Source: Barron's Chinese Author: Nicholas Jaskinski Evan Greenberg, CEO of Chubb Ltd, has a highly influential fan - Warren Buffet, CEO of Berkshire Hathaway. Berkshire Hathaway disclosed last month that it held 6% of the shares in Chubb, one of the world's largest insurance companies, by the end of 2023. Berkshire itself is a major participant in the insurance industry, but it is not the only buyer. In the past year, Chubb's stock return, including dividends, was about 40%, surpassing the S&P 500 index's total return of 25%, and making the company's market capitalization reach $110 billion. This increase in market capitalization reflects Chubb's outstanding performance, which is attributed to its prudent underwriting practices and conservative management of its investment portfolio of about $140 billion. The company's earnings per share increased by 48% in 2023 and its book value per share increased by 21%. Greenberg is the son of Maurice "Hank" Greenberg, the former CEO of American International Group (AIG). Greenberg worked at AIG for 25 years, rising through the ranks. He left the insurance company in 2000 and took over Ace Limited in 2004. The company merged with Chubb in 2016, the largest M&A in the property and casualty insurance industry at the time. Today, Chubb is the largest commercial insurance provider in the United States, and the company is also known for its high-end homeowner insurance for the wealthy. However, about half of the company's premiums last year came from outside the United States. Asia has always been a growth area where the company is bullish: Although Asia accounts for 40% of global GDP, the insurance industry accounts for only 26% of the global insurance market share. This gap is expected to narrow over time. Greenberg sits on the board of several nonprofits that focus on international and Asian affairs. Barron's recently interviewed Greenberg about his underwriting philosophy, the challenges of dealing with increasingly frequent climate disasters, and US-China relations. Following are the edited excerpts of the conversation.

Author: Andrew Barry

After Trump's victory, his proposed tariff policy during the campaign raised concerns in the market about the resurgence of inflation in the usa; it's time to buy commodities as an ideal inflation hedging tool.

Invesco commodity strategist Kathy Kriskey said: "Commodities are a hedging tool against inflation and also a diversification tool. We may face a period of higher inflation, and commodities are the most effective inflation hedging tool."

Even if Kriskey's expectations about inflation are not accurate, commodities are still worth holding - that is the meaning of hedging. Kriskey pointed out that if investors allocated 5% to commodities in 2022, it would absolutely help their investment performance, as that year$S&P 500 Index (.SPX.US)$fell by 19%, while the Bloomberg Commodity Index rose by 14%. In the next few years, compared to a 60/40 stock-bond portfolio, a 60/35/5 stock-bond-commodity portfolio may be a better choice.

Even if Kriskey's expectations about inflation are not accurate, commodities are still worth holding - that is the meaning of hedging. Kriskey pointed out that if investors allocated 5% to commodities in 2022, it would absolutely help their investment performance, as that year$S&P 500 Index (.SPX.US)$fell by 19%, while the Bloomberg Commodity Index rose by 14%. In the next few years, compared to a 60/40 stock-bond portfolio, a 60/35/5 stock-bond-commodity portfolio may be a better choice.

Many investors invest in commodities through the stocks of resource producers (mainly energy stocks), but investors can also invest directly in commodities. For example, in the past five years, buying gold or $SPDR Gold ETF (GLD.US)$ The returns from gold etfs are much higher than buying. $Barrick Gold (GOLD.US)$ and $Newmont (NEM.US)$ The returns from mining stocks are much higher.

