Daiwa believes that the s&p 500, represented by high-quality stocks, will benefit from the Fed's rate cut cycle, stabilization of business indicators, policy mix, and uncertainty in economic data. However, considering that specific policies have not yet been introduced, U.S. stocks have been severely overbought, and next year's market is unlikely to "rise in a straight line," the key will be to see the Trump administration's measures in cutting fiscal spending.

According to Morgan Stanley, with the Fed expected to cut rates next year and continued improvement in business cycle indicators, the momentum of profit growth will continue to expand in 2025. The "bull market scenario" is unfolding, raising the target price of the s&p 500 index by the end of next year to 6500 points.

Based on the closing price on Tuesday, this means the S&P still has 7.9% upside potential.

The report also indicates that considering the ongoing uncertainty in the external macro environment, US stock valuations may fluctuate throughout the next year, depending on the impact of new policy measures, interest rate trends, and geopolitical dynamics.

The report also indicates that considering the ongoing uncertainty in the external macro environment, US stock valuations may fluctuate throughout the next year, depending on the impact of new policy measures, interest rate trends, and geopolitical dynamics.

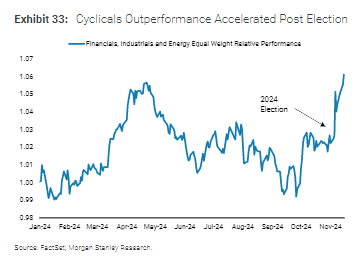

By sector, Morgan Stanley believes that fundamental trends and policy inclinations will favor quality cyclical stocks in the long term, while also bullish on the performance of financial, industrial, and software industries.

S&P reaching 6500 points next year, but the process won't be smooth sailing.

In a previously released outlook report in the middle of the year, Morgan Stanley believed that under the most optimistic "bull market scenario," by mid-2025, the S&P will reach 6350 points, mainly benefiting from continued fiscal stimulus driving profit growth.

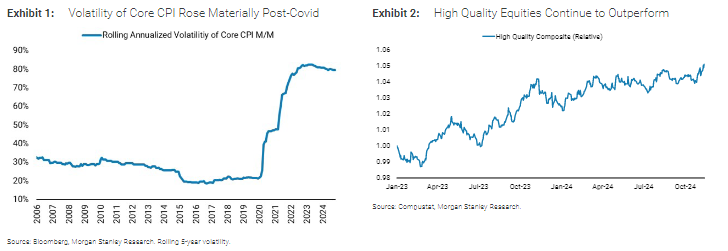

On November 18th, Morgan Stanley equity strategist Michael J. Wilson's team and others released the latest research report, providing an outlook for the US stock market in 2025. Morgan Stanley stated that the previously envisioned "bullish scenario" is unfolding midway through the year, considering the significant rise in inflation volatility after the pandemic, the increased uncertainty in economic data and policy combinations, and the outperformance of quality stocks over large caps, making high-quality indices like the S&P 500 the biggest beneficiaries.

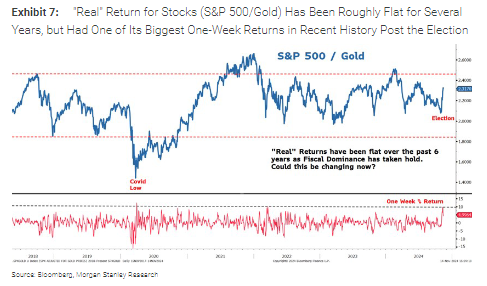

The explanation in the report states that this is mainly because in a relatively restrained fiscal policy environment, investors urgently need assets that can outperform inflation, which is also one of the reasons why gold and some cryptos are performing well.

From a political variable perspective, Morgan Stanley believes that in the case of a Republican victory, the corresponding trading pricing is underestimated, and it is expected that there will still be more upside potential after entering 2025.

The report also indicates that the current upward trend of the S&P has paused, considering the market's overbought condition, uncertainties in the prioritization and specific intensity of new policies, and Federal Reserve Chairman Powell's recent statements not showing clear bullishness. The market may need to see more positive growth data to reach the target price of 6500 points.

Morgan Stanley believes that from now until the end of 2025, the market performance is unlikely to increase in a straight line. Next year, the market is likely to rotate among various macro outcomes (similar to the situation in 2024).

The biggest market variable under Trump 2.0: fiscal policy.

According to Morgan Stanley, the most impactful and uncertain variable in the policies that Trump 2.0 may introduce is the measures to reduce fiscal spending, specifically how the newly established Department of Government Efficiency (DOGE) will lead the cut in government expenses.

The report indicates that considering the current government debt exceeding 120% of GDP, with a 'explosive' expansion scenario of debt increasing by 1 trillion USD every 100 days, it is meaningful for DOGE to 'adopt a more open attitude'.

Based on this, US bonds as the main trades betting on the Republican Party's victory will bring potential risks to the stock market.

Morgan Stanley explains that as the market may start considering the ability of the Trump administration and Congress to deal with fiscal deficits in the coming years, term premium will be a key indicator to observe the bond market response. The report states that if the long-term yield of US bonds rises by another 20-50 basis points, it may have a substantial negative impact on stock market PE ratios.

The report also adds that it is worth noting that the term premium on bonds did not rise significantly after the election, which could be a small sign indicating that the bond market might not be as concerned about the deficit expansion brought by a Republican victory as initially thought. However, time will tell if this dynamic will persist.

