The 13F report of Berkshire Hathaway, led by Buffett, has been released, revealing the latest holdings that have attracted the attention of global investors.

Since the beginning of this year, Berkshire has been selling stocks and hoarding a large amount of cash. Financial reports indicate that Buffett net sold 127 billion dollars in stocks in the first nine months of this year. In the third quarter, he sold holdings worth 36 billion dollars and bought stocks worth 1.5 billion dollars.

In the third quarter, Berkshire entered into two new consumer companies: domino's pizza and swimming pool supplies distributor pool corp.

As of the end of the third quarter, Berkshire held 1.28 million shares of domino's, with a holding market cap of approximately 0.549 billion dollars; it held 0.404 million shares of pool corp, with a holding market cap of approximately 0.152 billion dollars.

As of the end of the third quarter, Berkshire held 1.28 million shares of domino's, with a holding market cap of approximately 0.549 billion dollars; it held 0.404 million shares of pool corp, with a holding market cap of approximately 0.152 billion dollars.

After the latest disclosure of Buffett's holdings, domino's pizza and pool corp surged in post-market trading, rising 7.63% and 5.51% respectively as of the time of writing.

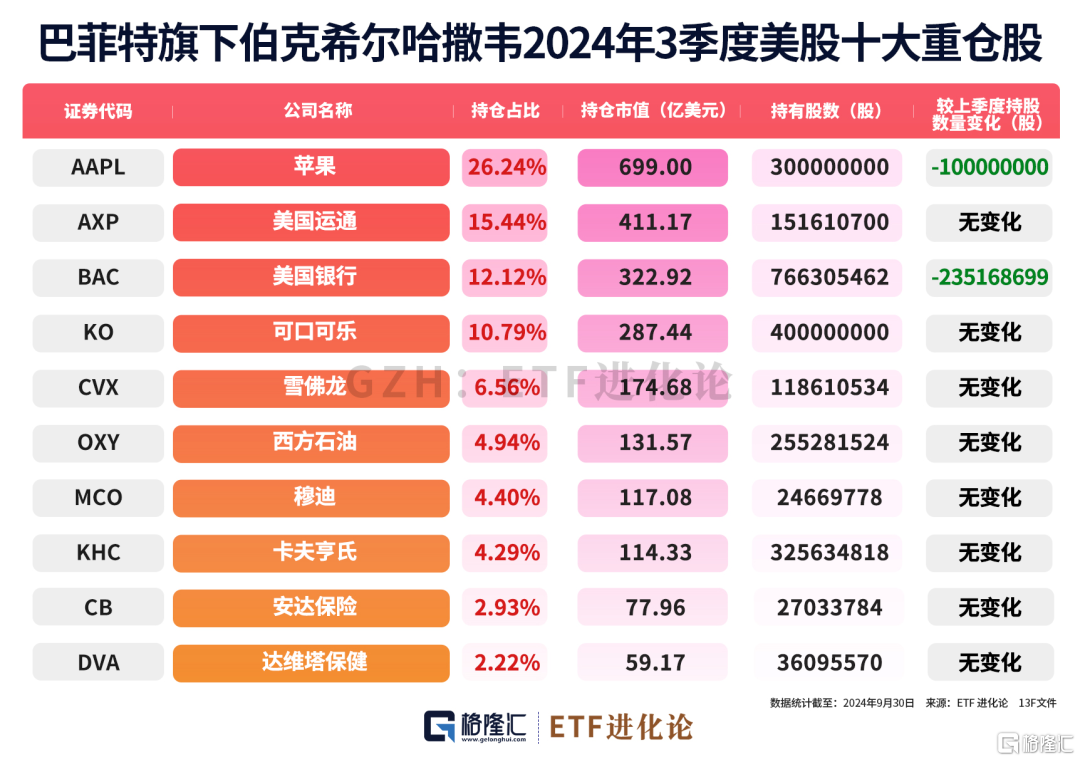

It is noteworthy that Buffett continues to reduce his shareholding in his major holdings, apple and bank of america.

In the third quarter, Buffett reduced his holdings in apple by 0.1 billion shares. Although apple remains Berkshire's largest holding, the number of shares held has plummeted from 0.905 billion shares at the beginning of the year to 0.3 billion shares.

In the third quarter, Buffett reduced his shareholding in Bank of America by 0.235 billion shares, with the latest holding of approximately 0.766 billion shares. Since mid-July this year, Buffett has reduced his stake in Bank of America 16 times, and according to statistics, he has cashed out over 10 billion dollars.

Currently, Berkshire's ownership percentage in Bank of America has fallen below 10%. According to relevant regulations from the SEC, there is no need to disclose trade situations promptly for shareholding reductions.

In addition to Apple and Bank of America, Buffett also reduced his holdings in the third quarter in stocks like Ulta Beauty, satellite broadcasting company Sirius, and charter communications; among the aircraft parts manufacturers, the beauty retail company Ulta Beauty is a new addition to Berkshire's portfolio in the second quarter, but the holding period was very short, with 96.5% of the holdings sold in the third quarter.

As of the end of the third quarter, Berkshire held 40 stocks with a holding market cap of 266.379 billion dollars, with the top ten holdings accounting for 89.68% of the total market cap.

Among Berkshire's major stocks, Apple still ranks first, with a holding market cap of approximately 69.9 billion dollars, accounting for 26.24% of the portfolio.

Berkshire has net sold US stocks for eight consecutive quarters, accumulating a large amount of cash. By the end of the third quarter, Berkshire's cash reserves surged to 325.2 billion dollars, setting a historical record, a significant increase of 157.2 billion dollars compared to the 168 billion dollars at the beginning of the year.

Berkshire's stock price hit a historical high in September this year, with a market cap surpassing 1 trillion dollars for the first time. Berkshire A increased by 29% within the year, exceeding the 24% ROI of the s&p 500 index.

When Buffett believes that the repurchase price is below Berkshire's intrinsic value, he will repurchase his own stock. In the third quarter, Buffett did not repurchase Berkshire shares, marking the first time since 2018 that Berkshire has stopped repurchasing its own stock.

Latest data shows that the valuations of major indices in the usa stock market are high. The nasdaq index.

Warren Buffett once said a widely circulated phrase, "I am fearful when others are greedy, and I am greedy when others are fearful." At present, the stock god seems to be "fearful" again.

截至三季度末,伯克希尔持有128万股达美乐,持仓市值约5.49亿美元;持有40.4万股Pool Corp,持仓市值约1.52亿美元。

截至三季度末,伯克希尔持有128万股达美乐,持仓市值约5.49亿美元;持有40.4万股Pool Corp,持仓市值约1.52亿美元。