Holding huge amounts of cash

Berkshire, a subsidiary of stock god Buffett, revealed its latest position report.

In the third quarter, in addition to reducing the much-publicized holdings of Apple and Bank of America, Buffett also built new warehouses for Domino's Pizza and Pool.

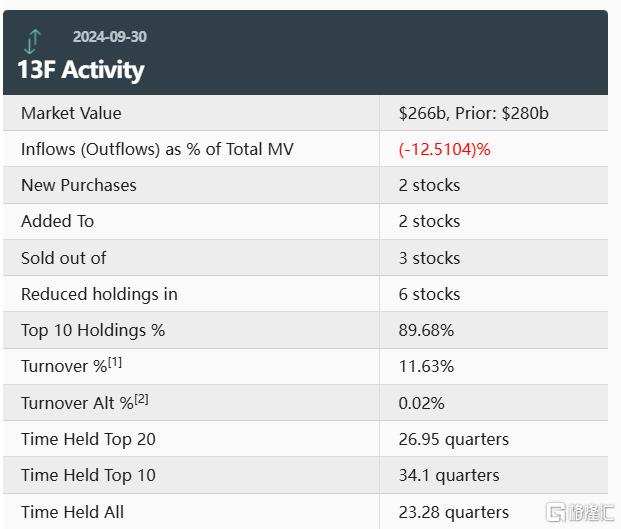

The total market value of shareholding declined

By the end of the third quarter, the total market value of Berkshire Hathaway's holdings was $266 billion, down slightly from $280 billion in the previous quarter.

By the end of the third quarter, the total market value of Berkshire Hathaway's holdings was $266 billion, down slightly from $280 billion in the previous quarter.

In the third quarter, Berkshire opened 2 new positions, added 2 stocks, cleared 3 stocks, and reduced its holdings by 6 shares.

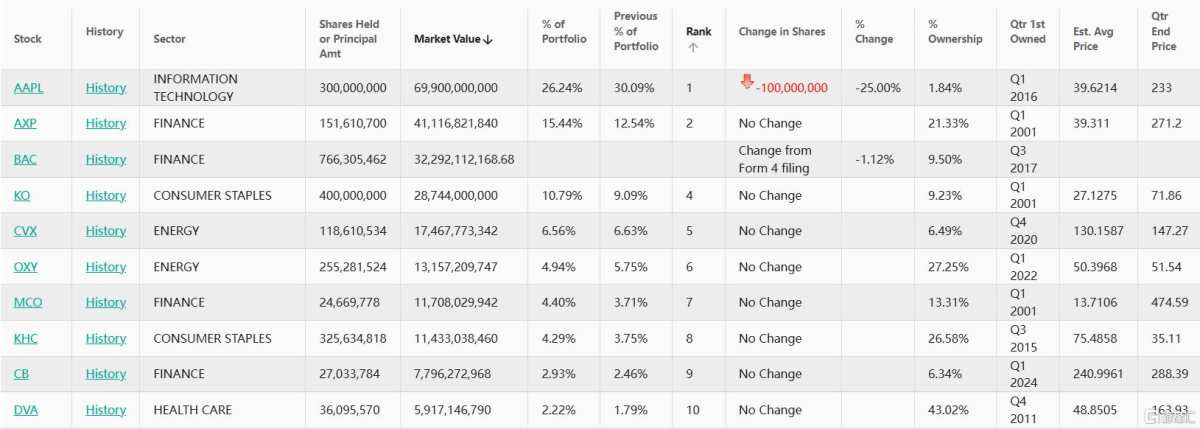

Berkshire's top ten holdings account for 89.68% of the total market value, namely Apple, American Express, Bank of America, Coca Cola, Chevron, Occidental Petroleum, Moody's, Kraft Heinz, Chubb Insurance, and Devitt.

Among the top ten major stocks, Berkshire's reduction in Apple's holdings has attracted attention. Its latest holdings of 0.3 billion shares have a market value of about 69.9 billion US dollars, accounting for 26.24% of the portfolio. The number of holdings is 25% lower than in the previous quarter.

Although Apple is still Berkshire's biggest stock, the number of holdings has plummeted from 0.905 billion shares at the beginning of the year to 0.3 billion shares.

In addition to Apple, Berkshire also reduced its Bank of America position in the third quarter. The latest number of holdings was about 0.766 billion shares, and the market value of the position was about 32.3 billion US dollars. The number of holdings decreased by 1.12% from the previous quarter.

Currently, Buffett's shareholding ratio in Bank of America has fallen below the 10% critical disclosure threshold.

Build a new warehouse for Domino's Pizza, Pool

Buffett has always been famous for pursuing value investing. He usually uses a small amount of capital to “test the water” in individual stocks. Once it is determined that it is worth investing more, unless he thinks the logic changes, there will be less changes in his position afterwards.

For other heavy-held stocks, Berkshire's holdings remained unchanged in the third quarter.

Berkshire built a new warehouse for Domino's Pizza and Pool in the third quarter, increasing its holdings in aircraft parts manufacturer Heico.

In addition to Apple and Bank of America, Buffett also reduced his holdings of tracking shares (LSXMA, LSXMK) that track the interests of Sirius XM under the Free Media Group, the flooring retailer Floor & Decor, Capital One, Charter Communications, Brazilian digital bank operator Nu Holdings, and the cosmetics chain Ulta Beauty in the third quarter.

Specifically, Berkshire bought about 1.3 million shares of Domino's Pizza in the third quarter, bringing its shareholding ratio to 3.6%, worth about 0.55 billion US dollars.

At the same time, it bought 1% of the shares of Pool, a wholesale distributor of swimming pool equipment, worth about 0.152 billion US dollars.

Following the announcement of Buffett's investment, Domino's Pizza's stock price rose 6.9% after the market, while Pool's stock price rose 5.7%.

Berkshire also sold more than 96% of its Ulta Beauty holdings. The company only disclosed its investment in Ulta Beauty for the first time in August, and Ulta Beauty's stock price fell 3.8% after the market.

According to statistics, Berkshire sold 34.6 billion US dollars of stock investment in the third quarter. In addition, there were no stock repurchases this quarter. This is also the first time since 2018 that Berkshire has stopped buying back the company's shares.

By the end of the third quarter, Berkshire's cash reserves reached a record high of $325.2 billion, the highest in history, accounting for 28.34% of the company's total assets.

Earlier, Buffett stated, “We're happy to spend it, but we won't spend it unless we think what we're doing is very risky and makes us a lot of money.”

截至第三季度末,伯克希尔哈撒韦公司持仓股的总市值为2660亿美元,相较于前一季度的2800亿美元略有下滑。

截至第三季度末,伯克希尔哈撒韦公司持仓股的总市值为2660亿美元,相较于前一季度的2800亿美元略有下滑。