Author: 636Marx

The author has previously discussed why only bitcoin has been continuously rising in the entire cryptocurrency market. If the bitcoin spot etf is driving the price, then why is there no resistance appearing on the K-line? The author's view is that as long as retail investors wait to short, institutional users dare to ramp up the price recklessly!

Today, bitcoin has once again set a new high at $97,852. Following yesterday's discussion in the article "With 11.23% until 2025, how much more can bitcoin rise?", this article will analyze the impact of bitcoin breaking through $0.1 million on market dynamics, regulatory environment, institutional adoption, and the broader crypto financial ecosystem.

Key factors for bitcoin's rise to $0.1 million.

Bitcoin's rise to $0.1 million is driven by a strong combination of macroeconomic trends, technological advancements, and institutional adoption. Let's analyze the main drivers behind this significant growth.

Bitcoin's rise to $0.1 million is driven by a strong combination of macroeconomic trends, technological advancements, and institutional adoption. Let's analyze the main drivers behind this significant growth.

1. Institutional adoption and spot ETF.

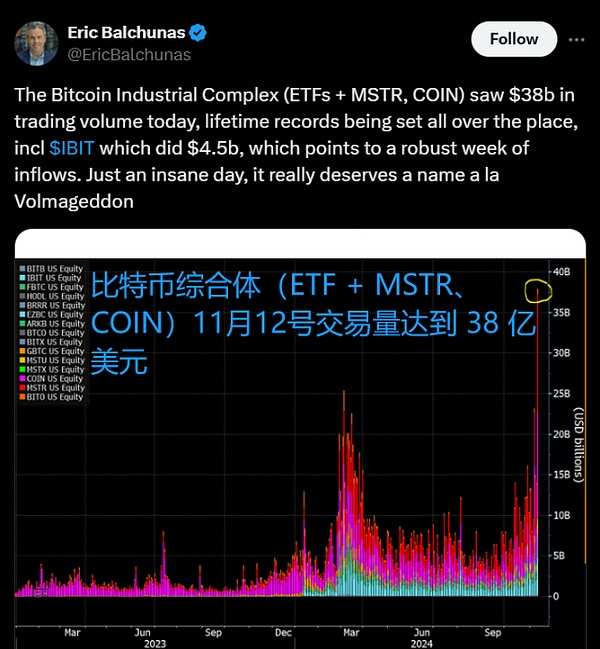

In 2024, institutional interest in bitcoin surged, primarily due to the SEC's approval of the spot bitcoin exchange-traded fund (ETF). Industry giants like blackrock, fidelity, and vanguard launched spot ETFs, providing retail and institutional investors with more convenient options to invest in bitcoin.

The debut of these ETFs created a positive feedback loop: increased accessibility led to higher demand, which in turn drove up the price of bitcoin. For example, blackrock's iShares bitcoin ETF surpassed gold ETFs in net assets under management. Bloomberg's ETF analyst published an article 10 days ago celebrating record trading volume for bitcoin. Currently, bitcoin, with a market cap of $1.92 trillion, has replaced silver as the eighth largest asset globally.

ETFs have also brought much-needed liquidity and legitimacy to the crypto market by integrating bitcoin into the traditional financial system, alleviating investors' concerns about safety and regulatory risks. It is believed that the influx of institutions played a key role in bitcoin's rise to $0.1 million.

II. The weakening dollar and favorable macroeconomic conditions.

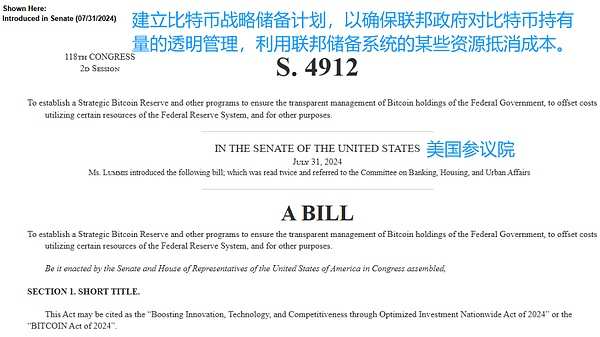

On July 31 this year, U.S. Republican Senator Cynthia Lummis introduced the S4912 "2024 Bitcoin Bill" to Congress. The bill calls for the establishment of a bitcoin strategic reserve and stipulates that these reserves should not be sold, exchanged, auctioned, or otherwise pledged. The bill proposes to purchase 1 million bitcoins over five years to alleviate the U.S.'s ever-increasing national debt of nearly $36 trillion.

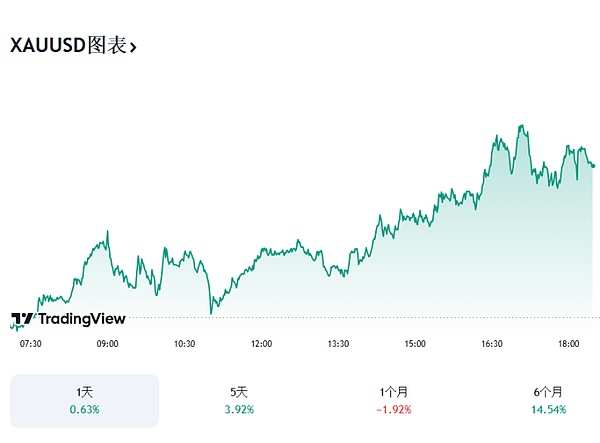

The macroeconomic conditions have enhanced the allure of bitcoin as a store of value, with increasing national debt and geopolitical instability calling the dollar into question. Additionally, the Federal Reserve's recent interest rate cuts have stimulated market risk aversion, driving funds into high-growth assets like bitcoin. This trend aligns with bitcoin's reputation as "digital gold", providing a hedge in times of economic uncertainty.

