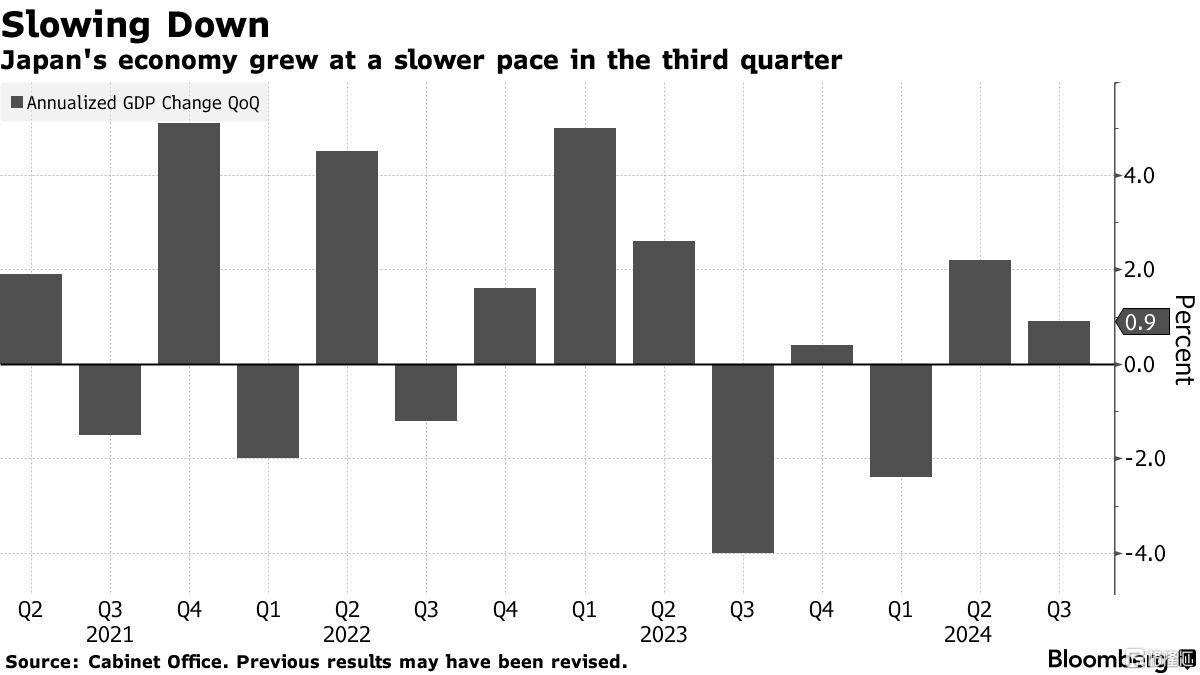

On November 15, local time, the Cabinet Office of japan released preliminary statistics showing that from July to September this year, japan's real gross domestic product (real GDP) grew by 0.2% quarter-on-quarter, with an annualized growth rate of 0.9%.

Among them, the quarter-on-quarter annual GDP growth has slowed compared to the previous quarter, highlighting the fragility of japan's economic recovery, while the risks of a slowdown in the usa economy and further weakening of the economies of large asian countries are increasing, which may drag down japan's future exports. On the other hand, consumer spending unexpectedly showed a rebound, adding a bright spot to the economy.

Consumer spending rebounds.

According to the Cabinet Office of japan, the third quarter GDP grew at an annual rate of 0.9% quarter-on-quarter, higher than the market consensus median estimate of 0.7%, while the previous quarter was revised to a growth of 2.2%; converted to a real GDP quarterly growth rate of 0.2%, in line with the forecasts from the Reuters survey. Private consumption, which accounts for more than half of economic output, grew by 0.9%, exceeding the market expectation of 0.2%, and also higher than the revised figure of 0.7% from the previous quarter.

Private consumption was stronger than expected, supporting the predictions of the Bank of japan. The Bank of japan believes that driven by wage and consumption growth, the economy will recover robustly, thereby helping inflation sustainably reach the 2% target and providing justification for raising interest rates.

Private consumption was stronger than expected, supporting the predictions of the Bank of japan. The Bank of japan believes that driven by wage and consumption growth, the economy will recover robustly, thereby helping inflation sustainably reach the 2% target and providing justification for raising interest rates.

Kengo Tanahashi, an economist at Nomura Securities, remarked that the significant growth in consumption is quite surprising.

However, this may reflect certain one-time factors, such as the recovery of auto production after the safety certification scandal and the push from temporary income tax reductions. Overall, this data is a good sign for future interest rate hikes.

On the other hand, capital expenditure in the third quarter decreased by 0.2%, consistent with the Reuters survey forecast; net exports fell by 0.4%, while the market expected a growth of 0.1%; private inventory grew by 0.1%, while the market anticipated 0%.

The head of the Cabinet Office in japan stated that spending on factory projects and other activities has decreased, and spending on semiconductor manufacturing equipment and commercial copiers has also declined.

It is reported that capital expenditure is the main driving force behind private demand fueling economic growth. Economists indicate that the slowdown in the overseas economy has placed downward pressure on machinery investment in industries such as chip manufacturing equipment. Net external demand (exports minus imports) contributed -0.4 percentage points to GDP, compared to -0.1 percentage points in the April to June quarter, indicating an increased extent of its drag on growth.

When will the Bank of japan raise interest rates again?

In last month's meeting, the Bank of japan continued to maintain ultra-low interest rates and stated that the risks to the usa economy have somewhat weakened, which also indicates that the conditions for another rate hike are becoming favorable.

Taro Kimura, a senior economist at Bloomberg Economics, stated that it is surprising how unexpectedly strong japan's economic growth is, which is driven by stronger-than-expected consumer spending.

For the Bank of japan, this data may support its view that the economy is strong enough to withstand further cuts to stimulus measures, bringing it one step closer to the next interest rate hike.

Looking at the forex market, on November 14th, the yen continued to weaken, falling below the 156 mark against the dollar, which is the first time since July this year. This also means that the risk of Japanese authorities intervening in the forex market is gradually increasing (Note: generally, when the yen falls below 155 against the dollar, the risk of government intervention rises).

At the same time, the weakening of the yen has also increased expectations for interest rate hikes by the Bank of Japan to some extent.

In the minutes of the Bank of Japan's monetary policy meeting held in October, the decision-makers did not reach a consensus on whether to raise interest rates in December. However, at the last meeting, some members suggested the need to clearly convey the Bank of Japan's determination to continue raising interest rates when the economy and price level meet expectations.

Currently, the likelihood of the Bank of Japan raising interest rates has significantly increased. JPMorgan pointed out that it is expected that the Bank of Japan will raise rates by 25 basis points in December this year, followed by further hikes in April and October 2025.

However, some experts have warned that further rate hikes by the Bank of Japan could trigger market turmoil and disrupt the long-term path of normalizing its monetary policy. Some economists stated that the Bank of Japan's rate hike in July was one of the factors that led to the global market crash in early August.

Editor/Rocky