Warren Buffett has just released his annual letter to Berkshire Hathaway shareholders. The letter has been closely watched by investors around the world because it contains not only Berkshire's operational details, but also some useful investment experience and wisdom.

Here are seven key pieces of information Berkshire shareholders and investors need to know.

1.Berkshire's book value has increased by 23%, which is due to deep reasons.

Berkshire's net worth rose by $65.3 billion, or 23%, in 2017. The growth comes from Berkshire's performance, tax cuts and the jobs bill. Specifically, $36 billion of that revenue comes from Berkshire's operations, while the remaining $29 billion is a direct result of tax reforms that have increased Berkshire's book value by 10 per cent.

two。Future "income" figures may be deceptive

A new accounting rule that includes unrealized investment returns, such as those in Berkshire's vast stock portfolio, into the company's net income figures could keep Berkshire's earnings growing. Buffett pointed out that the earnings of his stock portfolio may make a profit or lose $10 billion or more in a quarter, so this does not represent the actual "gain."

3.Cash "problem"Increasingly seriousBut right now,There is no good solution.

By the end of 2017, Berkshire's cash reserves had soared to $116 billion. Revenue of $7 billion was achieved in the fourth quarter alone. Berkshire prefers cash acquisitions and has independent acquisition criteria. A reasonable purchase price is crucial, but in 2017, due to rising asset prices, this became an obstacle to Buffett's acquisition.

While many investors believe that companies may resort to dividends or buybacks to cope with growing cash reserves, Buffett still believes there will be a lot of buying opportunities in the future.

4. Why does Buffett like insurance?

Insurance business, especially reinsurance business, is an important part of the company. Among them, "floating", that is, premiums that have been paid but not yet paid as claims, play a very important role and can be used to invest in reinsurance, so reinsurance is particularly attractive because it transfers part of the risk liability. This has enabled Berkshire to expand its outstanding shares to a very high level.

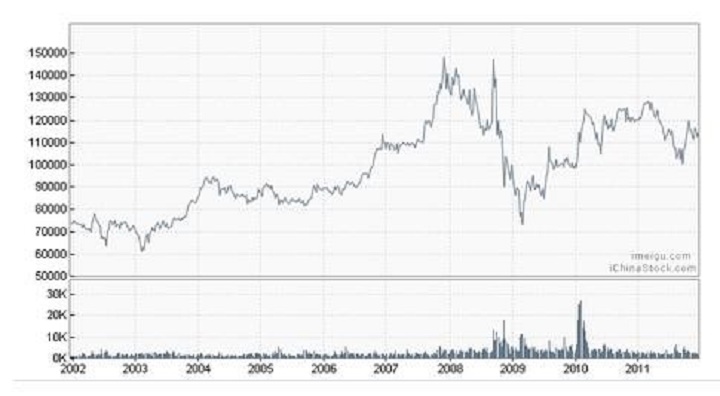

5.Berkshire's share price has plummeted and is likely to collapse again.

Investors can learn from Buffett's discussion of price randomness and short-term falls. While Berkshire has done a great job of creating value in the long run (growing by 20.9% a year for 54 years), there have been times when Berkshire has performed very badly. In the 22 months from 1973 to 1975, the stock lost 59.1% of its value; in the 25 days or so of Black Monday in 1987, it lost 37.1% of its value; from June 1998 to March 2000, it lost 48.9% of its value; and during the economic crisis from September 2008 to March 2009, the stock fell by 50.7%.

Buffett warns that such declines are likely to happen again. Investing in debt stocks can exacerbate losses and lead to bankruptcy, but investors in debt-free stocks can easily take advantage of these declines.

6. CandidateSuccessors Ted and Todd are currentlyManages Berkshire's $25 billion.

The plan for the next potential successor requires Buffett's job to be essentially divided into two parts. The chief executive will be in charge of operations, while managing the investment will be left to others. Ted and Todd are likely to manage investments because they have managed a large amount of Berkshire's investment capital over the past few years and increased again in 2017. They managed a total of $21 billion at the end of 2016 and rose to $25 billion at the end of 2017.

7.There's no big surprise.

It is rumored that Buffett will explain some of the topics that Berkshire shareholders are most concerned about, especially succession planning and cash, but they do not. He is likely to announce it at Berkshire's annual meeting on May 5th.

The original article is from the American investment website The Motley Fool.For more information, please see(compiled / proofread by Qi Yufan / Huang Ruixue)