Morgan Stanley states that the most encouraging signal for the market currently comes from the 'ratio of actual return on stocks to gold', a value that has been consolidating over the years, but has seen changes since the election results were announced.ResistanceSignificant climb. The report states that this indicates the market is starting to consider the possibility of fiscal dominance and crowding-out effects shifting towards potentially bringing about a more widespread, more positive actual return.

Although it is still too early to draw conclusions now, morgan stanley also mentioned that one thing can be certain: policies are important, and compared to immigration and tariff policies, the market is currently more interested in relaxed regulations and potential fiscal policies.

Preferring high-quality cyclical stocks, bullish on the finance, industrial, and software sectors.

The report indicates that considering the prospect of a more relaxed regulatory environment and a potential rebound in market sentiment will become clearer. With the positive impact of the Federal Reserve's interest rate cuts and stabilization of business indicators, it is expected that high-quality cyclical stocks will further rise.

Morgan Stanley's definition of "high-quality cyclical stocks" mainly meets the following criteria: stocks ranked in the top 1000 by market cap, comprehensive stock quality score above the median, categorized as cyclical stocks under the bank's classification criteria, and rated as "shareholding" by the bank.

Morgan Stanley believes that although the movement of yields has been suppressed so far, interest rates will still be an important focus in the future, making cyclical stocks perform well and driving up the market indexes.

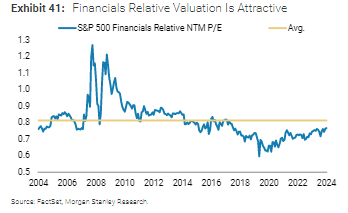

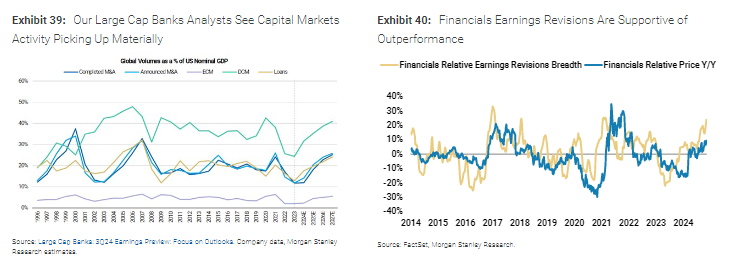

Furthermore, Morgan Stanley is bullish on the performance of financial stocks, mainly due to accelerated capital activities, relatively reasonable valuation levels, and expected performance growth driven by relaxed regulations.

In addition, the report believes that under the trend of manufacturing reshoring advocated by the Trump administration, the industrial sector will benefit. This sector also belongs to cyclical stocks and is expected to achieve strong and sustained growth. Morgan Stanley is particularly bullish on the electrical, automation, and distribution industries within this sector.

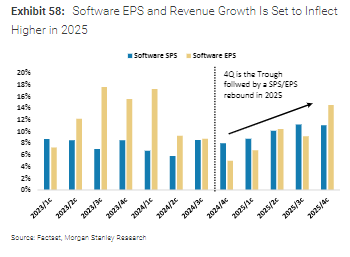

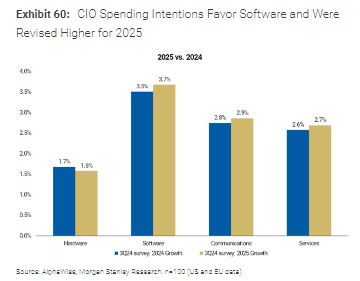

Software stocks that have long been lagging in the technology sector seem to have bottomed out. Morgan Stanley believes that although over the past two years, companies' technology spending budgets have increasingly shifted away from software models, leading to a decline in software company stock prices, currently, as profitability gradually improves, more and more software companies have turned free cash flow positive.

The report indicates that after the election, strong business confidence may return, which should also help stimulate a stronger spending environment in 2025, benefiting the software industry.

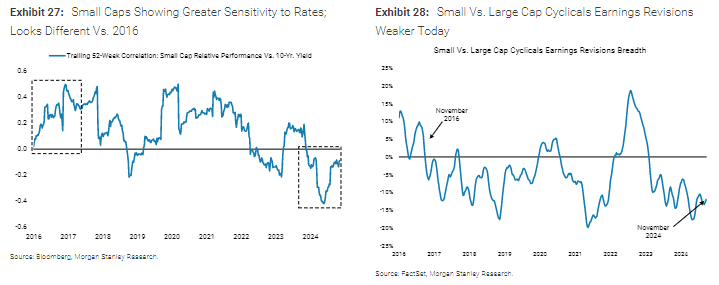

The report also suggests that potential incremental tariffs and limited pricing power may continue to put pressure on non-essential consumer stocks, maintaining a neutral stance on both small cap and large cap stocks due to their negative correlation with interest rates and weaker relative profit corrections.

Editor/Jeffy

报告同时表示,考虑到外部宏观环境仍具不确定性,美股估值明年全年内可能会有所波动,具体取决于新政策举措、利率走势和地缘政治动态的影响。

报告同时表示,考虑到外部宏观环境仍具不确定性,美股估值明年全年内可能会有所波动,具体取决于新政策举措、利率走势和地缘政治动态的影响。