The rise in the stock market, driven by the victory of President-elect Donald Trump, is expected to put upward pressure on the inflation indicators that the Federal Reserve is concerned about, and may cause interest rates to remain at a high level.

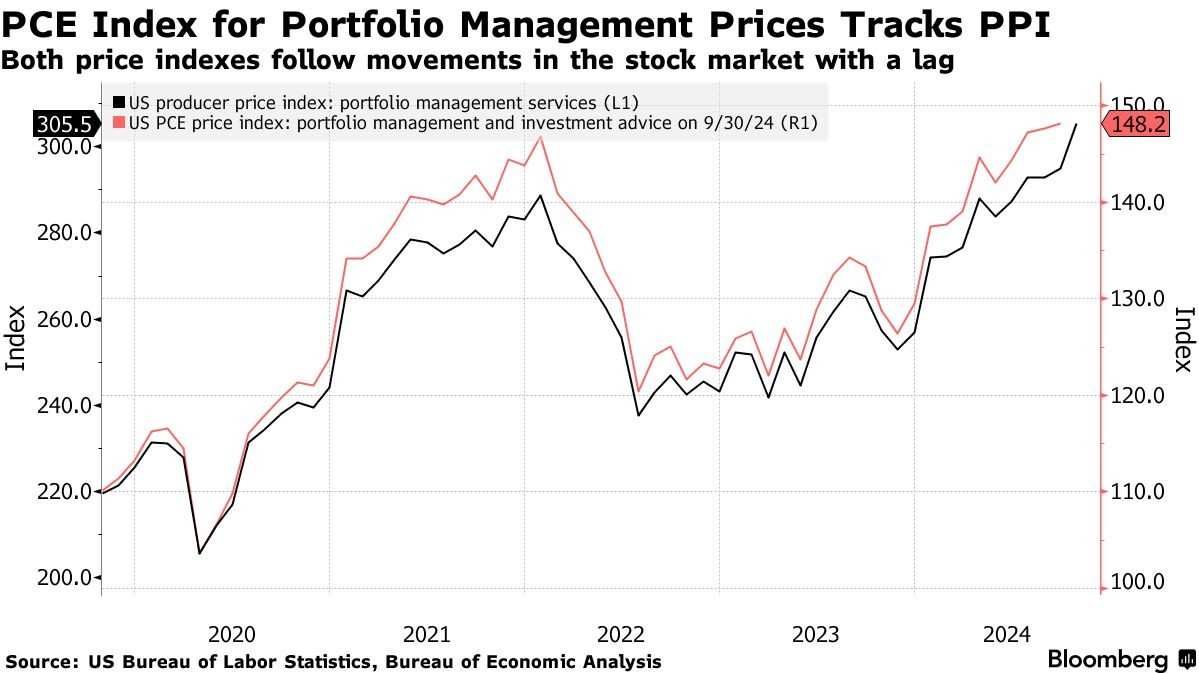

The Zhitong Finance App learned that the rise in the stock market driven by the victory of President-elect Donald Trump is expected to put upward pressure on the inflation indicators that the Federal Reserve is concerned about, which may cause interest rates to remain at a high level. After the election, the sharp rise in the stock market not only increased the cost of portfolio management and investment consulting services. As a category of personal consumption expenditure price indices fluctuated with the market, changes directly affected the Federal Reserve's policy decisions, especially on service sector inflation, which is a more stubborn part of the overall PCE index. According to the data, inflation in the service sector is expected to rise 0.2% month-on-month and 2.3% year-on-year in October. Among them, the stock market effect is considered one of the important factors driving up inflation in the core service sector.

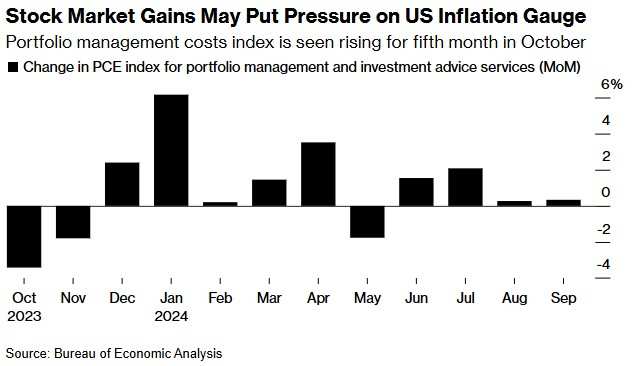

Figure 1

Specifically, the rise in the stock market prompted investors to join the “Trump Deal,” that is, betting that Trump will introduce pro-business policies after returning to the White House, thereby boosting the S&P 500 index. This upward trend has increased portfolio management fees. This is a component of the PCE index and accounts for about 1.5% of the total consumer basket. Although the ratio is small, it is enough to have an impact when the market fluctuates greatly. The data showed that portfolio management fees rose 3.6% in October compared to the previous month, the highest level in six months.

Specifically, the rise in the stock market prompted investors to join the “Trump Deal,” that is, betting that Trump will introduce pro-business policies after returning to the White House, thereby boosting the S&P 500 index. This upward trend has increased portfolio management fees. This is a component of the PCE index and accounts for about 1.5% of the total consumer basket. Although the ratio is small, it is enough to have an impact when the market fluctuates greatly. The data showed that portfolio management fees rose 3.6% in October compared to the previous month, the highest level in six months.

Figure 2

Skanda Amarnath, executive director of Accumulated America, pointed out that compared with the pre-pandemic trend, the stock market effect contributed more than one-third to the excessive increase in core service sector inflation.

He warned that either the stock market pulls back, or the Federal Reserve will have to slow down the pace of interest rate cuts and take a hawkish stance.

Furthermore, economists generally believe that stock market momentum is likely to continue to be a continuing source of inflation, especially in the context of more relaxed business expectations under the Trump administration.

However, Federal Reserve officials said they are in no hurry to continue cutting interest rates while the labor market remains resilient and the economy is growing strongly. At the same time, concerns that a rise in the stock market may re-trigger inflation have also become another reason for their restraint.

Citigroup economist Veronica Clark believes that although there is a risk that a rise in the stock market may continue to drive up inflation, policymakers may see through recent fluctuations because this component is highly volatile and may resume at some point.

In summary, the rise in the stock market caused by Trump's election victory has put upward pressure on the inflation indicators that the Federal Reserve is concerned about, which may affect interest rate policies, and has also sparked widespread discussion and concern about the relationship between the stock market and inflation.

具体来说,股市上涨促使投资者加入“特朗普交易”,即押注特朗普重返白宫后将出台利商政策,从而推高了标普500指数。这种上涨趋势增加了投资组合管理费,这是PCE指数中的一个组成部分,约占整个消费篮子的1.5%,虽然比例不大,但在市场大幅波动时足以产生影响。数据显示,10月份投资组合管理费较上月上涨3.6%,为六个月以来的最高水平。

具体来说,股市上涨促使投资者加入“特朗普交易”,即押注特朗普重返白宫后将出台利商政策,从而推高了标普500指数。这种上涨趋势增加了投资组合管理费,这是PCE指数中的一个组成部分,约占整个消费篮子的1.5%,虽然比例不大,但在市场大幅波动时足以产生影响。数据显示,10月份投资组合管理费较上月上涨3.6%,为六个月以来的最高水平。