Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH) shareholders have had their patience rewarded with a 27% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.4% in the last twelve months.

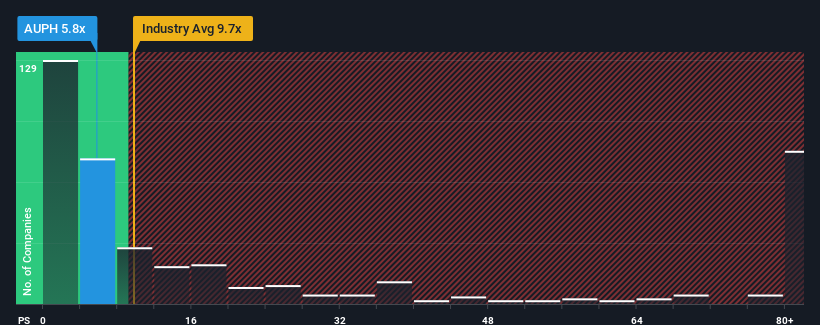

Even after such a large jump in price, Aurinia Pharmaceuticals may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 5.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.7x and even P/S higher than 60x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Aurinia Pharmaceuticals' P/S Mean For Shareholders?

Recent times haven't been great for Aurinia Pharmaceuticals as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aurinia Pharmaceuticals.Is There Any Revenue Growth Forecasted For Aurinia Pharmaceuticals?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Aurinia Pharmaceuticals' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Aurinia Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. Pleasingly, revenue has also lifted 205% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 118% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Aurinia Pharmaceuticals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Aurinia Pharmaceuticals' P/S

The latest share price surge wasn't enough to lift Aurinia Pharmaceuticals' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Aurinia Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Aurinia Pharmaceuticals with six simple checks on some of these key factors.

If you're unsure about the strength of Aurinia Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.