The Compass, Inc. (NYSE:COMP) share price has done very well over the last month, posting an excellent gain of 25%. The last month tops off a massive increase of 229% in the last year.

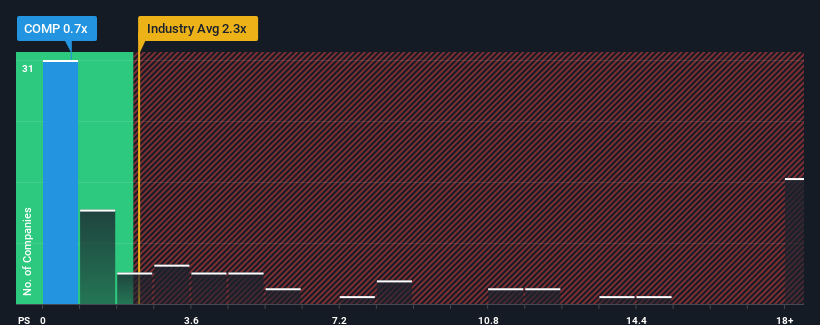

In spite of the firm bounce in price, Compass' price-to-sales (or "P/S") ratio of 0.7x might still make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 2.3x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Compass Performed Recently?

With revenue growth that's inferior to most other companies of late, Compass has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Compass will help you uncover what's on the horizon.How Is Compass' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Compass' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Compass' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.2%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 11% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the six analysts watching the company. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Compass' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Compass' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Compass' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Compass' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Compass you should be aware of.

If you're unsure about the strength of Compass' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.