Source: Zhitong Finance "Since 1950, the S&P 500 index has risen more than 10% 21 times as of the end of May. In about 90% of these cases, the S&P 500 index rose for the rest of the year. There were only two instances of declines for the rest of the year, in 1987 (-13%) and 1986 (-0.1%)." With the rebound of the stock market, the old adage "Sell in May and Go Away" seems to have been a bad advice once again. Last month, the S&P 500 index rose 4.8%, the best May performance since 2009. The NASDAQ 100 index rose nearly 6.2%, and the NASDAQ Composite Index rose 6.9%. Goldman Sachs FICC & Equities Trading Division said: "History doesn't really support this saying. Don't sell, leave the market (go on vacation), and enjoy the good times." The rising trend is still to be continued? If history is any guide, it may indicate that the rise of the stock market is not over yet. Looking ahead to the rest of 2024, Scott Rubner, Managing Director of the Goldman Sachs Global Markets Division and tactical expert, pointed out the following historical background for investors. Rubner stated that the S&P 500 index has risen 10.7% year-to-date, and since 1950, the S&P 500 index has risen more than 10% 21 times as of the end of May. In about 90% of these cases, the S&P 500 index rose for the rest of the year. There were only two instances of declines for the rest of the year, in 1987 (-13%) and 1986 (-0.1%). "Since 1950, the median return of the last 7 months of each year (June 1 to December 31) is 5.4%. In the aforementioned 21 cases, the average performance of the last 7 months increased to 8.1%." Rubner added. Rubner also pointed out that the NASDAQ index has risen for 16 consecutive Julys, with an average return of about 4.64%.

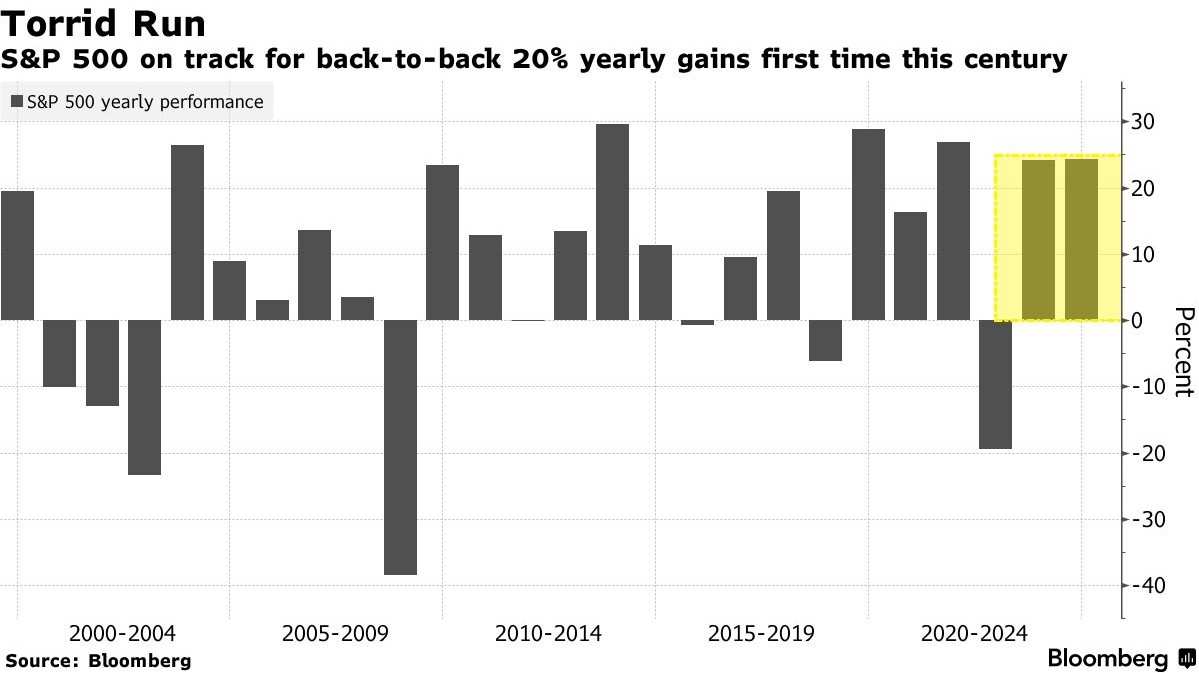

Despite the s&p 500 index achieving over 20% roi for the second consecutive year, there are currently no signs that the upward momentum is about to end.

Investors can expect that the upward trend in the usa stock market will continue next year, even though the s&p 500 index has already experienced strong gains of over 50% since the beginning of 2023, and this growth momentum will not be limited to those popular large technology companies. David Kelly, a strategist from jpmorgan's asset management division, pointed out that strong corporate earnings and the overall vitality of the usa economy will be key factors driving the stock market to continue rising. However, he also cautioned investors to be aware of potential risks such as overvaluation, overly concentrated portfolios, and the uncertainty surrounding the policies of the Trump administration. Nonetheless, they believe there are currently enough positive factors to maintain this momentum.

Kary stated in an interview that although the S&P 500 index has achieved a return on investment of over 20% for the second consecutive year, there is currently no sign that the upward momentum is about to end. He expects the economy to continue growing over the next two years, with overall returns also rising. However, he also acknowledged that Trump's trade protectionism policies could trigger inflation risks, forcing the Fed to adjust its interest rate reduction plans.

To hedge against these risks, Kary recommends that investors increase their overseas investments, especially in international stocks, which have long-term growth potential and dividend yields twice those of US stocks. Additionally, he pointed out that the stock market leadership position will be more stable, with sectors outside of large tech stocks also catching up. For example, the so-called 'Big Seven' index rose by 55% this year, more than double the increase of the S&P 500 index.

To hedge against these risks, Kary recommends that investors increase their overseas investments, especially in international stocks, which have long-term growth potential and dividend yields twice those of US stocks. Additionally, he pointed out that the stock market leadership position will be more stable, with sectors outside of large tech stocks also catching up. For example, the so-called 'Big Seven' index rose by 55% this year, more than double the increase of the S&P 500 index.

JPMorgan Asset Management is bullish on the prospects of multiple industries, including the financial sector benefiting from deregulation and high interest rates, consumer goods companies focusing on affluent clients, and the continuously innovative medical care industry. At the same time, they also advise investors to include small-cap stocks in their portfolios to weather the downturn cycle.

Despite facing risks such as overvaluation, high portfolio concentration, and policy uncertainties in the Trump administration, Kary is not the only one with an optimistic view. Wall Street heavyweights like Goldman Sachs, Morgan Stanley, and UBS Group also predict further increases in the stock market by 2025. These institutions generally believe that despite some potential risks, strong corporate earnings performance and overall vitality of the US economy will be sufficient to support the upward trend in the stock market.

Editor / jayden

凯利在接受采访时表示,尽管标普500指数已经连续第二年实现了超过20%的回报率,但目前并没有迹象表明上涨势头即将结束。他预计,未来两年经济将持续增长,总体收益也将上升。然而,他也承认特朗普的贸易保护主义政策可能引发通胀风险,迫使美联储调整降息计划。

凯利在接受采访时表示,尽管标普500指数已经连续第二年实现了超过20%的回报率,但目前并没有迹象表明上涨势头即将结束。他预计,未来两年经济将持续增长,总体收益也将上升。然而,他也承认特朗普的贸易保护主义政策可能引发通胀风险,迫使美联储调整降息计划。