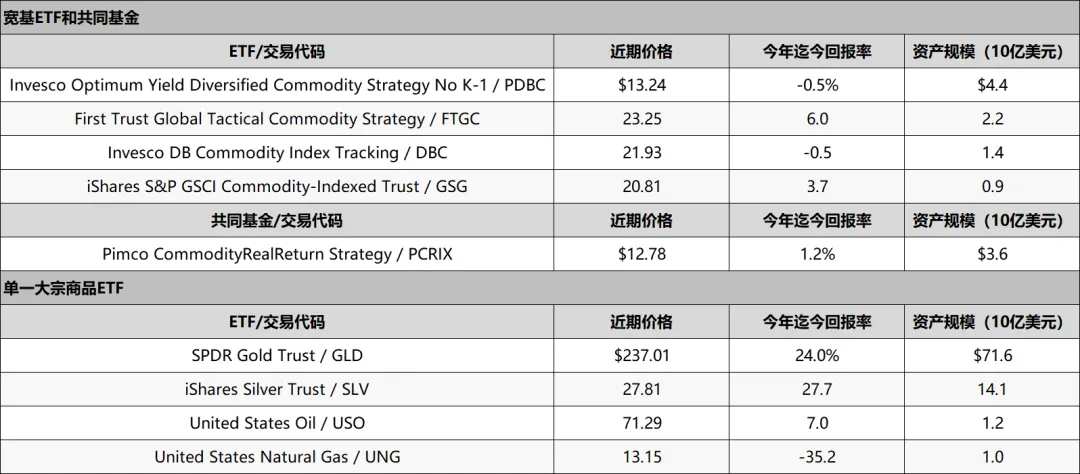

Investors can invest in commodities through broad-based etfs or mutual funds.

Different mutual funds and etfs track different commodity indices, and these indices have different exposures to individual commodities. The Pimco Commodity Real Return Strategy tracks the Bloomberg Commodity Index, allocating about one-third of the funds to energy, agriculture, and metal respectively. The iShares S&P GSCI Commodity-Indexed Trust and two Invesco ETFs track indices with over 50% weight in energy.

High volatility and underperformance relative to stocks are two reasons why commodities have fallen out of favor. This year, commodities have underperformed stocks for the second consecutive year, with the Bloomberg Commodity Index down 2% so far this year, while the s&p 500 index has risen 25%. In 2023, the Bloomberg Commodity Index fell 13%, and the s&p 500 index rose 26%. However, over the past 25 years, gold's roi has exceeded that of the s&p 500 index.

Trump's tariff policy has also cast a shadow over the prospects of commodities, as high tariffs could burden the economies of other countries.

However, the commodity market has already digested a lot of bad news. This year, the benchmark oil price in the usa fell by 4% to $70 per barrel, and the price of henry hub natural gas dropped by 30% to less than $3 per thousand cubic feet.

Greg Sharenow, co-fund manager of Pimco's Commodity Fund, pointed out that investors' concerns about the china economy have put pressure on commodities, including oil. He believes these concerns have been absorbed by the market, creating buying opportunities.

In addition, although copper, as a 'green metal', has generated a lot of interest in electric vehicles and wind power, this year the copper price is just slightly above $4 per pound, providing a great entry point, especially as the world's largest copper consumer, china, continues to stimulate the economy.

As a component of solar panels, silver remains a key metal in renewable energy, with a total annual value of mined silver around $30 billion, about one-tenth of the value of mined gold each year.

Currently, the prices of corn and chicago srw wheat are close to multi-year lows and production costs, indicating limited room for further declines. Corn prices are just above 4 dollars per bushel, while chicago srw wheat prices are 5.50 dollars per bushel, both half of their peaks in 2022. Teucrium's senior portfolio strategist Jake Hanley believes that the prospects for chicago srw wheat may be the best among all grains, as global consumption of chicago srw wheat has exceeded production in four out of the past five years. Furthermore, despite the impact of global warming, the American Midwest has not seen drought-induced crop failures for over a decade and if this continues in 2025, food prices may rise significantly. Teucrium's corn and chicago srw wheat etf, Teucrium Corn and Teucrium Wheat, are currently priced near 52-week lows.

Gold, silver, and many csi commodity equity index have faced pressure since the usa presidential election, one reason being the potential rise in interest rates. Since Trump's victory, the Bloomberg commodity index has dropped by 3%, making timing for investing in commodities crucial, and it appears to be a good entry point for investors.

Editor/Rocky

景顺(Invesco)大宗商品策略师凯西·克里斯基(Kathy Kriskey)说:“大宗商品是一种通胀对冲工具,也是一种多元化工具,我们可能会面临一段通胀较高的时期,而大宗商品是最有效的通胀对冲工具。”

景顺(Invesco)大宗商品策略师凯西·克里斯基(Kathy Kriskey)说:“大宗商品是一种通胀对冲工具,也是一种多元化工具,我们可能会面临一段通胀较高的时期,而大宗商品是最有效的通胀对冲工具。”