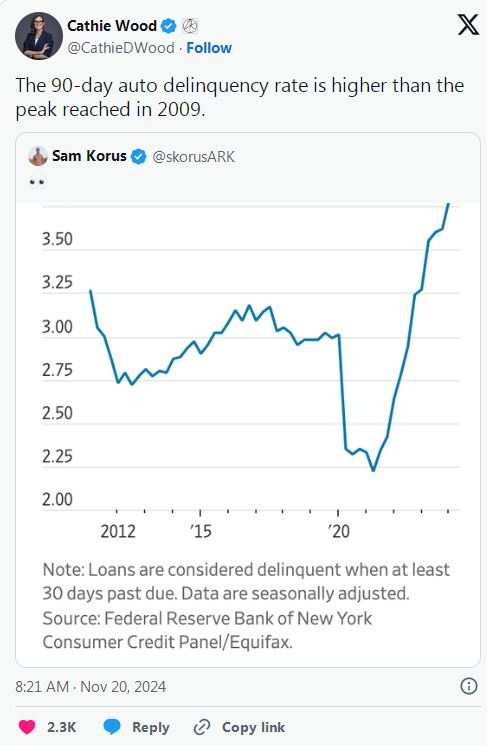

Cathy Wood, CEO of Ark Investment Management, has warned about the state of auto loans in the usa, pointing out that the 90-day default rate has now exceeded levels seen during the 2009 financial crisis.

Wood's comments come in response to recent data showing an increase in auto loan default rates, despite investor confidence in auto-backed securities. The latest regulatory report from the Federal Reserve confirms this trend, highlighting that auto loan delinquency rates will approach their highest levels in five years by 2024.

The auto loan delinquency rate refers to the percentage of auto loan borrowers who fail to repay their loans on time. A loan is typically considered delinquent if no payment has been made within a certain period (usually 30 days, 60 days, or 90 days).

While auto loan delinquency rates are rising, the entire auto industry is going through significant price reductions. In April of this year, Tesla lowered the prices of its Model Y, Model X, and Model S in the usa by $2,000 due to first-quarter delivery numbers falling short of expectations.

While auto loan delinquency rates are rising, the entire auto industry is going through significant price reductions. In April of this year, Tesla lowered the prices of its Model Y, Model X, and Model S in the usa by $2,000 due to first-quarter delivery numbers falling short of expectations.

Ford Motor has cut the price of the Mustang Mach-E by up to $8,100, while Nissan has lowered the price of its SUV Ariya by up to $6,000. Stellantis has also introduced discounts on the Jeep Wrangler and Grand Cherokee.

Despite these warning signs, investors continue to actively pursue auto loan backed bonds; as of October 2024, sales of securities related to subprime auto loans are approaching $40 billion, a 17% increase from the total in 2023. Nicholas Tripodes, a senior portfolio manager at Federated Hermes, reported that these trades were "oversubscribed by nearly 20 times."

The disconnect between rising default rates and investor enthusiasm reflects broader market dynamics. In October last year, the yield on the lowest-rated investment-grade auto bonds from Global Lending Services was about 6%, which is three times the yield of similar subprime auto loan backed securities in 2021.

This pressure is especially evident among low-income borrowers struggling with rising living costs and increasing interest rates. According to the Federal Reserve, the overall delinquency rate for auto loans reached 3.8% in June, the highest level since 2010.

The Federal Reserve noted: "In the first half of 2024, the delinquency rate for consumer loans remains high," and added that while there has been some improvement in credit card delinquencies in the second quarter, the default rate on auto loans continues to rise year-on-year.

汽车贷款拖欠率上升的同时,整个汽车行业都在大幅降价。今年4月,由于第一季度交付量低于预期,特斯拉将Model Y、Model X和Model S在美国的售价下调了2000美元。

汽车贷款拖欠率上升的同时,整个汽车行业都在大幅降价。今年4月,由于第一季度交付量低于预期,特斯拉将Model Y、Model X和Model S在美国的售价下调了2000美元。