On the other side of the high growth rate, the success of Apatinib has still not reversed the losses of Innocare.

Despite positive third-quarter financial data, it did not drive the stock price of Innocare (09969) to rise. A week after the Q3 financial report was released, the company's stock price rose slightly and then quickly fell back. By the close of the 15th, it had fallen to below 7 Hong Kong dollars, lower than the price level of a week ago.

Public information shows that Innocare was established in August 2015, mainly focusing on new drug research and development for malignant tumors and autoimmune diseases. The company has now achieved an "A+H" listing. Benefiting from the rapid increase in Apatinib sales, the company has further raised its annual product sales guidance to grow by over 45% year-on-year, demonstrating strong sales growth momentum.

As the company's most watched core product, Apatinib has brought considerable profits to the company since its listing in January 2021. In 2022 and 2023, the drug generated sales revenues of 0.566 billion yuan and 670 million yuan respectively. In the first three quarters of 2024, Apatinib's total revenue was 0.693 billion yuan, a year-on-year increase of 45.0%, surpassing last year's full-year sales revenue. The quarterly revenue growth rate in Q3 was as high as 75.5%.

As the company's most watched core product, Apatinib has brought considerable profits to the company since its listing in January 2021. In 2022 and 2023, the drug generated sales revenues of 0.566 billion yuan and 670 million yuan respectively. In the first three quarters of 2024, Apatinib's total revenue was 0.693 billion yuan, a year-on-year increase of 45.0%, surpassing last year's full-year sales revenue. The quarterly revenue growth rate in Q3 was as high as 75.5%.

However, on the other side of the high growth rate, the success of Apatinib has still not reversed the losses of Innocare. In the first three quarters, the company's net loss was 0.285 billion yuan, a decrease of 47.1% year-on-year. Market investors have not shown the expected enthusiasm for Innocare, indicating concerns that behind the glory of Apatinib, there are still worrying negative factors.

Exclusive approval for Apatinib, what is its value?

Public information shows that as of the first half of 2024, Innocare has 13 products in research and development, with 2 products entering the commercialization stage. In addition to the core product Apatinib, Tafasitamab is also being promoted for domestic market entry and is expected to be launched next year.

In recent bullish developments, with the implementation of the new national medical insurance catalog, in 2024, all three indications of Apatinib are covered by medical insurance, including adult patients with relapsed or refractory Chronic Lymphocytic Leukemia (CLL)/Small Lymphocytic Lymphoma (SLL) who have received at least one prior therapy, adult relapsed or refractory Mantle Cell Lymphoma (MCL) patients who have received at least one prior therapy, and adult relapsed or refractory Marginal Zone Lymphoma (MZL) patients who have received at least one prior therapy.

Of particular note is the approval for the MZL indication, making Apatinib the first and only BTK inhibitor approved for the MZL indication in China, and it has been classified as a level I recommended treatment in the 2024 Chinese Society of Clinical Oncology (CSCO) Lymphoma Diagnosis and Treatment Guidelines for Marginal Zone Lymphoma (MZL) as a second-line therapy.

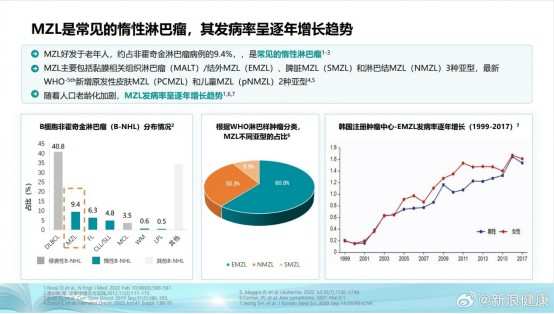

According to the understandings of Zhitong Finance and Economics APP, Marginal Zone Lymphoma is a relatively rare disease that is more common in the elderly population, with an increasing incidence trend year by year. Compared to other types of lymphoma, the treatment history of MZL is relatively short, and patient treatment options have always been very limited.

