In the third quarter of 2024, the smart phone market in the Middle East (excluding Turkey) grew by 2% year-on-year, with a shipment volume reaching 12.2 million units.

According to reports from Canalys obtained by Zhito Finance APP, in the third quarter of 2024, the smart phone market in the Middle East (excluding Turkey) grew by 2% year-on-year, with a shipment volume reaching 12.2 million units. This was mainly due to falling oil prices, escalating geopolitical tensions, and foreign nationals going on vacation during the summer, leading to a slowdown in key market demand. Despite these challenges, the long-term potential of the region remains strong as manufacturers invest in local business for sustained growth.

Despite strong growth in the retail trade, demand decreased during the summer vacation in the third quarter.

In the third quarter of 2024, despite retail promotions and new product launches, the smart phone market in the Middle East still faced downturns due to the departure of foreign nationals for summer vacations. Saudi Arabia is the largest market in the region, and although retailers actively launched promotions for the 'Kingdom’s National Day', the market growth was constrained as high inflation in housing, food, and hospitality limited consumer spending, leading to a 1% decline in market shipments. In contrast, the UAE saw a year-on-year growth of 16%, benefiting from events such as Dubai Summer Surprises (DSS) and strong back-to-school promotions from retailers like Sharaf DG and Emax. These promotions, combined with bundled offers and installment payment plans, stimulated demand, while the UAE's booming tourism and entertainment industries also boosted consumer confidence.

In the third quarter of 2024, despite retail promotions and new product launches, the smart phone market in the Middle East still faced downturns due to the departure of foreign nationals for summer vacations. Saudi Arabia is the largest market in the region, and although retailers actively launched promotions for the 'Kingdom’s National Day', the market growth was constrained as high inflation in housing, food, and hospitality limited consumer spending, leading to a 1% decline in market shipments. In contrast, the UAE saw a year-on-year growth of 16%, benefiting from events such as Dubai Summer Surprises (DSS) and strong back-to-school promotions from retailers like Sharaf DG and Emax. These promotions, combined with bundled offers and installment payment plans, stimulated demand, while the UAE's booming tourism and entertainment industries also boosted consumer confidence.

Until the second quarter of 2024, Iraq was one of the fastest-growing markets, but shipments decreased by 3% due to increased dollar procurement costs and rising ASP. However, the government plans to build a manufacturing plant in Erbil to support local production. The Qatari market saw a slight decline of 1%, while shipments in Kuwait grew by 5% driven by high-income groups.

Samsung performed strongly, while consumer sales of apple declined as they awaited the release of the iPhone 16.

