Applied Materials, Inc. (NASDAQ:AMAT) reported better-than-expected fourth-quarter results after Thursday's closing bell.

Applied Materials reported quarterly earnings of $2.32 per share, which beat the analyst consensus estimate of $2.19. Quarterly revenue clocked in at $7.05 billion, which beat the analyst consensus estimate of $6.95 billion and is an increase over sales of $6.72 billion from the same period last year.

"Applied Materials' technology leadership and strong execution drove record Q4 and fiscal 2024 performance, our fifth consecutive year of growth," said Gary Dickerson, president and CEO.

For the first quarter of fiscal 2025, Applied expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents.

For the first quarter of fiscal 2025, Applied expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents.

Applied shares gained 1.8% to close at $186.00 on Thursday.

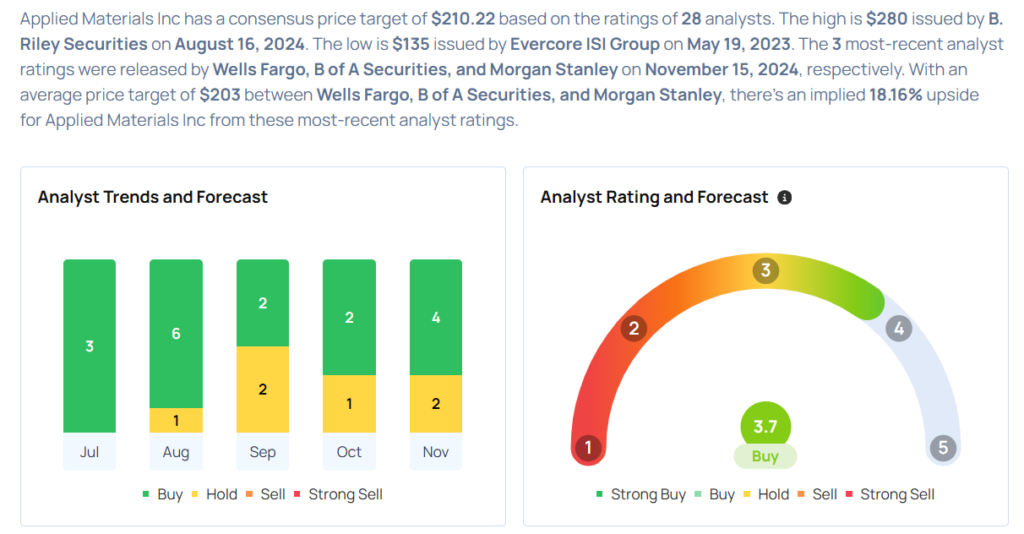

These analysts made changes to their price targets on Applied Materials following earnings announcement.

- Needham analyst Charles Shi maintained the stock with a Buy and lowered the price target from $240 to $225.

- Deutsche Bank analyst Sidney Ho maintained the stock with a Hold and lowered the price target from $220 to $200.

- Morgan Stanley analyst Joseph Moore maintained Applied Materials with an Equal-Weight rating and cut the price target from $185 to $179.

- B of A Securities analyst Vivek Arya maintained the stock with a Buy and lowered the price target from $220 to $210.

- Wells Fargo analyst Joseph Quatrochi maintained the stock with an Overweight and lowered the price target from $235 to $220.

Considering buying AMAT stock? Here's what analysts think:

Read More:

- Dow Dips Over 200 Points Following Economic Reports, Tesla Tumbles On Potential Removal Of EV Tax Credit: Fear Index Remains In 'Greed' Zone