Investors in different areas, from the stock market, bond market, currency market to the csi commodity equity index market, have found key 'themes' that affect their respective markets in the past 24 hours. And behind all these trends, it can actually be summed up as three major events.

Despite the shortened trading hours in the American financial market this week due to the Thanksgiving holiday, at the beginning of this short trading week, Wall Street traders have been extremely busy due to the derivative impacts of multiple major risk events. In the past 24 hours, investors in different areas, from the stock market, bond market, currency market to the csi commodity equity index market, have found key 'themes' that affect their respective markets.

And behind all these trends, it can actually be summed up as three major events.

The first major event: 'Nomination of Treasury Secretary' Bezent

The first major event undoubtedly refers to last weekend when U.S. President-elect Trump officially announced the nomination of 'Soros disciple' Bezent as the U.S. Treasury Secretary. This news helped boost U.S. stocks and bond prices on Monday.

The first major event undoubtedly refers to last weekend when U.S. President-elect Trump officially announced the nomination of 'Soros disciple' Bezent as the U.S. Treasury Secretary. This news helped boost U.S. stocks and bond prices on Monday.

Both the S&P 500 index and the Dow hit intra-day historical highs. Ultimately, all three major stock indexes rose throughout the day. At the close, the Dow rose 440.06 points, up 0.99%, to 44,736.57; the Nasdaq rose 51.18 points, up 0.27%, to 19,054.84; the S&P 500 index rose 18.03 points, up 0.30%, to 5,987.37.

Yesterday, U.S. bond prices had one of the strongest trading days in recent months. Yields on multiple maturities of U.S. bonds saw double-digit basis point declines, indicating significant price increases on U.S. bonds. At the close of the New York session, the 2-year U.S. bond yield fell by 10.5 basis points to 4.283%, the 5-year U.S. bond yield fell by 12.5 basis points to 4.182%, the 10-year U.S. bond yield fell by 13.1 basis points to 4.28%, and the 30-year U.S. bond yield fell by 12.5 basis points to 4.468%.

Analysts believe that the rise in both the U.S. stock and bond markets is mainly due to investors' approval of Trump's choice for Treasury Secretary. They believe that Bezent will be able to implement Trump's promised tax reduction measures and maintain caution in fiscal spending.

Over the weekend, Bennett stated in his first interview after being elected that his policy focus will be to fulfill Trump's various tax reduction commitments. These commitments include making permanent the tax cuts implemented during Trump's first term, as well as eliminating taxes on tips, social security benefits, and overtime wages. He also pointed out that imposing tariffs and reducing expenses will also be priorities, with maintaining the USD as the world's reserve currency being equally important.

Susannah Streeter, the Funds and Markets Head at Hargreaves Lansdown, stated in a research report that Trump's choice of Treasury Secretary further boosted investors' sentiment, indicating that Wall Street stocks may be poised for a new round of increase.

She added, "Bensent's long market experience enhances confidence in the forthcoming pro-business policies and raises hopes that any tariffs will be highly targeted, along with lower core inflation expectations."

"Bennett understands various asset classes well, which will help Trump maintain a very sensitive attitude towards market reactions," said Carol Schleif, Chief Investment Officer at BMO Family Office, "Investors are concerned that other (Treasury Secretary) candidates may take a tougher stance on tariffs and spending, paying less attention to potential market reactions."

Second Major Event: Rumors of a ceasefire in Lebanon

Apart from Bennett's Treasury Secretary nomination, the second major event affecting the financial markets on Monday is the rumors of a possible ceasefire agreement between Israel and Lebanon, causing a major stir in the commodity market—gold and crude oil both plunged overnight.

John Kirby, the National Security Council Strategic Communication Coordinator, stated on November 25th local time that discussions by the U.S. government regarding the ceasefire issue between Lebanon and Israel are "constructive" and moving in the right direction towards an agreement. Kirby mentioned that the developments are "positive" and they are "close" to reaching an agreement.