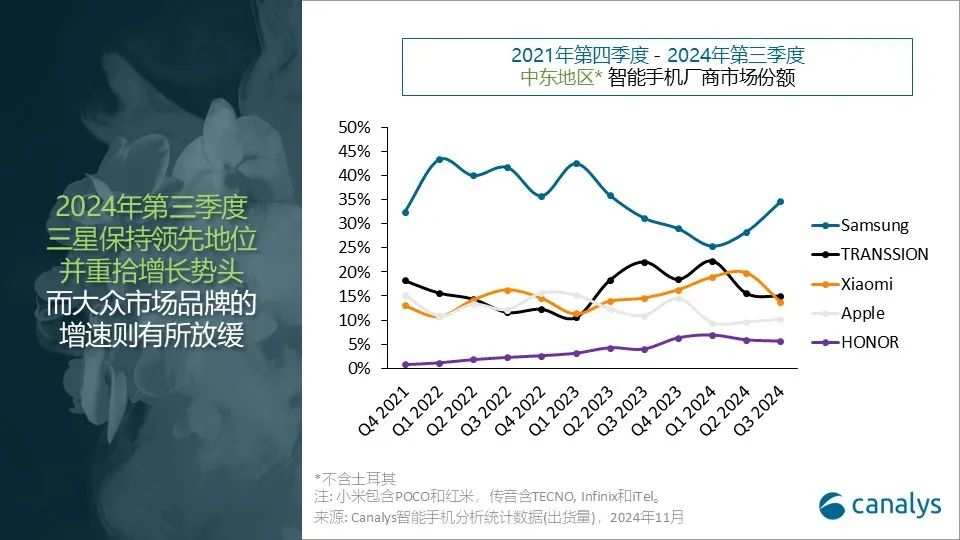

Senior analyst Manish Pravinkumar stated that after strong performance in the first half of the year, mass market brands have shown signs of slowdown, allowing Samsung to regain growth momentum. In the third quarter of 2024, Samsung saw a year-on-year growth of 13%, primarily due to strong demand for the A series and S24 models, supported by its highly competitive pricing and channel incentives. Due to consumer hesitance concerning the upcoming iPhone 16, apple's (AAPL.US) sales fell by 6%, but demand for the iOS ecosystem remains strong as the year draws to a close. Mass market brands like Transsion faced a decline of 31%, with their TECNO brand experiencing a significant drop of 50% despite partnering with the region's largest retailer, Lulu Hypermarkets. Infinix and iTel also faced challenges, declining by 14% and 24%, respectively. Xiaomi (01810) launched the cost-effective Redmi 14C. Emerging brands Honor and Motorola performed strongly, growing by 43% and 61%, respectively. Honor expanded its mid-range product line and launched brand-exclusive stores in Dubai to enhance consumer engagement, while Motorola propelled its strong sales through its value-for-money 5G series.

Due to the slowing pace of upgrades and adverse macroeconomic factors, the Middle East is expected to experience moderate growth in 2025.

Pravinkumar added: 'In 2025, influenced by prolonged device upgrade cycles, political complexities, and economic fluctuations, the Middle East smart phone market is projected to see moderate growth. Canalys predicts that the Middle East smart phone market will maintain low single-digit growth, with a slowdown in device upgrades and an increase in ASP. High-growth markets such as Saudi Arabia, the UAE, and Iraq position the region as an important strategic hub for consumer electronics, attracting manufacturers to establish local production. To drive upgrades, manufacturers must adopt a global strategy, offer value-oriented products, and establish strong relationships with local retailers to address the nuanced needs of these markets. Manufacturers should innovate in sustainability, optimize the blended retail experience, and respond dynamically to local trends to achieve long-term growth in this vibrant market.'

2024年第三季度,尽管有零售促销和新品发布,但由于暑期外籍人士离境度假,中东地区智能手机市场仍遭遇下行。沙特阿拉伯是该地区最大的市场,尽管零售商积极推出 “Kingdom’s National Day ”促销活动,但由于住房、食品和酒店业的高通胀抑制了消费支出,市场增长受到限制,因此该市场出货量下降 1%。相反,得益于迪拜夏季惊喜(DSS)等活动以及 Sharaf DG 和 Emax 等零售商大力开展返校促销活动,阿联酋同比增长16%。这些促销活动与捆绑优惠和分期付款计划相结合,刺激了需求,阿联酋蓬勃发展的旅游业和娱乐业也增强消费者的信心。

2024年第三季度,尽管有零售促销和新品发布,但由于暑期外籍人士离境度假,中东地区智能手机市场仍遭遇下行。沙特阿拉伯是该地区最大的市场,尽管零售商积极推出 “Kingdom’s National Day ”促销活动,但由于住房、食品和酒店业的高通胀抑制了消费支出,市场增长受到限制,因此该市场出货量下降 1%。相反,得益于迪拜夏季惊喜(DSS)等活动以及 Sharaf DG 和 Emax 等零售商大力开展返校促销活动,阿联酋同比增长16%。这些促销活动与捆绑优惠和分期付款计划相结合,刺激了需求,阿联酋蓬勃发展的旅游业和娱乐业也增强消费者的信心。