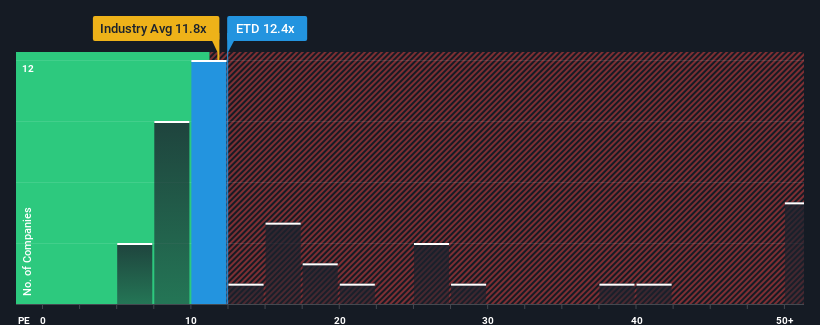

Ethan Allen Interiors Inc.'s (NYSE:ETD) price-to-earnings (or "P/E") ratio of 12.4x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 36x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Ethan Allen Interiors' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is Ethan Allen Interiors' Growth Trending?

In order to justify its P/E ratio, Ethan Allen Interiors would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 11% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 11% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 6.2% as estimated by the two analysts watching the company. That's not great when the rest of the market is expected to grow by 15%.

In light of this, it's understandable that Ethan Allen Interiors' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ethan Allen Interiors' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Ethan Allen Interiors (1 is significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Ethan Allen Interiors, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.