As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Bandwidth Inc. (NASDAQ:BAND) investors who have held the stock for three years as it declined a whopping 72%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The last week also saw the share price slip down another 9.6%.

With the stock having lost 9.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

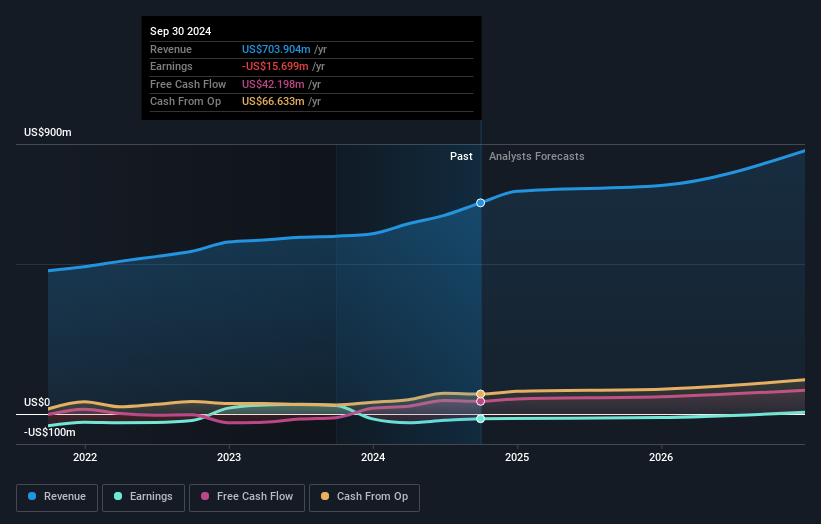

Because Bandwidth made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Bandwidth saw its revenue grow by 12% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

In the last three years, Bandwidth saw its revenue grow by 12% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Bandwidth's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Bandwidth shareholders have received a total shareholder return of 50% over the last year. That certainly beats the loss of about 11% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Bandwidth you should be aware of.

But note: Bandwidth may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.