III. Expanding use cases and technological advancements.

The practicality of bitcoin continues to grow, particularly with layer 2 solutions like the Lightning Network, making BTC suitable for payments and trades. Countries like El Salvador not only use bitcoin as a national reserve currency but have also integrated bitcoin into their payment systems with companies like paypal, expanding its use beyond speculative assets.

On March 20 this year, a Bloomberg report stated that Argentina's peso surprisingly began to strengthen, harming Argentinians who store their money in dollars. This correlation has led to a 20-month peak in bitcoin demand in Argentina, with bitcoin beginning to replace dollar savings.

Moreover, advancements in blockchain technology have improved bitcoin's scalability and efficiency, making BTC more attractive as a store of value to institutional investors.

IV. Social and Political Changes

In the 2024 USA presidential election, a government that supports digital currency is expected to emerge, which signifies a potential reduction in regulatory scrutiny for the industry. The White House will have a 'crypto president', and this Tuesday (November 19), the 'crypto president' appointed Howard Lutnick as Secretary of Commerce. Lutnick, the CEO of Cantor Fitzgerald, known for being at the 911 Twin Towers, currently manages assets that include 130 billion USDT in custody.

This political support, combined with increased global acceptance, makes bitcoin a strategic asset. Speculation about government-led bitcoin reserves further enhances its appeal, driving bullish momentum in a snowball effect.

The psychological and significance of bitcoin at 0.1 million.

The threshold of 0.1 million dollars is not just a number; it is a milestone defined by psychology and the market. This is why it is so important:

1. A new psychological benchmark.

In financial markets, round numbers often become psychological anchors. Bitcoin surpassing 0.1 million dollars validates its status as a major asset class. For skeptics, it indicates that bitcoin is no longer a fringe experiment, but a legitimate financial tool that is gaining support from an increasing number of institutions and retail investors.

This milestone will attract more previously hesitant investors, creating a 'fear of missing out' (FOMO) effect. Historically, such thresholds often trigger a new wave of participants, further enhancing liquidity and price stability.

II. Strengthen bitcoin's role as digital gold.

For years, bitcoin has been compared to gold due to its limited supply and decentralized nature. The milestone of 0.1 million dollars reinforces this claim, as bitcoin now competes with gold not only theoretically but also in terms of market valuation and investor preference.

This shift has significant implications for portfolio management, as institutions will start allocating a higher proportion of assets to bitcoin, viewing it as a core asset equally important as traditional assets like stocks and bonds.

III. Expand bitcoin's dominance in the cryptocurrency market.

Bitcoin's dominance—the proportion of bitcoin in the total market cap of digital currency—has risen alongside its price surge. When bitcoin's market cap reached 0.1 million dollars, it exceeded 2 trillion dollars, rendering most other digital assets insignificant.

This dominance underscores bitcoin's position as the benchmark asset of the crypto industry. While alternative coins like ETH and solana provide various use cases, bitcoin's longevity and security make it the preferred choice for institutional investors.

Impact on the cryptocurrency industry.

The milestone of 0.1 million dollars will have a completely different impact on the digital currency ecosystem. From regulatory developments to innovation and competition, here are the trajectories for the industry's development:

I. The clarity and standardization of regulations

The rise of bitcoin has put pressure on regulatory authorities to create a clear and consistent framework for digital currency. Countries that have been hesitant to adopt digital currency will now accelerate legislation to harness its economic potential.

The clarity of regulation is a double-edged sword; while it provides legitimacy and encourages institutions to participate, it also introduces stricter oversight, which can stifle innovation. The crypto industry needs to strike a delicate balance between compliance and innovation.

II. Institutionalization of the digital currency market

As bitcoin reaches 0.1 million dollars, traditional financial institutions will deepen their participation in the crypto market. This includes not only asset management companies but also banks, payment processors, and custodial service providers.

Institutional participation brings benefits such as improved liquidity and reduced volatility, however, it also leads to market centralization, as large participants have significant influence over price movements.

III. Promoting the growth and innovation of altcoins

The rise of bitcoin often acts like a rising tide that lifts all boats. Altcoins, particularly those with complementary use cases, will benefit from the inflow of capital and growing interest in the crypto market. The reason altcoins have not risen currently could still be that bitcoin is not high enough.

Meanwhile, the milestone of 0.1 million dollars will stimulate innovation in blockchain technology. Developers and entrepreneurs can seize the opportunity to create new products, applications, and protocols, leveraging the success of bitcoin.

Four, the competition from national currencies and CBDCs is intensifying.

The rise of bitcoin will prompt governments to accelerate the development of central bank digital currencies (CBDCs), such as our DCEP. While these digital currencies aim to modernize the financial system, they also serve as a counterbalance to the decentralized nature of bitcoin.

This competition will shape the future of currency as consumers weigh the benefits of sovereign-backed digital currencies against the freedoms offered by decentralized assets like bitcoin.

Author's viewpoint

The following chart shows the bitcoin trading data on Binance, which includes leveraged lending, long-short ratios, contract lending, etc. It clearly shows that the crypto market is behaving very rationally, with no signs of greed or overheating.

I think this could be a sign that bitcoin will break through 0.1 million dollars in the next few hours!

比特币的 10 万美元是由宏观经济趋势、技术进步和机构采用的强大组合推动的。随笔者分析一下这一显著增长背后的主要驱动力。

比特币的 10 万美元是由宏观经济趋势、技术进步和机构采用的强大组合推动的。随笔者分析一下这一显著增长背后的主要驱动力。