Lebanon's Deputy Speaker of Parliament Elias Bou Saab also informed Lebanese media on the same day that the Lebanon-Israel ceasefire is expected to be announced within the "next few hours or days." However, he emphasized the need for caution given past dealings with Israeli Prime Minister Netanyahu. Information received from the U.S. envoy indicates that the final issue has been resolved. The Committee overseeing the implementation of United Nations Security Council Resolution 1701 will include members from the U.S. and France, and may expand.

According to media reports citing two Lebanese officials, the proposed agreement will require a preliminary ceasefire of 60 days. During this period, the Israeli army will withdraw from Lebanon, and Hezbollah will move its weapons to north of the Litani River, 30 kilometers from the border designated by the United Nations.

The above news undoubtedly brought a ray of light to the Middle East peace process. As a result, the safe-haven asset gold price plummeted to around $2620 on Monday, dropping nearly $100 throughout the day.

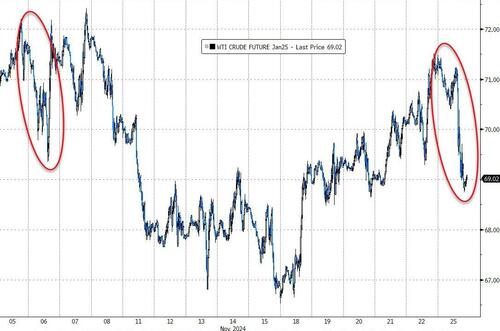

Equally affected is the 'black gold' oil. American WTI crude oil futures fell over 3.2% on Monday, breaking below $69. Brent crude also dropped nearly 3%, approaching $73.

Even bitcoin's decline may also have been affected by the waning market risk aversion. After being blocked ahead of the $0.1 million mark, profit-taking overnight further pushed bitcoin below $95,000.

The third major event: Trump brandishing tariffs

The third major event in the past 24 hours occurred at around 7:40 am Beijing time on Tuesday. Trump began waving tariffs around, posting two consecutive messages on his social media platform Truth Social regarding tariff hikes.

In one of the posts, Trump announced, "As one of my first executive orders, I will sign all necessary documents to impose a 25% tariff on all products entering the United States from Mexico and Canada."

The other post arrogantly announced an additional 10% tariff on all goods imported from China.

After the above post was published, the USD index quickly strengthened, while non-USD currencies all fell. Among them, the USD against the Mexican peso once rose more than 2%, and the USD against the Canadian dollar rose 1.2%.

The offshore renminbi against the usd also dropped about 0.3%, reaching a minimum of 7.2729, refreshing a 4-month low. However, in comparison, the decline of the offshore renminbi is still significantly smaller than that of the Canadian dollar and the Mexican peso.

The State Council Information Office held a regular press conference on November 22. Wang Shouwen, deputy minister of Commerce and China's international trade representative, said at the time:

China's economy has shown very strong resilience, with great potential and vitality. We are building a new development pattern in which the domestic cycle is the mainstay and the domestic and international circulations reinforce each other. We have the ability to resolve and withstand the impact of external shocks. At the same time, history has shown that imposing tariffs on China does not solve the trade deficit problem of the imposing country itself. On the contrary, it raises the prices of products imported from China and other countries by the imposing country. Because ultimately, tariffs are paid by consumers and end-users in the importing country, leading to an increase in consumer prices, rising costs for users, and inflation due to price increases.

China and the USA are the two largest economies in the world, and there is a strong complementarity between their economies. We believe that if China and the USA can maintain a stable, healthy, and sustainable development trend in the economic and trade relationship, it will benefit both the people of China and the people of the USA, as well as people from all over the world, which is also the expectation of the international community. We are willing to engage in active dialogue with the US side based on mutual respect, peaceful coexistence, and win-win cooperation principles, to expand cooperation areas, manage differences, and promote the steady and far-reaching development of bilateral economic and trade relations. At the same time, China will firmly safeguard its own sovereignty, security, and development interests.

Editor / jayden