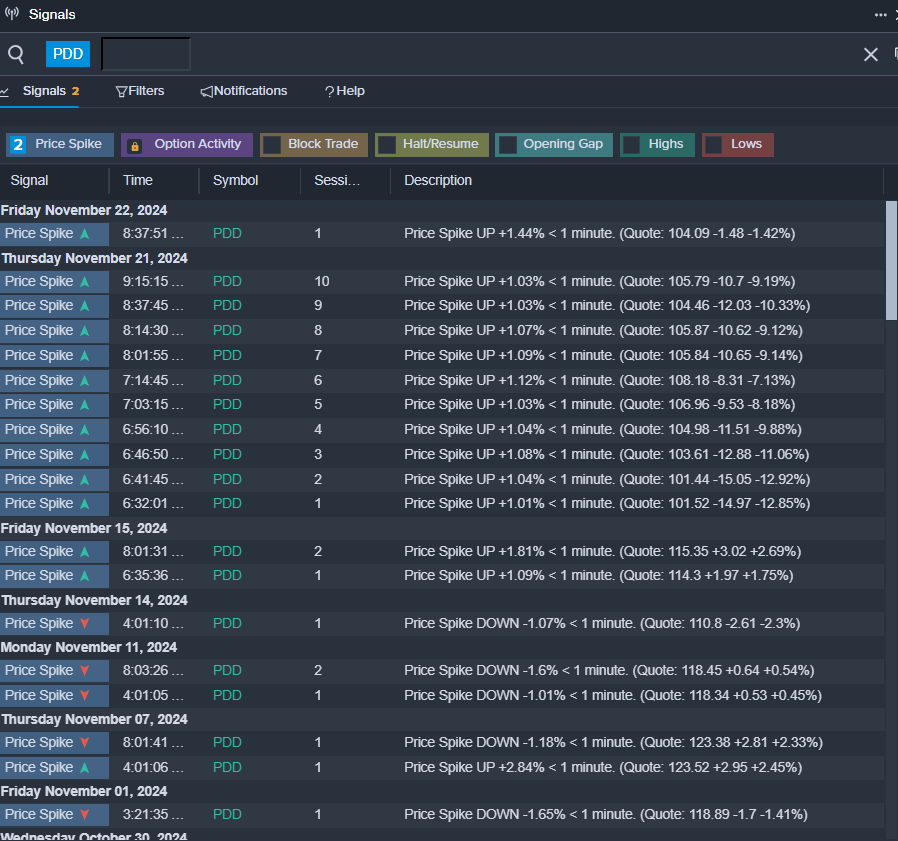

PDD Holdings Inc – ADR (NASDAQ:PDD)

- On Nov. 21, PDD Holdings reported worse-than-expected third-quarter financial results. PDD reported fiscal third-quarter 2024 revenue growth of 44% year-on-year to $14.16 billion (68.84 billion Chinese yuan), missing the analyst consensus estimate of $14.47 billion. The company's stock fell around 21% over the past month and has a 52-week low of $88.01.

- RSI Value: 29.89

- PDD Price Action: Shares of PDD fell 1.4% to close at $99.31 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in PDD shares.

Read More:

Read More:

- Jim Cramer: Linde Is A 'Terrific' Company, Sees Another Stock Up 75% As 'Not Done'