The first Chinese Marginal Zone Lymphoma (MZL) White Paper released in September this year pointed out that currently, common first-line systemic treatments for Marginal Zone Lymphoma mainly consist of immunochemotherapy and chemotherapy-free regimens mainly based on targeted therapy. Chemotherapy-free regimens primarily based on targeted therapy have comparable efficacy to immunochemotherapy and better safety, gradually becoming a new trend in Marginal Zone Lymphoma treatment.

Previously, drugs commonly used for Marginal Zone Lymphoma treatment such as Rituximab, Obinutuzumab, BTK inhibitors, PI3K inhibitors, etc., were not covered by medical insurance, and patients often had to bear treatment costs of up to hundreds of thousands of yuan on their own. Therefore, with Apatinib's MZL indication obtaining medical insurance coverage, the volume of this drug is expected to increase rapidly, driving stock prices and performance to new heights.

As the current revenue pillar of Innocare, is there an underlying concern hidden in the market prospects of Apatinib as the competition in the specific field intensifies?

Amid the overall market landscape, does the market outlook for Apatinib, the main revenue driver for Innocare, really sail as smoothly as imagined? From the perspective of the overall market situation, the answer to this question seems to imply quite a bit of uncertainty.

According to the Wise Finance APP, Acalabrutinib belongs to BTK inhibitors, with BTK being a key kinase in the BCR (B-Cell Receptor) pathway, playing a crucial role in the signal transduction of B-cell antigen receptors (BCR), which is essential for the proliferation and survival of malignant B cells in lymphoma. Due to its regulation of cell proliferation, survival, and migration in various malignant B cell tumors, the BTK target has become one of the most promising targets involving the activation of B cells and macrophages.

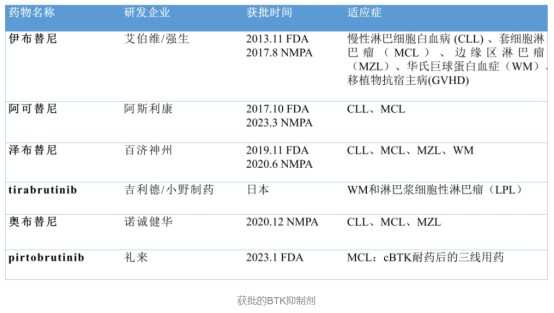

However, in the sub-race of BTK inhibitors, Acalabrutinib is not the only dominant player. Data shows that there are currently 6 BTK inhibitors approved for marketing globally, including the first-generation Ibrutinib, the second-generation Acalabrutinib, Zanubrutinib, Tirabrutinib, and Acalabrutinib, and the third-generation Pirtobrutinib. Compared to the first-generation product Ibrutinib, the second-generation products led by Acalabrutinib have improved in terms of efficacy and safety.

Specifically, among similar drugs, Acerta Pharma's original Acalabrutinib is the highest-selling drug among second-generation BTK inhibitors globally, reaching $2.057 billion in 2022, with sales in the first half of 2023 increasing by 33% year-on-year to $1.185 billion.

Beigene's Zanubrutinib (Brukinsa) developed has been marketed in multiple countries in Europe and the United States. It is the BTK inhibitor with the most approved indications, achieving a global sales revenue of approximately $0.501 billion in the first half of 2023.

Unlike first and second-generation BTKis, third-generation BTKis are non-covalent inhibitors, with the representative product being Pirtobrutinib developed by Eli Lilly and Co. Data shows that Pirtobrutinib has great potential in terms of safety and resistance. In preclinical studies, Pirtobrutinib is 300 times more selective to BTK than 98% of other kinases. Due to its non-covalent nature, its half-life is significantly extended, thereby not developing apparent drug resistance.

In the past year, Pirtobrutinib has received two accelerated FDA approvals to treat relapsed/refractory MCL patients who have received at least second-line systemic therapy including BTK inhibitors and CLL/SLL adult patients who have received at least second-line therapy, including BTK inhibitors and BCL-2 inhibitors. GlobalData predicts that by 2032, Pirtobrutinib will dominate the CLL BTK inhibitor market, occupying 60% of the demand, with potential annual sales reaching $3 billion.

