Deep-pocketed investors have adopted a bearish approach towards ConocoPhillips (NYSE:COP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in COP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for ConocoPhillips. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 2 are puts, totaling $60,600, and 6 are calls, amounting to $730,955.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $135.0 for ConocoPhillips over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $135.0 for ConocoPhillips over the recent three months.

Volume & Open Interest Trends

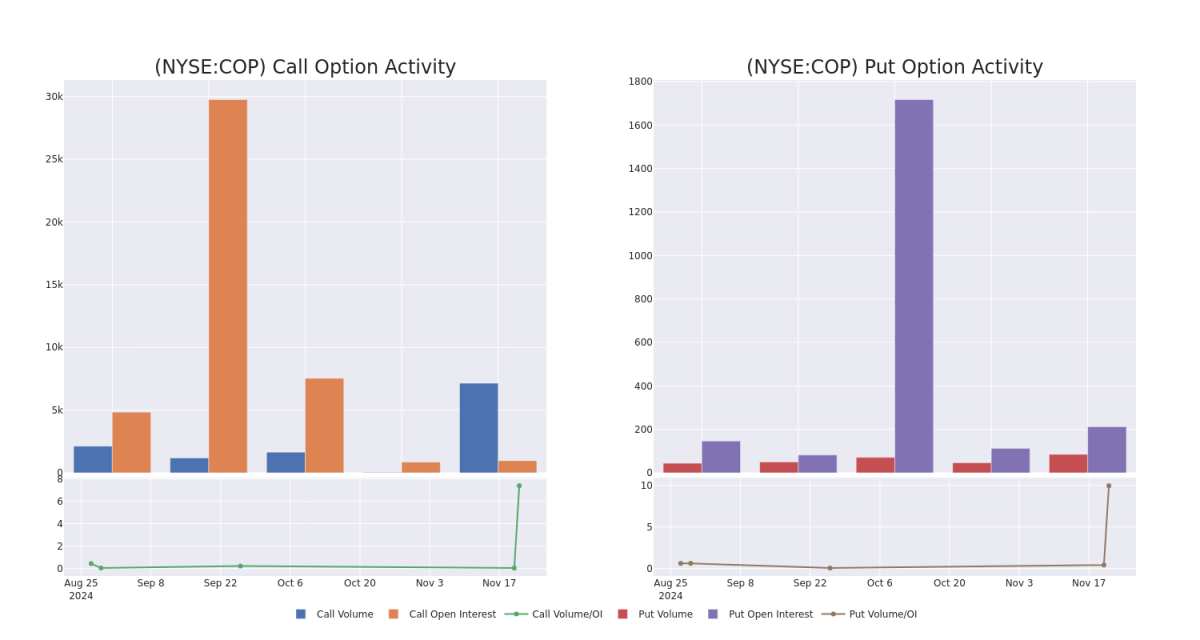

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ConocoPhillips's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ConocoPhillips's substantial trades, within a strike price spectrum from $115.0 to $135.0 over the preceding 30 days.

ConocoPhillips Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | CALL | SWEEP | BEARISH | 05/16/25 | $3.05 | $3.0 | $3.0 | $130.00 | $450.0K | 61 | 1.8K |

| COP | CALL | SWEEP | BEARISH | 05/16/25 | $3.05 | $3.0 | $3.0 | $130.00 | $116.1K | 61 | 2.2K |

| COP | CALL | SWEEP | BULLISH | 05/16/25 | $3.05 | $3.0 | $3.0 | $130.00 | $59.4K | 61 | 375 |

| COP | CALL | SWEEP | BULLISH | 05/16/25 | $3.0 | $2.99 | $3.0 | $130.00 | $47.1K | 61 | 2.4K |

| COP | PUT | TRADE | BEARISH | 05/16/25 | $7.4 | $7.05 | $7.4 | $115.00 | $34.0K | 208 | 46 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

Present Market Standing of ConocoPhillips

- Currently trading with a volume of 705,190, the COP's price is up by 1.46%, now at $115.09.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 77 days.

What Analysts Are Saying About ConocoPhillips

3 market experts have recently issued ratings for this stock, with a consensus target price of $139.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for ConocoPhillips, targeting a price of $132. * An analyst from Susquehanna has decided to maintain their Positive rating on ConocoPhillips, which currently sits at a price target of $148. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on ConocoPhillips with a target price of $137.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ConocoPhillips options trades with real-time alerts from Benzinga Pro.