According to the disclosure by the USA Securities and Exchange Commission (SEC), the world's largest asset management company, BlackRock, has submitted its third-quarter holding report (Form 13F) as of September 30, 2024.

According to the news app Zhitong Finance, based on the disclosure by the USA Securities and Exchange Commission (SEC), the world's largest asset management company, BlackRock, has submitted its third-quarter holding report (Form 13F) as of September 30, 2024.

According to statistics, the total market value of BlackRock's holdings in the third quarter was 4.76 trillion USD, up from 4.42 trillion USD in the previous quarter, representing a quarter-on-quarter increase of 7%.

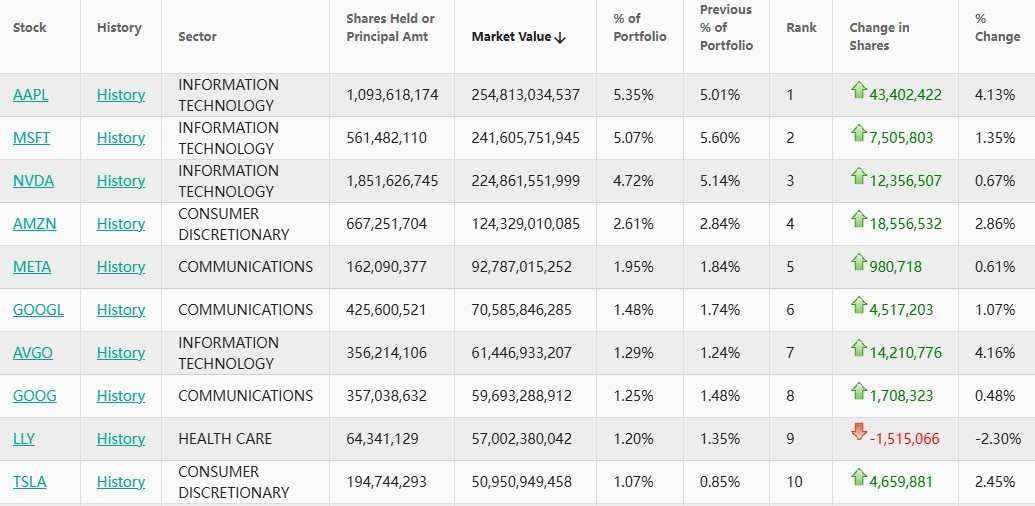

In BlackRock's top ten holdings for the third quarter, large technology giants dominated. Among the top five holdings, Apple (AAPL.US) became the largest holding with 1.093 billion shares, with a market value of approximately 254.813 billion USD, accounting for 5.35% of the portfolio, which is a 4.13% increase in the number of shares compared to the previous quarter.

In BlackRock's top ten holdings for the third quarter, large technology giants dominated. Among the top five holdings, Apple (AAPL.US) became the largest holding with 1.093 billion shares, with a market value of approximately 254.813 billion USD, accounting for 5.35% of the portfolio, which is a 4.13% increase in the number of shares compared to the previous quarter.

Microsoft (MSFT.US) was surpassed, ranking second with 0.561 billion shares, and a market value of approximately 241.606 billion USD, accounting for 5.07% of the portfolio, an increase of 1.35% in the number of shares from the previous quarter.

NVIDIA (NVDA.US) ranked third with 1.851 billion shares, with a market value of approximately 224.862 billion USD, accounting for 4.72% of the portfolio, experiencing a 0.67% increase in the number of shares compared to the previous quarter.

Amazon (AMZN.US) and META (META.US) ranked fourth and fifth, with market values of 124.329 billion USD and 92.787 billion USD respectively, showing increases of 2.86% and 0.61% in the number of shares compared to the previous quarter.

The top ten holdings also include Google-A (GOOGL.US), Broadcom (AVGO.US), Google-C (GOOG.US), Eli Lilly and Co (LLY.US), and Tesla (TSLA.US).

Blackrock established positions in Smurfit WestRock (SW.US), Six Flags Entertainment (FUN.US), etc., and liquidated positions in Conn's (CONNQ.US), among others.

In this quarter, Blackrock aggressively bought 43.4 million shares of Apple, which allowed Apple to surpass Microsoft and become the top holding stock. The institution also significantly increased its shareholding in the seven major U.S. stocks, increasing its positions in Microsoft by 7.51 million shares, Nvidia by 12.36 million shares, Amazon by 18.56 million shares, Meta by 0.98 million shares, Tesla by 4.66 million shares, Google-A by 4.52 million shares, and Google-C by 1.71 million shares. Additionally, the institution increased its holdings in Broadcom by 14.21 million shares and Berkshire-B by 2.59 million shares.

In this quarter, Blackrock reduced its shareholding in Eli Lilly and Co by 1.52 million shares, Netflix (NFLX.US) by 0.093 million shares, and AMD (AMD.US) by 0.86 million shares.

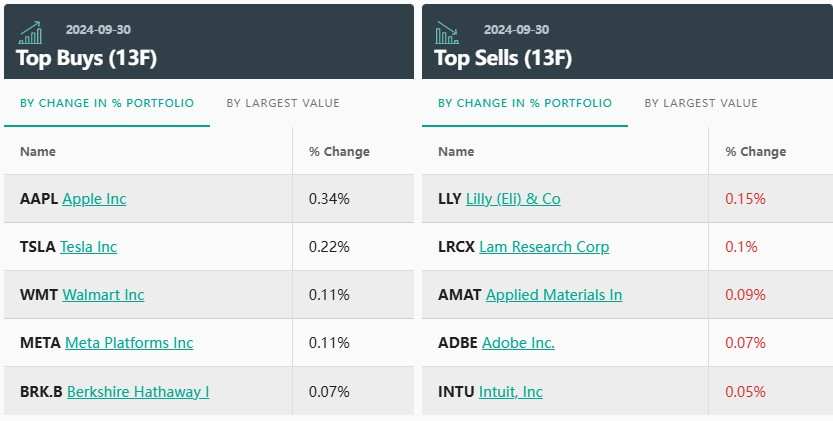

From the changes in holding proportions, the top five bought symbols are: Apple, Tesla, Walmart, Meta, and Berkshire-B (BRK.B.US).

The top five sold symbols include: Eli Lilly and Co, Lam Research (LRCX.US), Applied Materials (AMAT.US), Adobe (ADBE.US), and Intuit (INTU.US).

在贝莱德的第三季度前十大重仓股中,大型科技巨头仍占多数。在前五大重仓股中,苹果(AAPL.US)成为持仓第一,持仓10.93亿股,持仓市值约2548.13亿美元,占投资组合比例为5.35%,较上季度持仓数量增长4.13%。

在贝莱德的第三季度前十大重仓股中,大型科技巨头仍占多数。在前五大重仓股中,苹果(AAPL.US)成为持仓第一,持仓10.93亿股,持仓市值约2548.13亿美元,占投资组合比例为5.35%,较上季度持仓数量增长4.13%。