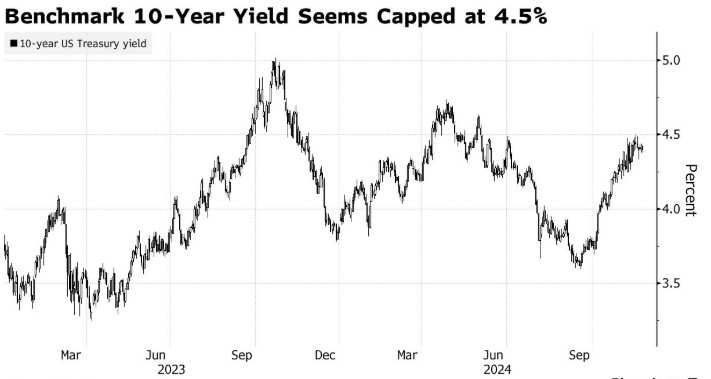

The US bond market has stopped fluctuating, with buyers eagerly chasing a 4.5% yield.

After two months of selling off, the US bond market finally shows signs of stabilization. Every time US bond yields test new highs, investors start buying heavily. Since mid-September, high and persistent inflation, a series of strong economic data, and Trump's victory in the presidential election have significantly pushed up the yield of the 10-year US Treasury bonds. However, there is still no clear consensus on where the yield may go.

However, after the 'anchor of global asset pricing,' the 10-year US Treasury bond yield, broke through 4.5% on November 15, it quickly reversed its trend in a wave of massive buying and has not surpassed this level since. The 10-year US Treasury bond yield closed at 4.4% last Friday, down 3 basis points from the previous week's close.

The fund manager at Pacific Investment Management Company said that the US Treasury bond yield well above 4% is attractive in itself. As federal government debt is now generally moving in the opposite direction of stock prices, it has also started to play the traditional role of hedging against stock market declines.

The fund manager at Pacific Investment Management Company said that the US Treasury bond yield well above 4% is attractive in itself. As federal government debt is now generally moving in the opposite direction of stock prices, it has also started to play the traditional role of hedging against stock market declines.

Erin Browne, fund manager at Pacific Investment Management Company, said in an interview that US Treasuries are 'very low volatility, high yield assets,' and added that if the 10-year US Treasury bond yield rises to 5%, she would 'really be interested in purchasing more actively.'

The past two months have marked another turbulent shift in the bond market, as people expected a rebound once the Fed began cutting interest rates. However, since the Fed's first rate cut in September, strong economic data and Trump's victory have prompted traders to adjust their rate cut expectations, leading to higher yields.

Last Friday, Trump nominated Scott Bessent, CEO of macro hedge fund Key Square Group, as the next US Treasury Secretary. Prior to this, Trump had spent a long time screening multiple prominent candidates. Bessent is seen by some on Wall Street as a 'fiscal hawk,' and he will play a key role in overseeing the government's large-scale bond issuance. Bessent has questioned the Biden administration's management of federal debt financing and criticized the significant rate cut by the Fed in September.

Subadra Rajappa, head of US rate strategy at French industrial bank, said: 'I do not believe investors have a strong conviction about a significant rise in yields, but at the same time, meaningful resistance exists to any rebound. Investors are cautious and not taking any new positions.' Rajappa pointed out that due to the uncertainty of Trump administration's tariffs and fiscal stimulus, the market is 'more pausing and assessing the situation.'

Asset management company TwentyFour Asset Management's portfolio manager Felipe Villarroel believes that the fair value of the 10-year US Treasury bonds is between 4.25% and 4.5%, but he added that given the recent lack of severe deterioration in inflation, investors do not know if Trump's policies will drive prices up, stating that 'volatility will continue to exist'.

While derivative traders believe that the probability of a rate cut by the Federal Reserve at the next month's meeting is slightly less than 50%, they expect that by December 2025, the Fed will cut rates by a total of around 66 basis points.

Bloomberg US Interest Rate/Forex Strategist Alyce Andres stated: 'The yield on the 10-year US Treasury bonds hovers around 4.40%. Until more catalysts emerge, the yield is unlikely to break through. A key driving factor may be answering the question of who will lead the US Treasury.'

However, some strategists suggest that if Trump significantly lowers taxes and increases tariffs, there is room for an increase in the yield of the 10-year US Treasury bonds, potentially reaching the significant level of 5% seen in October 2023. Bond options trading indicates that investors are hedging the risk of the yield breaking through, therefore more upside potential has not completely disappeared.

This week, traders will gain new insights from the Fed's most favored inflation indicator released on Wednesday - the core PCE price index. The report will be published on the day before the US Thanksgiving holiday on Thursday, with the market closing early the next day. If the data significantly exceeds expectations, light trading volume may trigger substantial price swings.

Editor/new

太平洋投资管理公司的基金经理说,远高于4%的美国国债收益率本身就具有吸引力。但随着联邦政府债务现在也普遍与股价走势相反,它也开始扮演对冲股市下跌的传统角色。

太平洋投资管理公司的基金经理说,远高于4%的美国国债收益率本身就具有吸引力。但随着联邦政府债务现在也普遍与股价走势相反,它也开始扮演对冲股市下跌的传统角色。