①Shenzhen Chipscreen Biosciences announced a private placement plan, planning to raise 0.96 billion yuan, with 0.71 billion yuan for innovative drug research and development, and 0.25 billion yuan for supplementary working capital, with a ratio of 26.04%; ②Multiple research pipelines continue to burn cash for Shenzhen Chipscreen Biosciences, with a total research and development expenses of 0.927 billion yuan from 2021 to 2023, with 17 indication pipelines currently in the clinical trial stage.

On November 21, the Science and Technology Innovation Board Daily News (Reporter: Zheng Bingxun) reported that the original innovative drug company Shenzhen Chipscreen Biosciences (688321.SH) is seeking financing again!

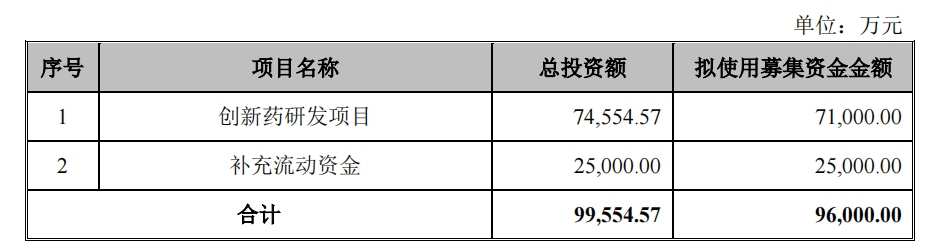

On the evening of the 20th, Shenzhen Chipscreen Biosciences announced its private placement plan for 2024, planning to raise 0.96 billion yuan. This is another fundraising activity after its IPO fundraising in 2019 and the issuance of convertible bonds for refinancing in 2021.

According to the private placement plan, Shenzhen Chipscreen Biosciences plans to use 0.71 billion yuan of the funds raised for 'innovative drug research projects,' with the remaining 0.25 billion yuan for supplementary working capital, accounting for 26.04%.

According to the private placement plan, Shenzhen Chipscreen Biosciences plans to use 0.71 billion yuan of the funds raised for 'innovative drug research projects,' with the remaining 0.25 billion yuan for supplementary working capital, accounting for 26.04%.

Prior to this, out of the 0.804 billion yuan raised in Shenzhen Chipscreen Biosciences' IPO plan, 0.16 billion yuan was used for working capital, accounting for nearly 20%. When issuing convertible bonds, out of the planned 0.5 billion yuan, 0.12 billion yuan was also used for working capital, accounting for 24%.

Shenzhen Chipscreen Biosciences does need to make more preparations for cash flow. When Shenzhen Chipscreen Biosciences landed on the Science and Technology Innovation Board in 2019, its cash and cash equivalents balance was 0.336 billion yuan. By the end of 2022 when the convertible bond issuance plan registered effective, the year-end cash balance reached a new high of 0.415 billion yuan. However, by the end of 2023, Shenzhen Chipscreen Biosciences' cash and cash equivalents balance had rapidly decreased to 0.267 billion yuan, further reduced to 0.193 billion yuan by the end of September 2024.

The core reason for this situation is that Shenzhen Chipscreen Biosciences is a biotech company, and furthermore, a biotech company mainly focused on developing original innovative drugs. This determines that Shenzhen Chipscreen Biosciences needs to continue to invest heavily in research and development.

In 2021-2023, Shenzhen Chipscreen Biosciences achieved revenues of 0.43 billion yuan, 0.53 billion yuan, and 0.524 billion yuan respectively, with research and development expenditures of 0.234 billion yuan, 0.288 billion yuan, and 0.405 billion yuan, accounting for revenue proportions of 54.44%, 54.33%, and 77.30%, totaling 0.927 billion yuan over 3 years. In the first three quarters of 2024, Shenzhen Chipscreen Biosciences achieved revenue of 0.481 billion yuan, with research and development investment of 0.246 billion yuan, also exceeding 51%.

