The Wix.com Ltd. (NASDAQ:WIX) share price has done very well over the last month, posting an excellent gain of 26%. The annual gain comes to 118% following the latest surge, making investors sit up and take notice.

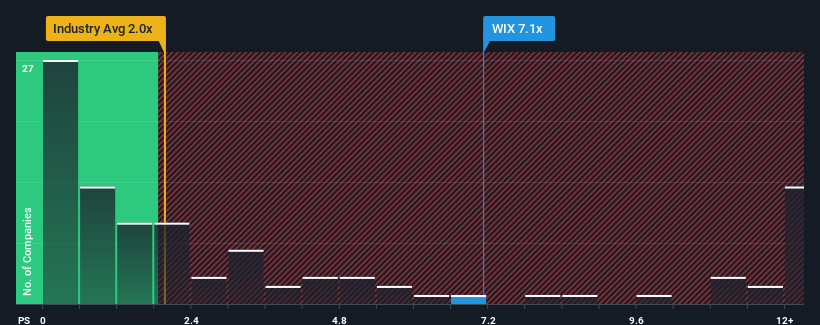

After such a large jump in price, you could be forgiven for thinking Wix.com is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.1x, considering almost half the companies in the United States' IT industry have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Wix.com Performed Recently?

With revenue growth that's superior to most other companies of late, Wix.com has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Wix.com's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wix.com's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wix.com's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is not materially different.

With this information, we find it interesting that Wix.com is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Wix.com's P/S?

The strong share price surge has lead to Wix.com's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Wix.com currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Wix.com that you should be aware of.

If these risks are making you reconsider your opinion on Wix.com, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.