According to the Securities and Exchange Commission (SEC) disclosure, Wells Fargo & Co (WFC.US) submitted the third-quarter (Q3) shareholding report (Form 13F) as of September 30, 2024.

According to the Securities and Exchange Commission (SEC) disclosure, Wells Fargo & Co (WFC.US) submitted the third-quarter (Q3) shareholding report (Form 13F) as of September 30, 2024.

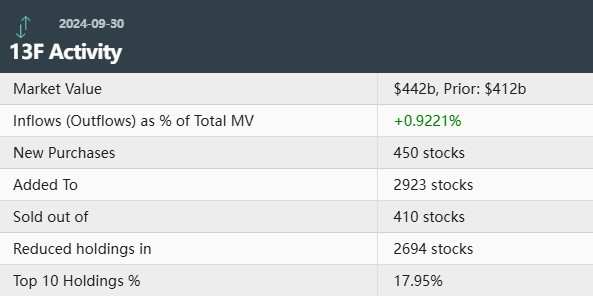

Statistics show that Wells Fargo & Co's total holding market value in the third quarter was $442 billion, an increase of 7.3% from the previous quarter's $412 billion. In the third quarter, Wells Fargo & Co added 450 individual stocks to its portfolio, increased positions in 2923 individual stocks, reduced positions in 2694 individual stocks, and liquidated 410 individual stocks. The top ten holdings accounted for 17.95% of the total market value.

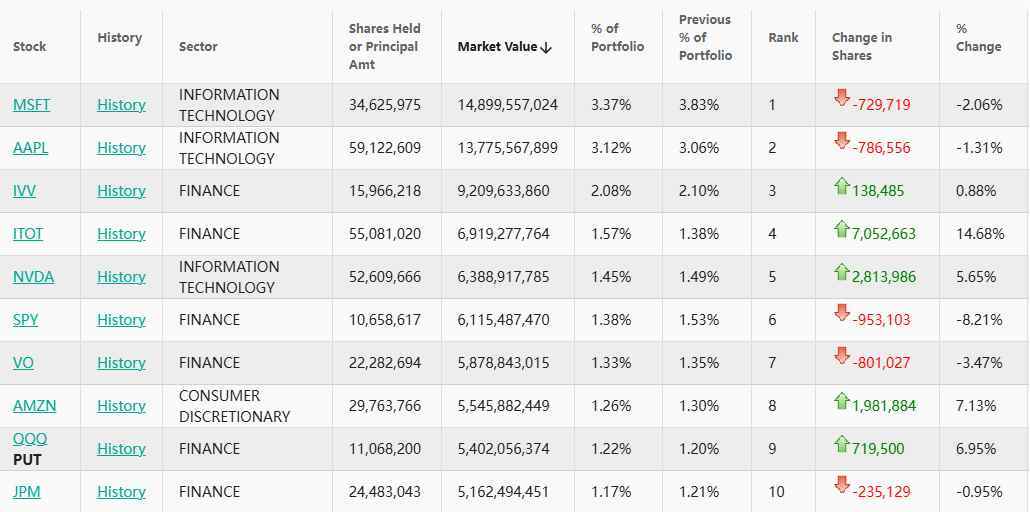

Among the top five heavy-weight stocks, Microsoft (MSFT.US) ranked first with approximately 34.63 million shares, valued at around $14.9 billion. The position decreased by 2.06% compared to the previous quarter, representing 3.37% of the investment portfolio.

Among the top five heavy-weight stocks, Microsoft (MSFT.US) ranked first with approximately 34.63 million shares, valued at around $14.9 billion. The position decreased by 2.06% compared to the previous quarter, representing 3.37% of the investment portfolio.

Apple (AAPL.US) ranked second with approximately 59.12 million shares, valued at around $13.776 billion. The position decreased by 1.31% compared to the previous quarter, representing 3.12% of the investment portfolio.

iShares S&P 500 Index ETF (IVV.US) ranked third with approximately 15.97 million shares, valued at around $9.21 billion. The position increased by 0.88% compared to the previous quarter, representing 2.08% of the investment portfolio.

iShares Core S&P Total U.S. Stock Market ETF (ITOT.US) ranked fourth with approximately 55.08 million shares, valued at around $6.919 billion. The position increased by 14.68% compared to the previous quarter, representing 1.57% of the investment portfolio.

NVIDIA (NVDA.US) ranks fifth, holding approximately 52.61 million shares, with a holding market value of approximately 6.389 billion USD. The number of holdings increased by 5.65% compared to the previous quarter, accounting for 1.45% of the investment portfolio.

In the third quarter, Wells Fargo & Co initiated positions in KraneShares CSI China Internet ETF call options (KWEB.US, CALL) and closed positions in SPDR SSGA US Small Cap Low Volatility Index ETF (SMLV.US).

During the quarter, Wells Fargo & Co increased holdings in five of the 'Seven Tech Giants', namely increasing shareholding in NVIDIA by 5.65%, Amazon (AMZN.US) by 7.13%, Meta (META.US) by 1.81%, Google - Class A (GOOGL.US) by 1.64%, Google - Class C (GOOG.US) by 0.78%, and Tesla (TSLA.US) by 21.75%. Meanwhile, the bank reduced shareholding in Microsoft by 2.06% and Apple by 1.31%.

Looking at the changes in holdings proportions, the top five purchases were iShares Russell 2000 ETF put options (IWM.US, PUT), Broadcom (AVGO.US), iShares Core S&P Total U.S. Stock Market ETF, iShares Broad USD High Yield Corporate Bond ETF (USHY.US), and Tesla.

The top five divestments were Microsoft, SPDR S&P 500 Index ETF put options (SPY.US, PUT), iShares U.S. Aggregate Bond ETF (AGG.US), SPDR S&P 500 Index ETF (SPY.US), and PIMCO ETF Trust Enhanced Short Maturity ETF (MINT.US).

在前五大重仓股中,微软(MSFT.US)位列第一,持仓约3463万股,持仓市值约149.00亿美元。持仓数量较上季度减少2.06%,占投资组合比例为3.37%。

在前五大重仓股中,微软(MSFT.US)位列第一,持仓约3463万股,持仓市值约149.00亿美元。持仓数量较上季度减少2.06%,占投资组合比例为3.37%。