In April of this year, Sanofi announced that the BTK inhibitor Rilzabrutinib (SAR444671/PRN-1008) achieved the primary endpoint in the Phase III LUNA 3 study for the treatment of chronic or persistent immune thrombocytopenia (ITP) in adult patients and plans to submit a marketing application for Rilzabrutinib to the FDA by the end of this year. If Rilzabrutinib is successfully approved, it will become the 7th marketed BTK inhibitor globally and the first globally approved BTK inhibitor for ITP indication.

Compared to its competitors, Acalabrutinib has a significantly later approval time, and has not yet received FDA approval, lagging behind Acalabrutinib and Zanubrutinib, both of which are second-generation products. With more and more related drugs entering the market, Acalabrutinib's market share may gradually be compressed.

On the other hand, osimertinib also faced many twists and turns in the expansion of indications. Two years ago, osimertinib caused a stir due to poor clinical data: a limited number of cases of liver damage caused by the drug led to the suspension of osimertinib's Phase II clinical study for the treatment of multiple sclerosis (MS) by the FDA; in the same year, Biogen Inc., known as "Bo Jian," terminated the global development and commercialization collaboration and licensing agreement with Innocare on osimertinib.

According to the original agreement, Bo Jian will make a one-time non-refundable and non-deductible upfront payment of $0.125 billion to Innocare, with a maximum of $0.8125 billion in sales milestone payments. The termination of the agreement undoubtedly indicates that the subsequent sales milestone payments have "fallen through," casting doubt on the real clinical efficacy of osimertinib in the market.

It is understood that Innocare's product pipeline layout mainly revolves around six major autoimmune diseases, including multiple sclerosis (MS), systemic lupus erythematosus (SLE), primary immune thrombocytopenia (ITP), atopic dermatitis (AD), psoriasis, and vitiligo.

As for the core product osimertinib, according to the latest news, the FDA has approved the initiation of Phase III clinical trials of osimertinib for the treatment of primary progressive multiple sclerosis (PPMS); the Phase III clinical trial plan for SPMS overseas has not been fully confirmed yet, and is expected to officially start in the first half of next year; the Phase III clinical trial for treating ITP with osimertinib is expected to complete clinical trials and submit a marketing application by 2025; the Phase IIb clinical trial for treating SLE has completed patient enrollment.

Futu Securities App has learned that currently, the 6 approved BTK inhibitors are all used to treat hematologic malignancies. With the market competition becoming increasingly fierce, many companies are also seeking to advance their applications in other indications, such as the focus area of autoimmune diseases targeted by Innocare.

According to Huachuang Securities statistics, there are over 20 BTK inhibitors being explored in the field of autoimmune diseases, focusing on indications such as multiple sclerosis (MS), chronic spontaneous urticaria, systemic lupus erythematosus, and rheumatoid arthritis. In addition to Norah's Remibrutinib, Sanofi's Tolebrutinib targets MS and is currently in Phase III clinical trials; Bojian's BIB091 for MS, AbbVie's Elsubrutinib for systemic lupus erythematosus, and rheumatoid arthritis have also entered Phase II clinical trials.

The research and development of BTK inhibitors in the field of autoimmune diseases is in full swing, and Innocare clearly cannot rely solely on osimertinib. Considering the significant reliance of the company's current performance on a single product and the potential risk of slowing sales revenue growth for osimertinib in the future, the company's stock price growth reaching its peak seems quite reasonable.

作为公司最受关注的核心产品,奥布替尼自2021年1月上市后已为公司带来了不菲的利润,2022年、2023年该药物全年分别录得5.66亿元和6.7亿元的销售收入。2024年前三季度,奥布替尼总收入6.93亿元,同比增长45.0%,已超过去年全年的销售收入,Q3单季度收入增速更是高达75.5%。

作为公司最受关注的核心产品,奥布替尼自2021年1月上市后已为公司带来了不菲的利润,2022年、2023年该药物全年分别录得5.66亿元和6.7亿元的销售收入。2024年前三季度,奥布替尼总收入6.93亿元,同比增长45.0%,已超过去年全年的销售收入,Q3单季度收入增速更是高达75.5%。