Kodiak Gas Services, Inc. (NYSE:KGS) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 114% in the last year.

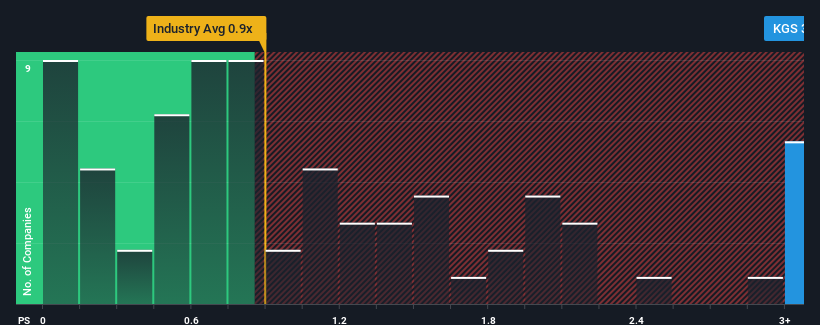

Following the firm bounce in price, when almost half of the companies in the United States' Energy Services industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Kodiak Gas Services as a stock not worth researching with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Kodiak Gas Services Performed Recently?

Recent times have been advantageous for Kodiak Gas Services as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Kodiak Gas Services' future stacks up against the industry? In that case, our free report is a great place to start.How Is Kodiak Gas Services' Revenue Growth Trending?

In order to justify its P/S ratio, Kodiak Gas Services would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Kodiak Gas Services would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. Pleasingly, revenue has also lifted 77% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.3%, which is noticeably less attractive.

With this information, we can see why Kodiak Gas Services is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Kodiak Gas Services' P/S

The strong share price surge has lead to Kodiak Gas Services' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Kodiak Gas Services shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Kodiak Gas Services (including 2 which are a bit concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.