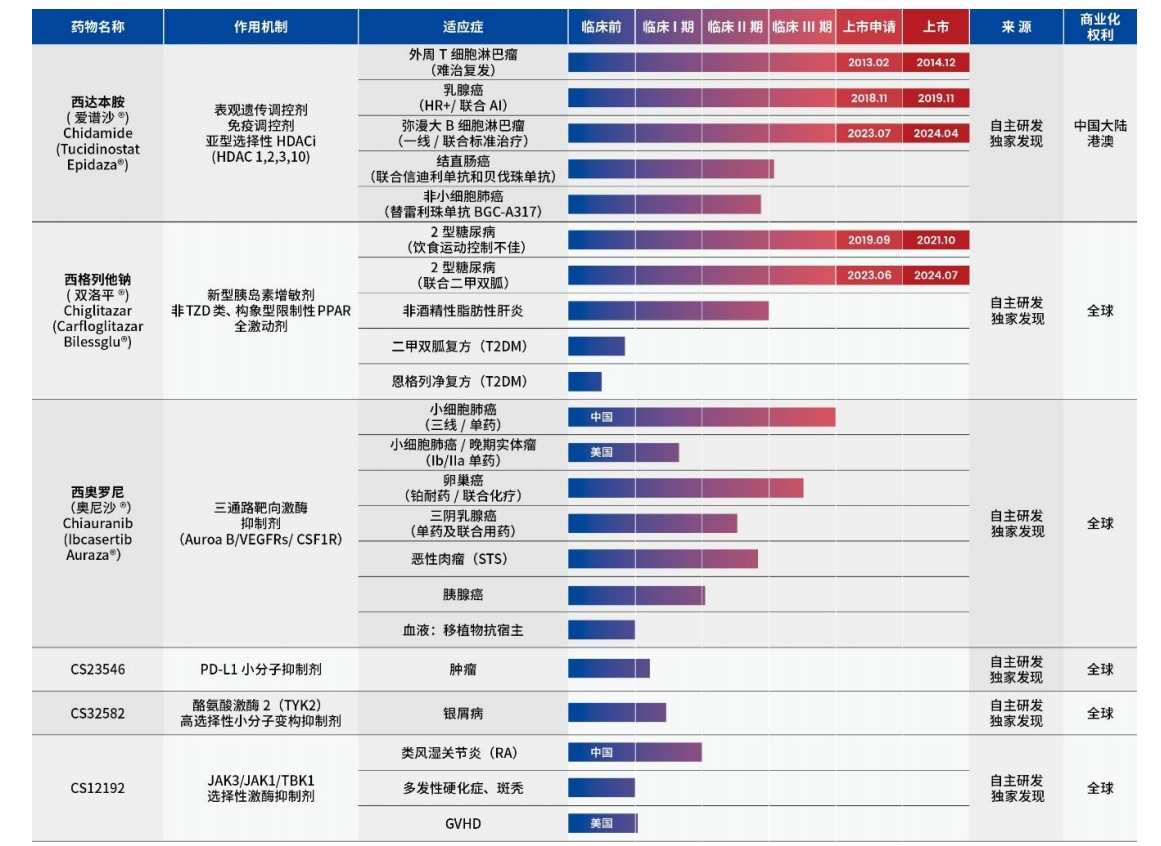

The information shows that shenzhen chipscreen biosciences has developed globally the first-in-class and best-in-class original innovative drugs, with 2 products approved for 5 indications, namely Xidabenamine and Xiglitate Sodium.

In mainland China, Xidabenamine was approved in December 2014, November 2019, and April 2024 for the indications of relapsed or refractory peripheral T-cell lymphoma, hormone receptor-positive advanced breast cancer, and diffuse large B-cell lymphoma separately.

Xiglitate Sodium was approved later than Xidabenamine, approved in October 2021 and July 2024 for the indications of monotherapy for type 2 diabetes and combination with metformin for type 2 diabetes.

Xidabenamine and Xiglitate Sodium brought in sales revenues of 0.391 billion yuan, 0.483 billion yuan, and 0.509 billion yuan respectively for shenzhen chipscreen biosciences from 2021 to 2023, accounting for 90.75%, 91.07%, and 97.16% of the total revenue proportion.

In 2017, Xidabenamine was first included in the national medical insurance catalog, and the unified retail price was reduced to 385 yuan per tablet. In 2021, Xidabenamine was renewed for inclusion in the medical insurance catalog, with the price reduced to 343 yuan per tablet. In 2023, Xidabenamine was once again renewed, but the unit price was further reduced to 322.42 yuan per tablet.

However, despite the continuous price decline, the gross margin of Xidabenamine was not affected, standing at 95.24%, 96.82%, and 96.09% from 2021 to 2023.

In comparison, the profit-making ability of Xiglitate Sodium is significantly inferior to Xidabenamine. In January 2023, Xiglitate Sodium was first included in the national medical insurance catalog, with a retail price reduction to 2.92 yuan per tablet, resulting in a sales gross margin of 15.44% for that year.

On the 20th, shenzhen chipscreen biosciences also disclosed the use of the previous fundraising, revealing that the price reduction of Xiglitate Sodium tablets when included in the medical insurance catalog in 2023 was 68.15%, which also led to product revenue profit falling short of expectations.

Currently, Shenzhen Chipscreen Biosciences obviously cannot support its large operating expenses with the sales revenue of 2 approved products. In order to enrich its product line, Shenzhen Chipscreen Biosciences currently has at least 17 indications in the R&D pipeline, with some pipelines entering Phase III clinical trials. At the same time, Shenzhen Chipscreen Biosciences also has more than 10 preclinical small molecule products.

In this private placement, Shenzhen Chipscreen Biosciences' innovative drug research and development projects will mainly focus on the indications under research of Sida Benamine and Siglec Thalidzine, including: Sida Benamine + Sindilimab + Bevacizumab triplet therapy for treating colorectal cancer, single use of Siglec Thalidzine to treat metabolic dysfunction-related non-alcoholic steatohepatitis (MASH), Sida Benamine in combination with PD-1 first-line treatment for locally advanced or metastatic non-small cell lung cancer (NSCLC) with positive PD-L1 expression, among other Phase III clinical trials.

根据定增预案,

根据定增预案,