Nomura believes that as the USA's external liabilities soar, the safety of dollar assets is being questioned, and foreign investors may seek higher returns, thereby pushing up US interest rates. In the long run, the risk of US long-term bond yield rising seems much higher than the risk of a significant devaluation of the dollar.

"Will Trump 2.0 destroy the dollar's hegemony? Nomura believes it is unlikely, rather US debt may be 'a bit dangerous.'

With Trump's return, the market is concerned that his 'America First' policy may further weaken the dollar's status as a global reserve currency, exacerbating the 'modern Triffin dilemma.'

The core of this dilemma lies in the fact that the usa needs to meet the growing global demand for safe dollar assets while ensuring the long-term safety of these assets.

The core of this dilemma lies in the fact that the usa needs to meet the growing global demand for safe dollar assets while ensuring the long-term safety of these assets.

Nomura stated in a research report released on the 13th that as us foreign debt rises sharply, the security of dollar assets is being questioned, and foreign investors may demand higher roi, thereby pushing up us interest rates.

Nomura pointed out that in the long run, the risk of rising long-term us bond yields seems much higher than the risk of a significant depreciation of the dollar, although the latter cannot be completely ruled out.

The dollar's 'excessive privilege' and the Triffin dilemma.

Nomura pointed out that the dollar, as a global reserve currency, grants the usa 'excessive privilege.' The huge global demand for safe dollar assets enables the usa to borrow at low costs and profit from it.

However, this privilege is also accompanied by challenges, namely the "Triffin Dilemma."

The "Triffin Dilemma", also known as the Triffin problem, is an economic theory proposed by Belgian-American economist Robert Triffin in 1960.

This theory describes the inherent contradictions in the international monetary system, specifically referring to the fact that when a country's currency is widely used as an international reserve currency, that country needs to continuously increase the money supply to meet global demand, but this may lead to the devaluation of that currency and a crisis of confidence.

Triffin pointed out that this contradiction will ultimately lead to the collapse of the monetary system.

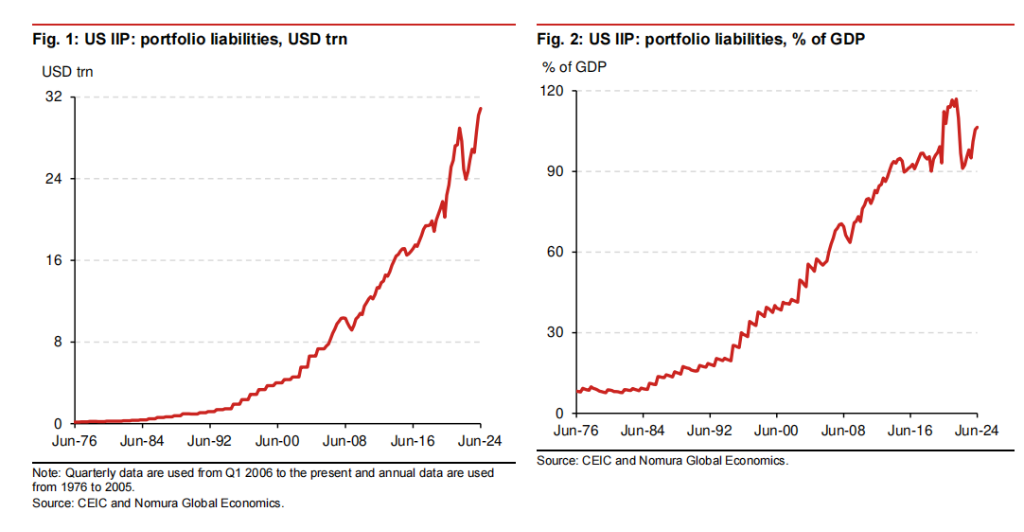

Nomura's report shows that since the 2008 global financial crisis, the USA's foreign investment liabilities have rapidly increased. By the second quarter of 2024, the USA's external debt had grown from 9.5 trillion dollars at the beginning of the crisis to 30.9 trillion dollars, exceeding 106% of GDP.

Nomura's analysis suggests that about half of this increase comes from new foreign investments, while the other half is due to the valuation increase brought about by the rise in the USA's asset market prices.

"Trump 2.0" populist policies: A threat to dollar hegemony.

Nomura's research specifically points out that after Trump's re-election, his "America First" policy may lead to larger fiscal deficits and higher inflationary pressures, further widening the USA's external debt levels.

Trump's policies include increasing tariffs on foreign investment, restricting immigration, and increasing fiscal spending. These populist policies may exacerbate the imbalances within the usa economy, leading to a decrease in the attractiveness of dollar assets.

Although the dollar remains the global reserve currency, its status will be somewhat weakened.

Nomura analyzes that despite the dollar accounting for as much as 58% of global forex reserves, global investors' confidence in the dollar has been shaken, especially due to the unstable performance of the usa treasury market in recent years, prompting some foreign institutions to pay attention to higher risk premium demands.

The risk of rising usa treasury yields is greater.

Nomura expects that in the coming years, the risk of rising long-term usa treasury yields will be greater than the risk of dollar depreciation.

This is because, although foreign capital may raise the risk premium on dollar assets, the usa still possesses strong economic and military advantages, making it difficult to replace the dollar's status as a reserve currency.

Additionally, the independence of the Federal Reserve means that even if the policies implemented by Trump lead to rising inflation, the Federal Reserve still has the capacity to control inflation through interest rate hikes, thus maintaining the attractiveness of dollar assets.

Moreover, although currencies like the euro were once seen as potential substitutes for the global reserve currency, they have deficiencies in liquidity, transparency, and other areas, making it difficult to challenge the dollar's global dominance.

Currently, there is no alternative currency to the dollar internationally that meets all the necessary conditions, which means that the dollar's dominance will not undergo disruptive changes in the short term.

Nomura's conclusion is that the likelihood of a large-scale sell-off of dollar assets is currently low, therefore, in the coming years, the risk of rising long-term bond yields in the usa seems to be much higher than the risk of a significant depreciation of the dollar, although the latter cannot be completely ruled out.

Editor/ping

这一难题的核心在于,美国需要同时满足全球对安全美元资产日益增长的需求,并保证这些资产的长期安全性。

这一难题的核心在于,美国需要同时满足全球对安全美元资产日益增长的需求,并保证这些资产的长期安全性。